Question: please answer quickly on PART I. PROBLEM SOLVING / CASE ANALYSIS Directions: Read the case or problem stated below and answer the questions asked. 1.

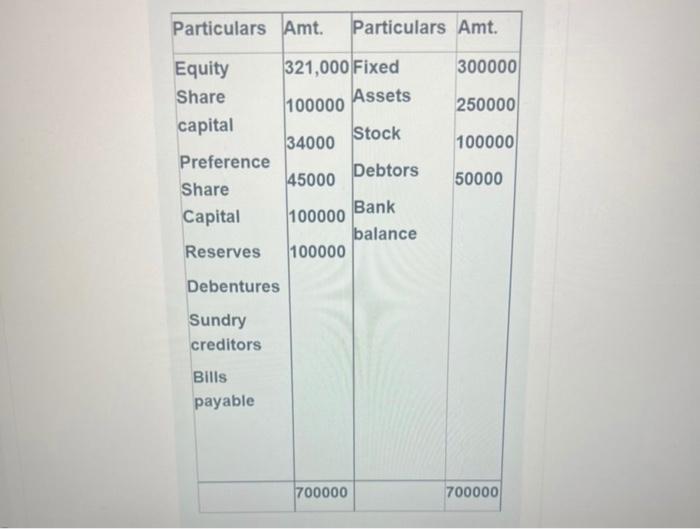

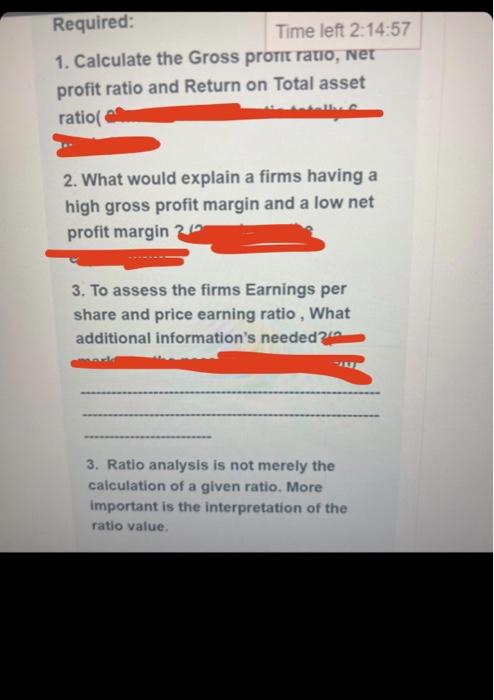

on PART I. PROBLEM SOLVING / CASE ANALYSIS Directions: Read the case or problem stated below and answer the questions asked. 1. The liquidity of the firm measured by its ability satisfy its short-term obligations as they come due. The following information states the summary of Bartlett company financial position in the year 2019. Particulars Amt. Particulars Amt. 321,000 Fixed 100000 Equity Share capital Preference 45000 Share Capital 100000 Reserves 100000 Debentures Sundry creditors 34000 Bills payable 700000 Assets Stock Debtors Bank balance 300000 250000 100000 50000 700000 Required: 1. Calculate the Gross pronit ratio, Net profit ratio and Return on Total asset ratio( Time left 2:14:57 2. What would explain a firms having a high gross profit margin and a low net profit margin 26 3. To assess the firms Earnings per share and price earning ratio, What additional information's needed? 3. Ratio analysis is not merely the calculation of a given ratio. More important is the interpretation of the ratio value. on PART I. PROBLEM SOLVING / CASE ANALYSIS Directions: Read the case or problem stated below and answer the questions asked. 1. The liquidity of the firm measured by its ability satisfy its short-term obligations as they come due. The following information states the summary of Bartlett company financial position in the year 2019. Particulars Amt. Particulars Amt. 321,000 Fixed 100000 Equity Share capital Preference 45000 Share Capital 100000 Reserves 100000 Debentures Sundry creditors 34000 Bills payable 700000 Assets Stock Debtors Bank balance 300000 250000 100000 50000 700000 Required: 1. Calculate the Gross pronit ratio, Net profit ratio and Return on Total asset ratio( Time left 2:14:57 2. What would explain a firms having a high gross profit margin and a low net profit margin 26 3. To assess the firms Earnings per share and price earning ratio, What additional information's needed? 3. Ratio analysis is not merely the calculation of a given ratio. More important is the interpretation of the ratio value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts