Question: please answer req. 2 alternative a please explain in detail how you got each answer Casual Seating Company is currently selling 2,000 oversized bean bag

please answer req. 2 alternative a

please answer req. 2 alternative a

please explain in detail how you got each answer

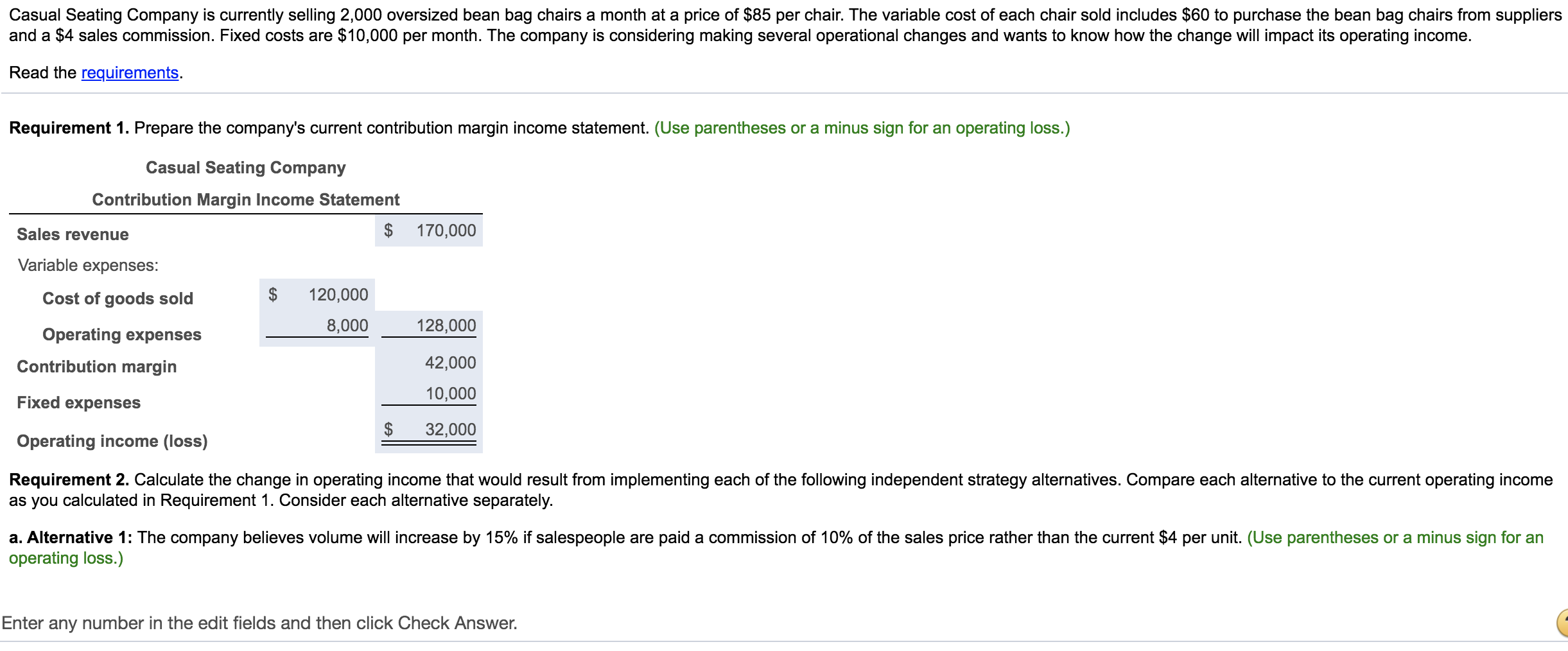

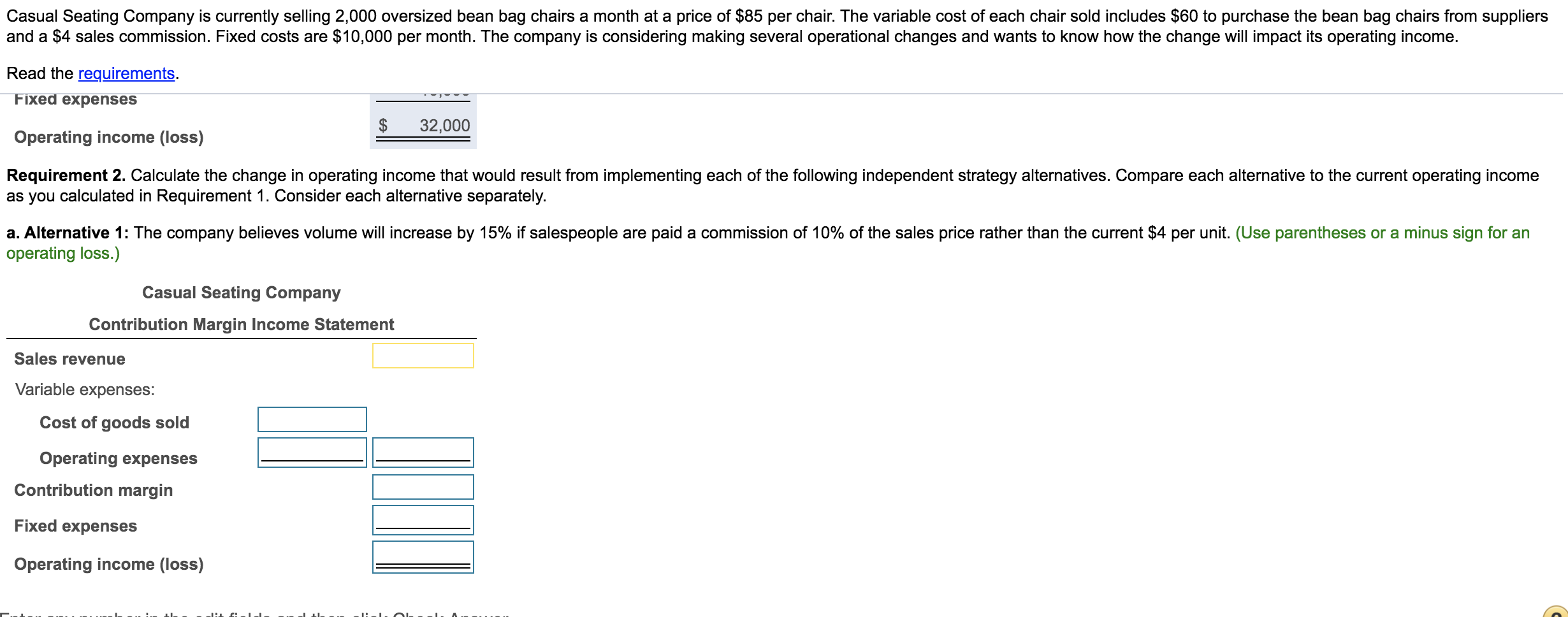

Casual Seating Company is currently selling 2,000 oversized bean bag chairs a month at a price of $85 per chair. The variable cost of each chair sold includes $60 to purchase the bean bag chairs from suppliers and a $4 sales commission. Fixed costs are $10,000 per month. The company is considering making several operational changes and wants to know how the change will impact its operating income. Read the requirements. Requirement 1. Prepare the company's current contribution margin income statement. (Use parentheses or a minus sign for an operating loss.) Casual Seating Company Contribution Margin Income Statement $ 170,000 Sales revenue Variable expenses: Cost of goods sold 120,000 8,000 128,000 Operating expenses Contribution margin 42,000 Fixed expenses 10,000 32,000 Operating income (loss) Requirement 2. Calculate the change in operating income that would result from implementing each of the following independent strategy alternatives. Compare each alternative to the current operating income as you calculated in Requirement 1. Consider each alternative separately. a. Alternative 1: The company believes volume will increase by 15% if salespeople are paid a commission of 10% of the sales price rather than the current $4 per unit. (Use parentheses or a minus sign for an operating loss.) Enter any number in the edit fields and then click Check Answer. Casual Seating Company is currently selling 2,000 oversized bean bag chairs a month at a price of $85 per chair. The variable cost of each chair sold includes $60 to purchase the bean bag chairs from suppliers and a $4 sales commission. Fixed costs are $10,000 per month. The company is considering making several operational changes and wants to know how the change will impact its operating income. Read the requirements. Fixed expenses $ 32,000 Operating income (loss) Requirement 2. Calculate the change in operating income that would result from implementing each of the following independent strategy alternatives. Compare each alternative to the current operating income as you calculated in Requirement 1. Consider each alternative separately. a. Alternative 1: The company believes volume will increase by 15% if salespeople are paid a commission of 10% of the sales price rather than the current $4 per unit. (Use parentheses or a minus sign for an operating loss.) Casual Seating Company Contribution Margin Income Statement Sales revenue Variable expenses: Cost of goods sold Operating expenses Contribution margin MILI Fixed expenses Operating income (loss)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts