Question: Please answer qustion d, thank you! Problem 10-14 (book/static) Question Help Jackson Heating & Air Company had sales revenue of $2,250,000 from operations during tax-year

Please answer qustion d, thank you!

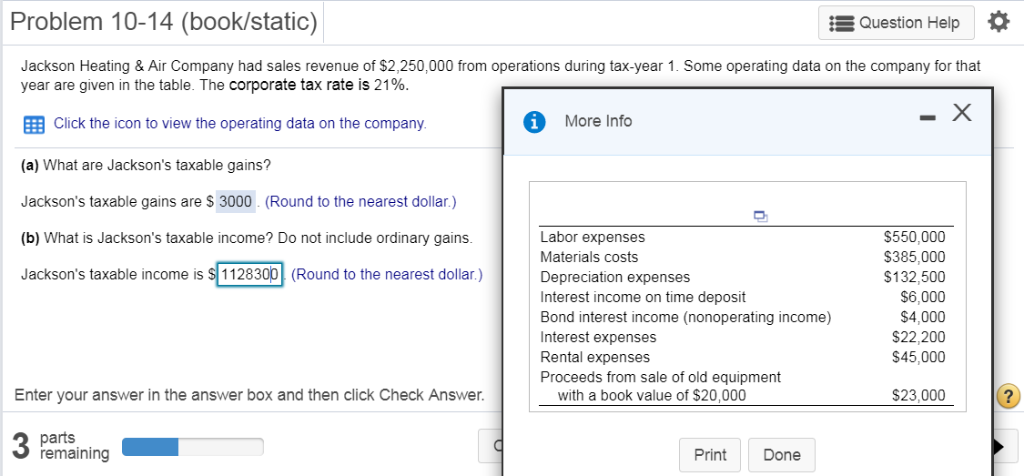

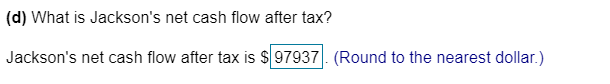

Problem 10-14 (book/static) Question Help Jackson Heating & Air Company had sales revenue of $2,250,000 from operations during tax-year 1. Some operating data on the company for that year are given in the table. The corporate tax rate is 21% Click the icon to view the operating data on the company (a) What are Jackson's taxable gains? Jackson's taxable gains are S 3000. (Round to the nearest dollar.) (b) What is Jackson's taxable income? Do not include ordinary gains Jackson's taxable income is S 1128300 (Round to the nearest dollar.) More Info Labor expenses Materials costs Depreciation expenses Interest income on time deposit Bond interest income (nonoperating income) Interest expenses Rental expenses Proceeds from sale of old equipment S550,000 S385,000 S132,500 $6,000 $4,000 $22,200 $45,000 Enter your answer in the answer box and then click Check Answer. with a book value of $20,000 $23,000 parts remaining Print Done (d) What is Jackson's net cash flow after tax? Jackson's net cash flow after tax is $|97937|. (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts