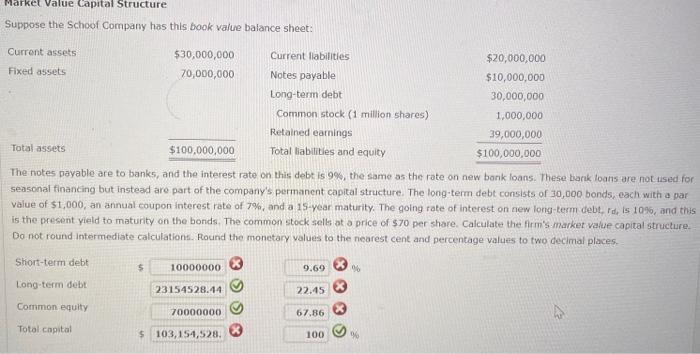

Question: Please answer short term debt... Please note- the answer 10,000,000 is NOT correct as can be seen in the photo. Suppose the Schoof Company has

Suppose the Schoof Company has this book value balance sheet: The notes payable are to banks, and the interest rate on this debt is 9%, the same as the rate on new bonk loans. These bark loans are not used for. seasonal financing but instead are part of the company's permanent capital structure. The long-term debt consists of 30 , ooe bonds, each with a par value of $1,000, an arinual coupon interest rate of 7%, and a 15 -year maturity. The going rate of interest on new long-term debt. r d, is 1096 , and this is the present yield to maturity on the bonds. The common stock selle at a price of $70 per share. Calculate the firmis.market value capital struclure. Bo not round intermediate calculations. Round the monetary yalues to the nearest cent and percentage values to two decimal places. Suppose the Schoof Company has this book value balance sheet: The notes payable are to banks, and the interest rate on this debt is 9%, the same as the rate on new bonk loans. These bark loans are not used for. seasonal financing but instead are part of the company's permanent capital structure. The long-term debt consists of 30 , ooe bonds, each with a par value of $1,000, an arinual coupon interest rate of 7%, and a 15 -year maturity. The going rate of interest on new long-term debt. r d, is 1096 , and this is the present yield to maturity on the bonds. The common stock selle at a price of $70 per share. Calculate the firmis.market value capital struclure. Bo not round intermediate calculations. Round the monetary yalues to the nearest cent and percentage values to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts