Question: Please answer quickly, WILL GIVE THUMBS UP Problem Two: 8 points Brickley Corporation purchased machinery on November 1, 2020. The following details relate to the

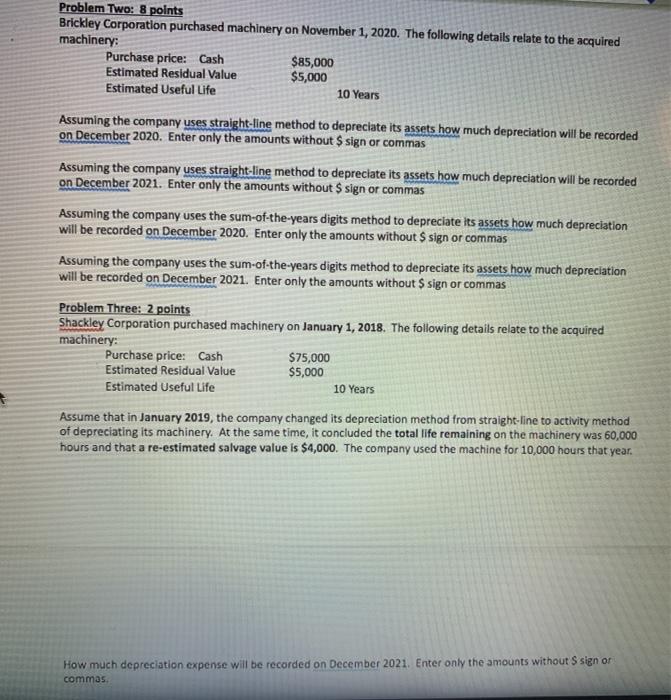

Problem Two: 8 points Brickley Corporation purchased machinery on November 1, 2020. The following details relate to the acquired machinery: Purchase price: Cash $85,000 Estimated Residual Value $5,000 Estimated Useful Life 10 Years Assuming the company uses straight-line method to depreciate its assets how much depreciation will be recorded on December 2020. Enter only the amounts without $ sign or commas Assuming the company uses straight-line method to depreciate its assets how much depreciation will be recorded on December 2021. Enter only the amounts without $ sign or commas Assuming the company uses the sum-of-the-years digits method to depreciate its assets how much depreciation will be recorded on December 2020. Enter only the amounts without $ sign or commas Assuming the company uses the sum-of-the-years digits method to depreciate its assets how much depreciation will be recorded on December 2021. Enter only the amounts without $ sign or commas Problem Three: 2 points Shackley Corporation purchased machinery on January 1, 2018. The following details relate to the acquired machinery: Purchase price: Cash $75,000 Estimated Residual Value $5,000 Estimated Useful Life 10 Years Assume that in January 2019, the company changed its depreciation method from straight-line to activity method of depreciating its machinery. At the same time, it concluded the total life remaining on the machinery was 60,000 hours and that a re-estimated salvage value is $4,000. The company used the machine for 10,000 hours that year. How much depreciation expense will be recorded on December 2021. Enter only the amounts without S sign or commas

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts