Question: ***PLEASE ANSWER SHOWING THE STEP BY STEP BREAK DOWN. THANK YOU!!*** 1 Flag Carwash is considering the purchase of new car wash equipment in order

***PLEASE ANSWER SHOWING THE STEP BY STEP BREAK DOWN. THANK YOU!!***

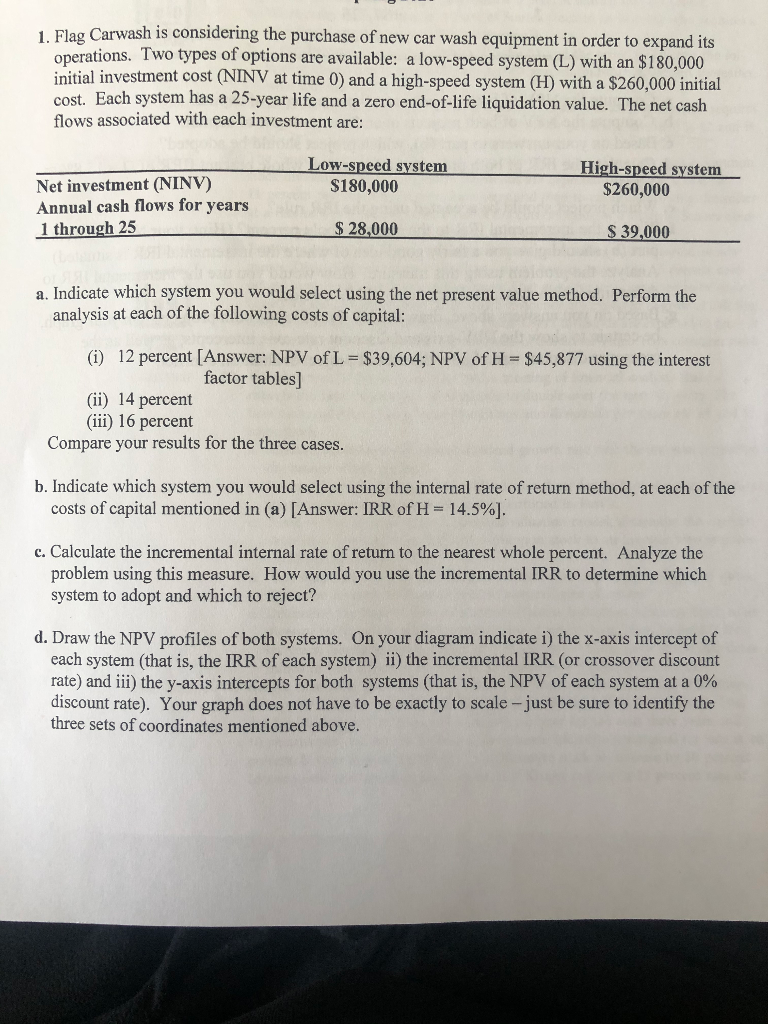

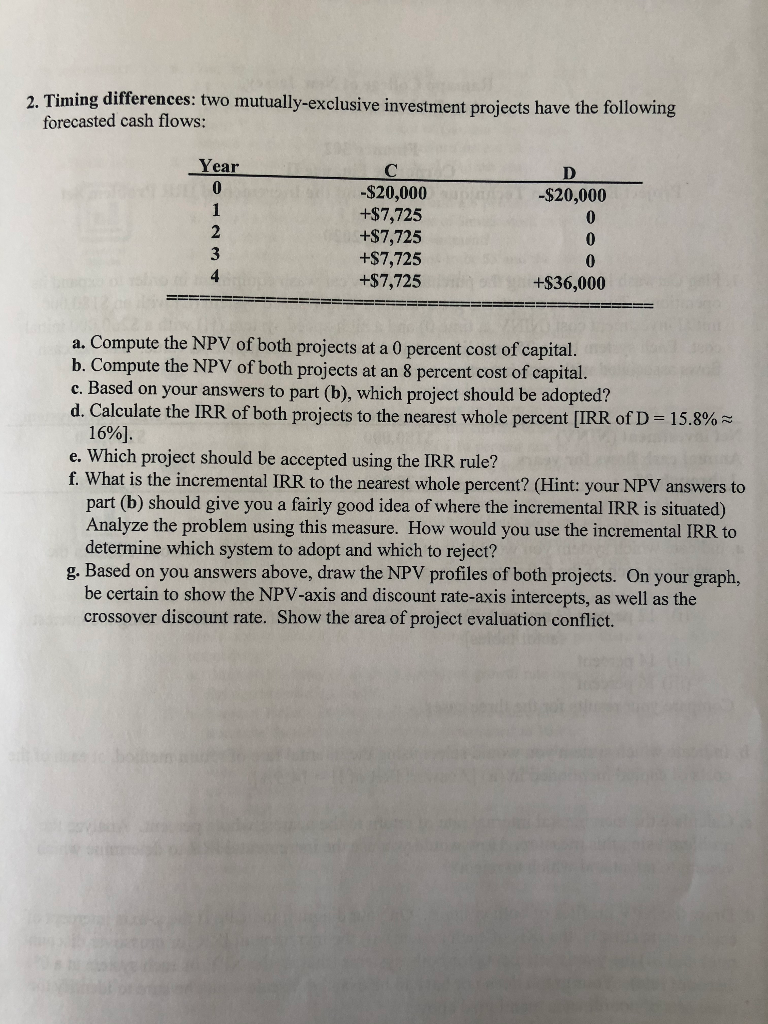

1 Flag Carwash is considering the purchase of new car wash equipment in order to expand its operations. Two types of options are available: a low-speed system (L) with an $180,000 initial investment cost (NINV at time 0) and a high-speed system (H) with a $260,000 initial cost. Each system has a 25-year life and a zero end-of-life liquidation value. The net cash flows associated with each investment are: Low-speed system $180,000 High-speed system $260,000 Net investment (NINV) Annual cash flows for years 1 through 25 $ 28,000 $ 39,000 a. Indicate which system you would select using the net present value method. Perform the analysis at each of the following costs of capital: (1) 12 percent [Answer: NPV of L = $39.604; NPV of H = $45,877 using the interest factor tables] (ii) 14 percent (iii) 16 percent Compare your results for the three cases. b. Indicate which system you would select using the internal rate of return method, at each of the costs of capital mentioned in (a) Answer: IRR of H = 14.5%). c. Calculate the incremental internal rate of return to the nearest whole percent. Analyze the problem using this measure. How would you use the incremental IRR to determine which system to adopt and which to reject? d. Draw the NPV profiles of both systems. On your diagram indicate i) the x-axis intercept of each system (that is, the IRR of each system) ii) the incremental IRR (or crossover discount rate) and iii) the y-axis intercepts for both systems (that is, the NPV of each system at a 0% discount rate). Your graph does not have to be exactly to scale - just be sure to identify the three sets of coordinates mentioned above. 2. Timing differences: two mutually-exclusive investment projects have the following forecasted cash flows: Year -$20,000 -$20,000 +$7,725 +$7,725 +$7,725 +$7,725 +$36,000 a. Compute the NPV of both projects at a 0 percent cost of capital. b. Compute the NPV of both projects at an 8 percent cost of capital. c. Based on your answers to part (b), which project should be adopted? d. Calculate the IRR of both projects to the nearest whole percent (IRR of D = 15.8% 16%). e. Which project should be accepted using the IRR rule? f. What is the incremental IRR to the nearest whole percent? (Hint: your NPV answers to part (b) should give you a fairly good idea of where the incremental IRR is situated) Analyze the problem using this measure. How would you use the incremental IRR to determine which system to adopt and which to reject? g. Based on you answers above, draw the NPV profiles of both projects. On your graph, be certain to show the NPV-axis and discount rate-axis intercepts, as well as the crossover discount rate. Show the area of project evaluation conflict

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts