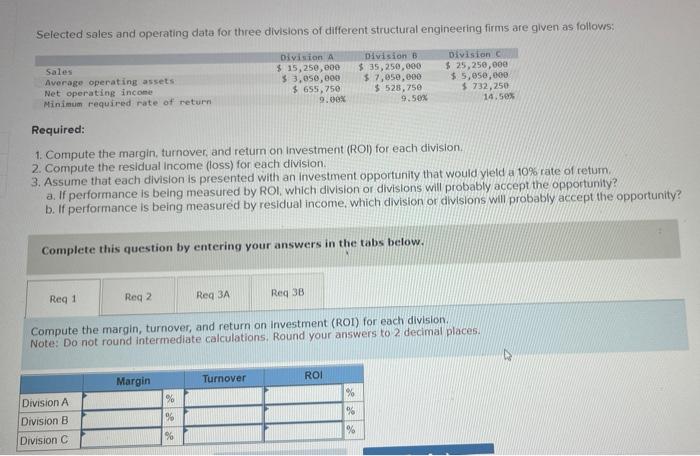

Question: please answer Selected sales and operating data for three divisions of different structural engineering firms are given as follows: Required: 1. Compute the margin, turnover,

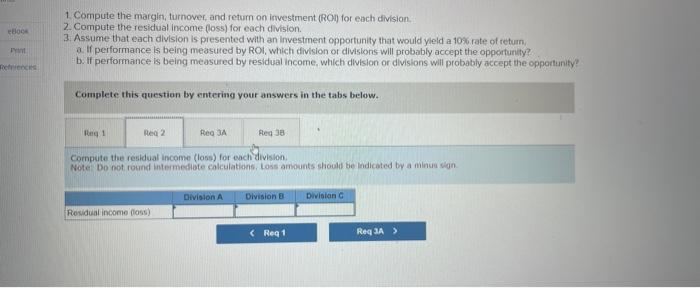

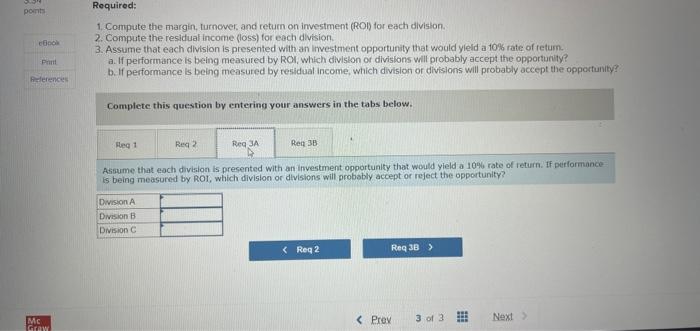

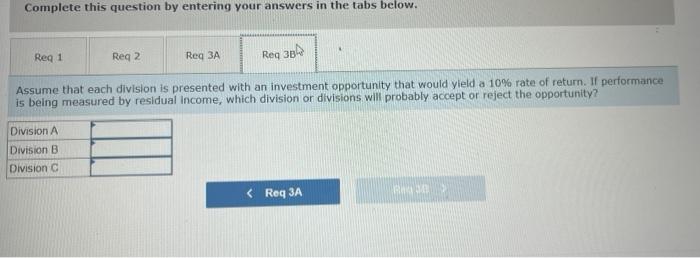

Selected sales and operating data for three divisions of different structural engineering firms are given as follows: Required: 1. Compute the margin, turnover, and return on investment (ROI) for each division. 2. Compute the residual income (loss) for each division. 3. Assume that each division is presented with an investment opportunity that would yleld a 10% rate of retum. a. If performance is being measured by ROI, which division or divisions will probably accept the opportunity? b. If performance is being measured by residual income, which division or divisions will probably accept the opportunity? Complete this question by entering your answers in the tabs below. Compute the margin, turnover, and return on investment (ROI) for each division. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. 1. Compute the margin, turnover, and return on investment (ROI) for each division. 2. Compute the residual income (loss) for each division. 3. Assume that each dlvision is presented with an investment opportunity that would yleid a 10% rate of retum. a. If performance is being measured by ROI, which division of divisions will probably accept the opportunity? b. If performance is being measured by residual income, which division or divisions will probably accept the oppontunity Complete this question by entering your answers in the tabs below. Compute the residual income (loss) for eoch division. Note Do not round intermediote calculations. Loss amounts shiould be lndicated by a minue sign. 1. Compute the margin, turnover. and return on investment (ROI) for each dlvision. 2. Compute the residual income (loss) for each division. 3. Assume that each division is presented with an investment opportunity that would yleid a tosk rate of tetum. a. If performance is being measured by ROI, which diviston or divisions will probably accept the opporturity? b. If performance is being measured by residual income, which division or divisions will probably accept the opportunity? Complete this question by entering your answers in the tabs below. A Assume that each division is presented with an investment opportunity that would yield a 1090 rate of return. If performance is being measured by ROI, which division or divisions will probably accept or reject the opportunity? Complete this question by entering your answers in the tabs below. Assume that each division is presented with an investment opportunity that would yleld a 10% rate of return. If performance is being measured by residual income, which division or divisions will probably accept or reject the opportunity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts