Question: PLEASE ANSWER SECOND PART A commercial bank decides to expand its service menu to include the underwriting of new security offerings (i.e., investment banking) as

PLEASE ANSWER SECOND PART

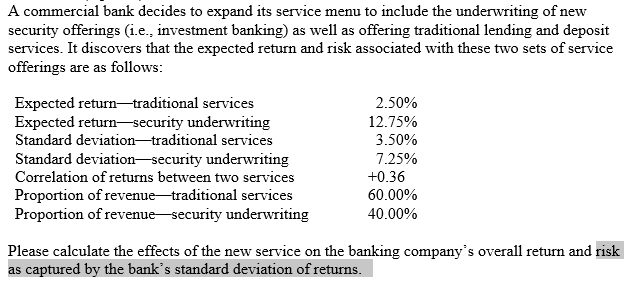

A commercial bank decides to expand its service menu to include the underwriting of new security offerings (i.e., investment banking) as well as offering traditional lending and deposit services. It discovers that the expected return and risk associated with these two sets of service offerings are as follows: Expected return-traditional services 2.50% Expected return-security underwriting 12.75% Standard deviationtraditional services 3.50% Standard deviation security underwriting 7.25% Correlation of returns between two services +0.36 Proportion of revenue traditional services 60.00% Proportion of revenue-security underwriting 40.00% Please calculate the effects of the new service on the banking company's overall return and risk as captured by the bank's standard deviation of returns

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts