Question: please answer quickly Question 4 (1 point) ABC Co collects 25% of sales in the month of sale, 65% in the month following the month

please answer quickly

please answer quickly

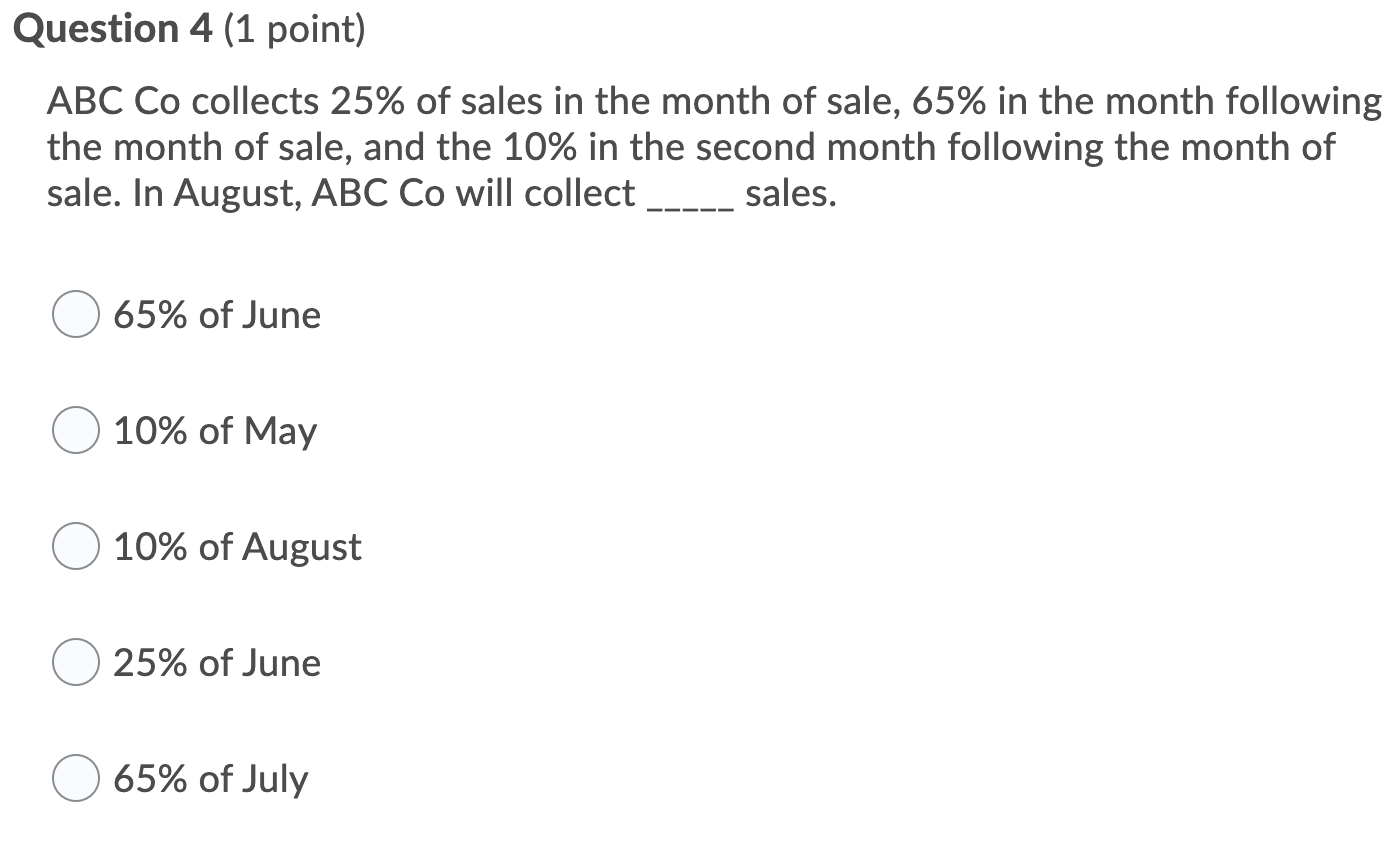

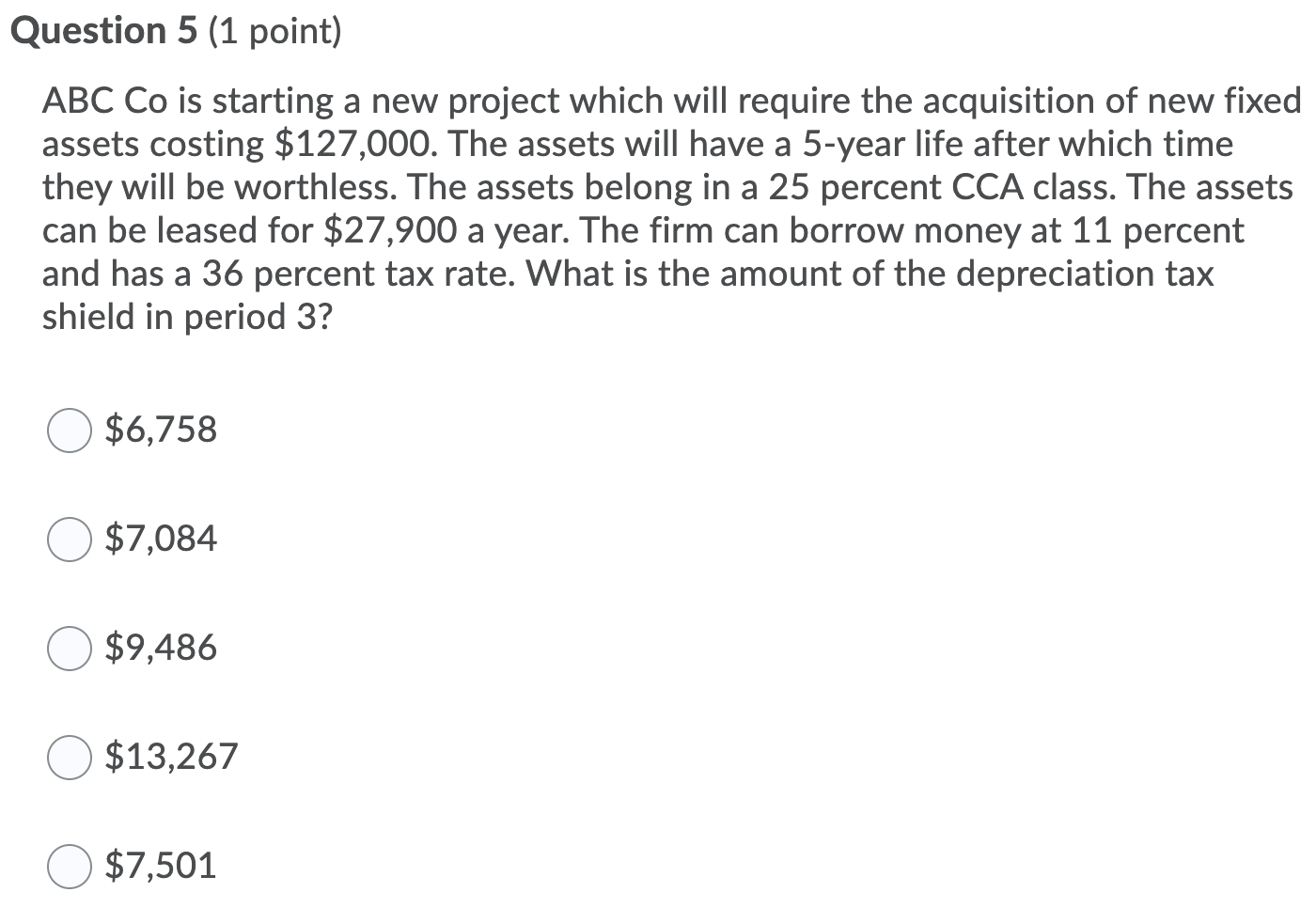

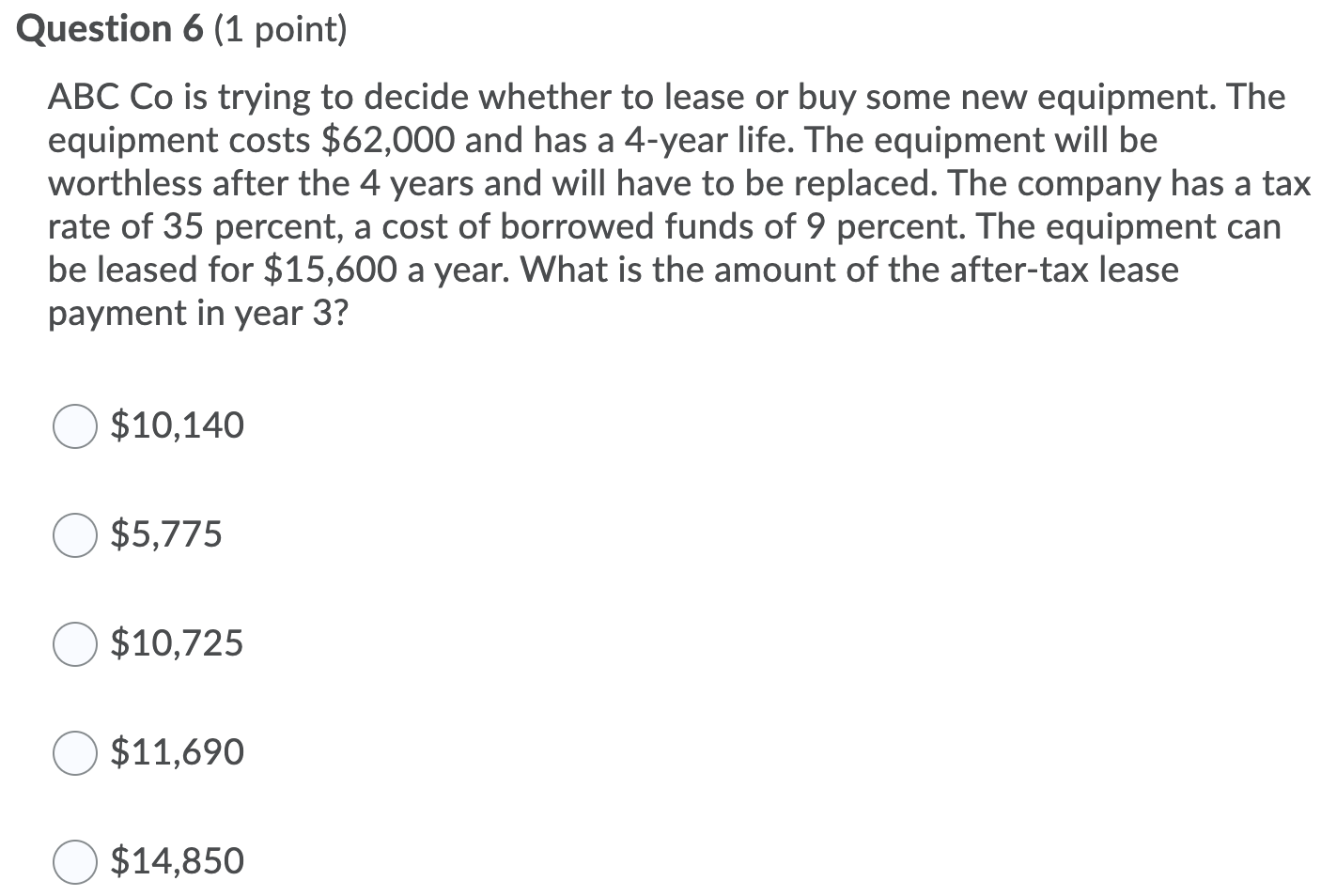

Question 4 (1 point) ABC Co collects 25% of sales in the month of sale, 65% in the month following the month of sale, and the 10% in the second month following the month of sale. In August, ABC Co will collect sales. 65% of June 10% of May 10% of August 25% of June 65% of July Question 5 (1 point) ABC Co is starting a new project which will require the acquisition of new fixed assets costing $127,000. The assets will have a 5-year life after which time they will be worthless. The assets belong in a 25 percent CCA class. The assets can be leased for $27,900 a year. The firm can borrow money at 11 percent and has a 36 percent tax rate. What is the amount of the depreciation tax shield in period 3? $6,758 $7,084 $9,486 $13,267 O $ $7,501 Question 6 (1 point) ABC Co is trying to decide whether to lease or buy some new equipment. The equipment costs $62,000 and has a 4-year life. The equipment will be worthless after the 4 years and will have to be replaced. The company has a tax rate of 35 percent, a cost of borrowed funds of 9 percent. The equipment can be leased for $15,600 a year. What is the amount of the after-tax lease payment in year 3? $10,140 $5,775 $10,725 $11,690 $14,850

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts