Question: please answer quicly Question Completion Status Question 2 5 point A machine costing $200,000 with a four year ile and an estimated $10.000 salvage values

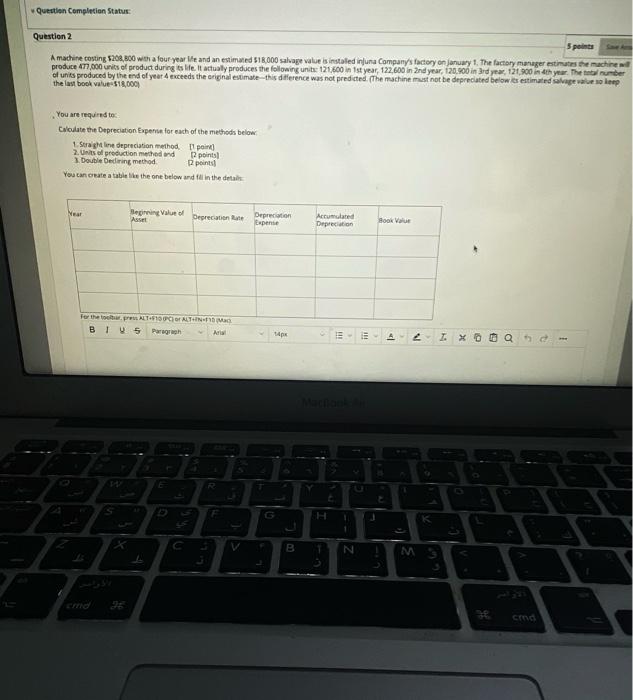

Question Completion Status Question 2 5 point A machine costing $200,000 with a four year ile and an estimated $10.000 salvage values installed injuna Company's factory on January 1, The factory manager estimate the machines produce 477,000 units of product during its life. It actually produces the following units: 121,600 in 1st year, 122.600 in 2nd year, 120.906 in 3rd year 121,00 in the year. The number of units produced by the end of year exceeds the original estimate this difference was not predicted. (The machine must not be deprecated below is estimated avevo lep the last book value $18,000) You are required to Calculate the Depreciation Experte for each of the methods below 1 Straight line depreciation method. point) 2. Uns of production method and points Double Deciring method 2 points You onte a table the one below and in the detail Near Repring Value of Asset Deprecatione Depreciation Expense Accumulated Depreciation Book Valur For the LT-610 CIO ALTIMO B TV5 Paragrah pe Ini 11! A 2 TXO O Q G H B N M crna

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts