Question: please answer !! Renault: Electric Business Model Inovation Read the case below and answer the questions that follow. The European consumer has disrupted the market

please answer !!

please answer !!

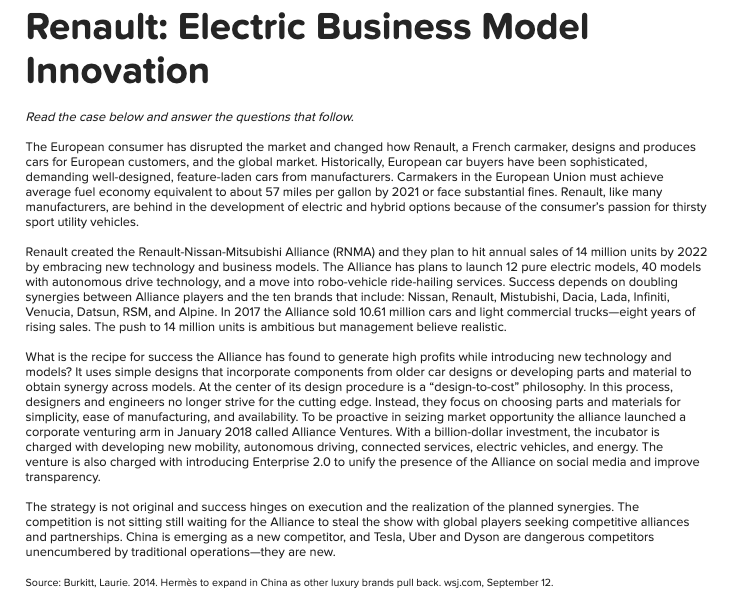

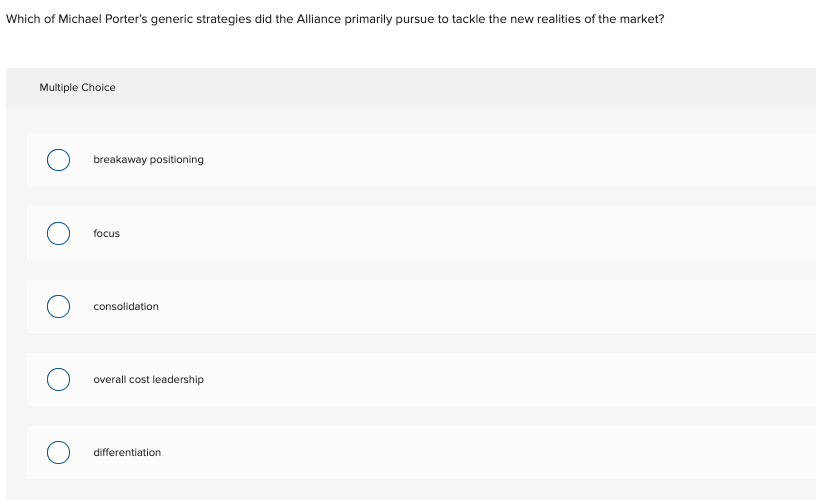

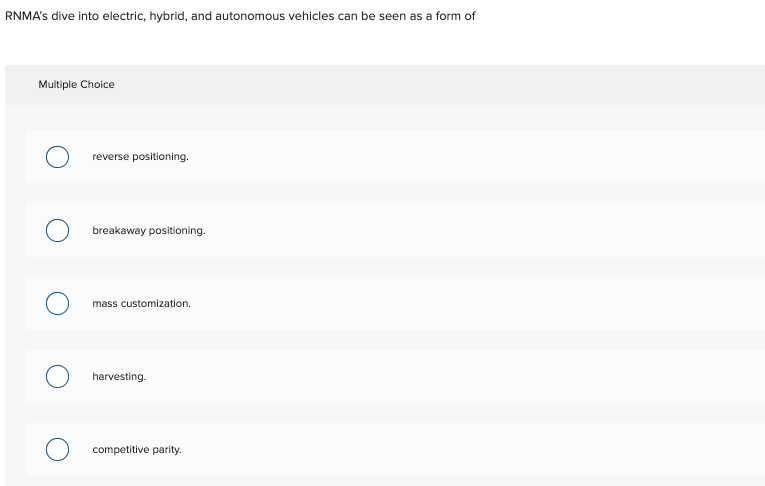

Renault: Electric Business Model Inovation Read the case below and answer the questions that follow. The European consumer has disrupted the market and changed how Renault, a French carmaker, designs and produces cars for European customers, and the global market. Historically, European car buyers have been sophisticated, demanding well-designed, feature-laden cars from manufacturers. Carmakers in the European Union must achieve average fuel economy equivalent to about 57 miles per gallon by 2021 or face substantial fines. Renault, like many manufacturers, are behind in the development of electric and hybrid options because of the consumer's passion for thirsty sport utility vehicles. Renault created the Renault-Nissan-Mitsubishi Alliance (RNMA) and they plan to hit annual sales of 14 million units by 2022 by embracing new technology and business models. The Alliance has plans to launch 12 pure electric models, 40 models with autonomous drive technology, and a move into robo-vehicle ride-hailing services. Success depends on doubling synergies between Alliance players and the ten brands that include: Nissan, Renault, Mistubishi, Dacia, Lada, Infiniti, Venucia, Datsun, RSM, and Alpine. In 2017 the Alliance sold 10.61 million cars and light commercial trucks-eight years of rising sales. The push to 14 million units is ambitious but management believe realistic. What is the recipe for success the Alliance has found to generate high profits while introducing new technology and models? It uses simple designs that incorporate components from older car designs or developing parts and material to obtain synergy across models. At the center of its design procedure is a "design-to-cost" philosophy. In this process, designers and engineers no longer strive for the cutting edge. Instead, they focus on choosing parts and materials for simplicity, ease of manufacturing, and availability. To be proactive in seizing market opportunity the alliance launched a corporate venturing arm in January 2018 called Alliance Ventures. With a billion-dollar investment, the incubator is charged with developing new mobility, autonomous driving, connected services, electric vehicles, and energy. The venture is also charged with introducing Enterprise 2.0 to unify the presence of the Alliance on social media and improve transparency. The strategy is not original and success hinges on execution and the realization of the planned synergies. The competition is not sitting still waiting for the Alliance to steal the show with global players seeking competitive alliances and partnerships. China is emerging as a new competitor, and Tesla, Uber and Dyson are dangerous competitors unencumbered by traditional operations-they are new. Source: Burkitt, Laurie. 2014. Herms to expand in China as other luxury brands pull back. wsj.com, September 12. Which of Michael Porter's generic strategies did the Alliance primarily pursue to tackle the new realities of the market? Multiple Choice breakaway positioning focus consolidation overall cost leadership differentiation RNMA's dive into electric, hybrid, and autonomous vehicles can be seen as a form of Multiple Choice reverse positioning. breakaway positioning. mass customization. harvesting. competitive parity. What is the most likely reason that RNMA's strategy might fail to result in a sustainable competitive advantage? Multiple Choice RNMA's competitive advantage appears to be sustainable. The firm cannot earn enough profit selling low-end automobiles. RNMA's strategy could be imitated by competitors. The firm is vulnerable to new entrants into the market. There are many substitute products available to consumers. The European Union fuel economy mandates sent the European market for full-featured automobiles Multiple Choice into the maturity stage. out of the industry life cycle. into the decline stage. into competitive parity. down the experience curve. Renault: Electric Business Model Inovation Read the case below and answer the questions that follow. The European consumer has disrupted the market and changed how Renault, a French carmaker, designs and produces cars for European customers, and the global market. Historically, European car buyers have been sophisticated, demanding well-designed, feature-laden cars from manufacturers. Carmakers in the European Union must achieve average fuel economy equivalent to about 57 miles per gallon by 2021 or face substantial fines. Renault, like many manufacturers, are behind in the development of electric and hybrid options because of the consumer's passion for thirsty sport utility vehicles. Renault created the Renault-Nissan-Mitsubishi Alliance (RNMA) and they plan to hit annual sales of 14 million units by 2022 by embracing new technology and business models. The Alliance has plans to launch 12 pure electric models, 40 models with autonomous drive technology, and a move into robo-vehicle ride-hailing services. Success depends on doubling synergies between Alliance players and the ten brands that include: Nissan, Renault, Mistubishi, Dacia, Lada, Infiniti, Venucia, Datsun, RSM, and Alpine. In 2017 the Alliance sold 10.61 million cars and light commercial trucks-eight years of rising sales. The push to 14 million units is ambitious but management believe realistic. What is the recipe for success the Alliance has found to generate high profits while introducing new technology and models? It uses simple designs that incorporate components from older car designs or developing parts and material to obtain synergy across models. At the center of its design procedure is a "design-to-cost" philosophy. In this process, designers and engineers no longer strive for the cutting edge. Instead, they focus on choosing parts and materials for simplicity, ease of manufacturing, and availability. To be proactive in seizing market opportunity the alliance launched a corporate venturing arm in January 2018 called Alliance Ventures. With a billion-dollar investment, the incubator is charged with developing new mobility, autonomous driving, connected services, electric vehicles, and energy. The venture is also charged with introducing Enterprise 2.0 to unify the presence of the Alliance on social media and improve transparency. The strategy is not original and success hinges on execution and the realization of the planned synergies. The competition is not sitting still waiting for the Alliance to steal the show with global players seeking competitive alliances and partnerships. China is emerging as a new competitor, and Tesla, Uber and Dyson are dangerous competitors unencumbered by traditional operations-they are new. Source: Burkitt, Laurie. 2014. Herms to expand in China as other luxury brands pull back. wsj.com, September 12. Which of Michael Porter's generic strategies did the Alliance primarily pursue to tackle the new realities of the market? Multiple Choice breakaway positioning focus consolidation overall cost leadership differentiation RNMA's dive into electric, hybrid, and autonomous vehicles can be seen as a form of Multiple Choice reverse positioning. breakaway positioning. mass customization. harvesting. competitive parity. What is the most likely reason that RNMA's strategy might fail to result in a sustainable competitive advantage? Multiple Choice RNMA's competitive advantage appears to be sustainable. The firm cannot earn enough profit selling low-end automobiles. RNMA's strategy could be imitated by competitors. The firm is vulnerable to new entrants into the market. There are many substitute products available to consumers. The European Union fuel economy mandates sent the European market for full-featured automobiles Multiple Choice into the maturity stage. out of the industry life cycle. into the decline stage. into competitive parity. down the experience curve

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts