Question: PLEASE ANSWER SHOWING STEPS TO SOLUTION You are considering an investment that costs $3,800. It is expected to have a useful life of three years.

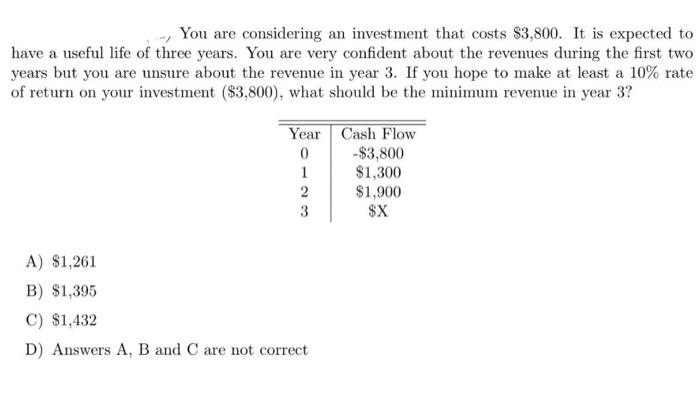

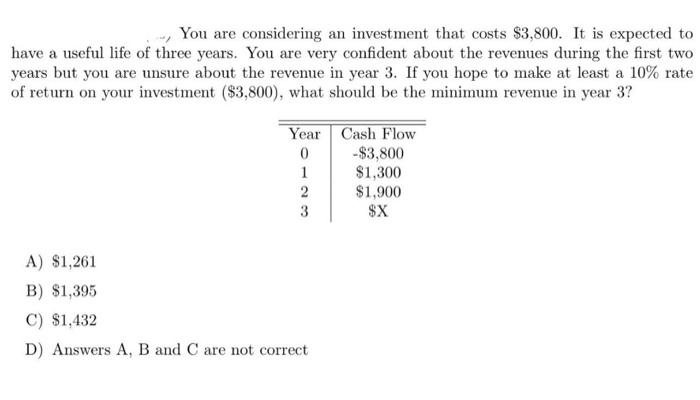

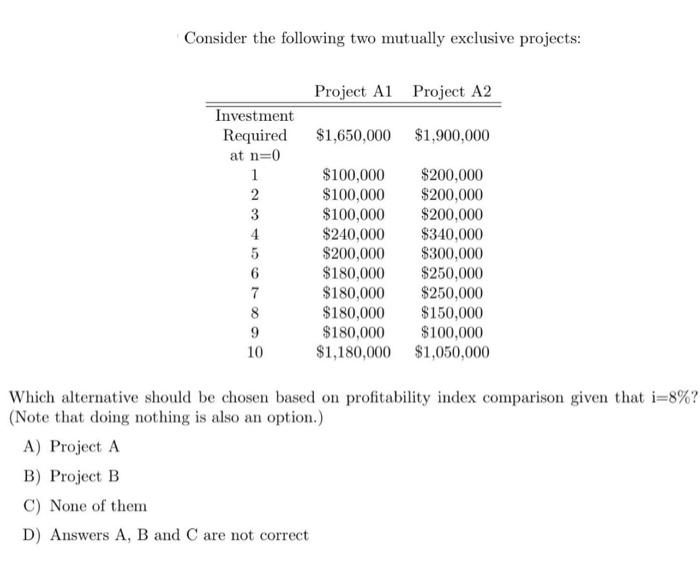

You are considering an investment that costs $3,800. It is expected to have a useful life of three years. You are very confident about the revenues during the first two years but you are unsure about the revenue in year 3. If you hope to make at least a 10% rate of return on your investment ($3,800), what should be the minimum revenue in year 3? Year Cash Flow 0 -$3,800 1 $1,300 2 $1,900 3 $X A) $1,261 B) $1,395 C) $1,432 D) Answers A, B and C are not correct Consider the following two mutually exclusive projects: Project Al Project A2 $1,650,000 $1,900,000 Investment Required at n=0 1 2 3 4 5 6 7 8 9 10 $100,000 $200,000 $100,000 $200,000 $100,000 $200,000 $240,000 $340,000 $200,000 $300,000 $180,000 $250,000 $180,000 $250,000 $180,000 $150,000 $180,000 $100,000 $1,180,000 $1,050,000 Which alternative should be chosen based on profitability index comparison given that i=8%? (Note that doing nothing is also an option.) A) Project A B) Project B C) None of them D) Answers A, B and C are not correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts