Question: please answer requirement 1 & 2 Gardi Manufacturing uses normal costing for its job-costing system, which has two direct-cost categories (direct materials and direct manufacturing

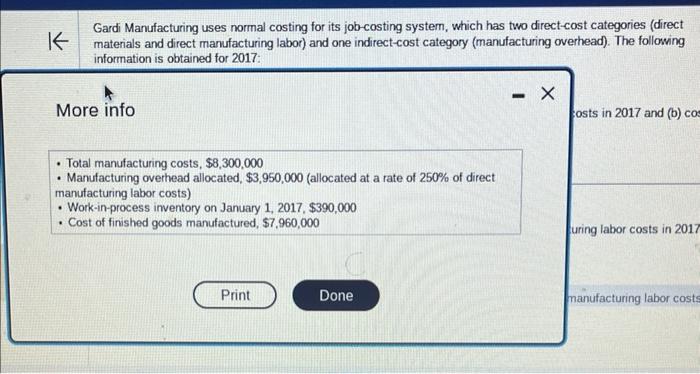

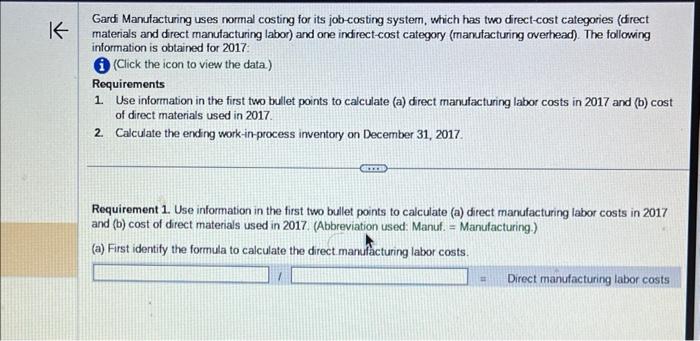

Gardi Manufacturing uses normal costing for its job-costing system, which has two direct-cost categories (direct materials and direct manufacturing labor) and one indirect-cost category (manufacturing overhead). The following information is obtained for 2017 : More info osts in 2017 and (b) cos - Total manufacturing costs, $8,300,000 - Manufacturing overhead allocated, $3,950,000 (allocated at a rate of 250% of direct manufacturing labor costs) - Work-in-process inventory on January 1, 2017, $390,000 - Cost of finished goods manufactured, $7,960,000 uring labor costs in 2017 Gard Manulacturing uses normal costing for its job-costing system, which has two direct-cost categories (drect materials and direct manulacturing labor) and one indirect-cost category (manulacturing overhead). The following information is obtained for 2017 : (i) (Click the icon to view the data) Requirements 1. Use information in the first two bullet points to calculate (a) drect manulacturing labor costs in 2017 and (b) cost of direct materials used in 2017. 2. Calculate the ending work-in-process inventory on December 31, 2017. Requirement 1. Use information in the first two bullet points to calculate (a) direct manufacturing labor costs in 2017 and (b) cost of direct materials used in 2017. (Abbreviation used: Manuf. = Manufacturing.) (a) First identify the formula to calculate the direct manufacturing labor costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts