Question: Please answer quickly Question 11 5 pts Last year, a company's gross income was $84,000, expenses (not including depreciation) were $23,000, and the depreciation allowance

Please answer quickly

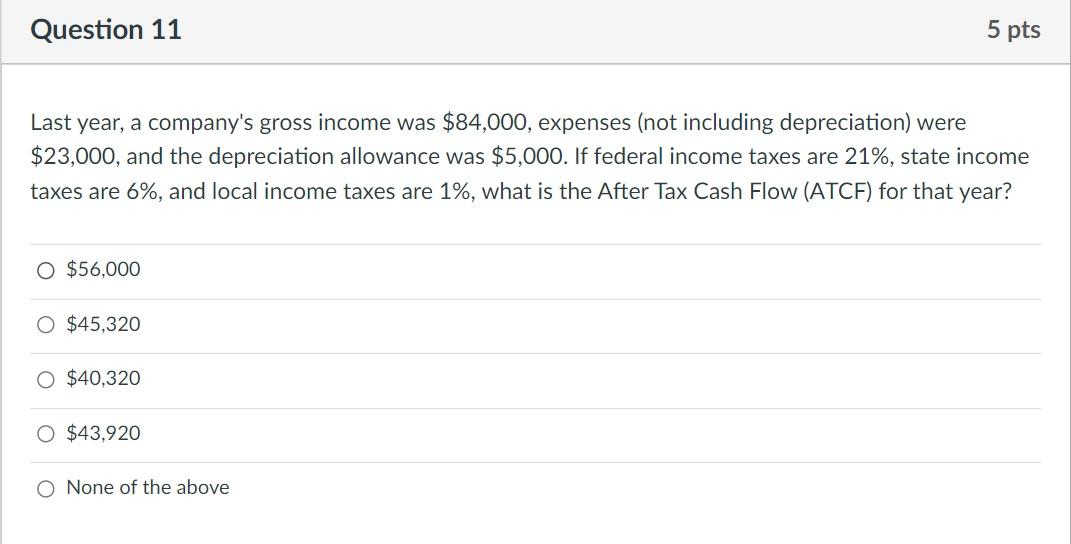

Question 11 5 pts Last year, a company's gross income was $84,000, expenses (not including depreciation) were $23,000, and the depreciation allowance was $5,000. If federal income taxes are 21%, state income taxes are 6%, and local income taxes are 1%, what is the After Tax Cash Flow (ATCF) for that year? $56,000 O $45,320 O $40,320 $43,920 O None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts