Question: PLEASE ANSWER SOON!! Question 14 (5 points) Listen Kertis, Inc. reported Net fixed assets as follows on its Balance sheets for December 31, Year 1

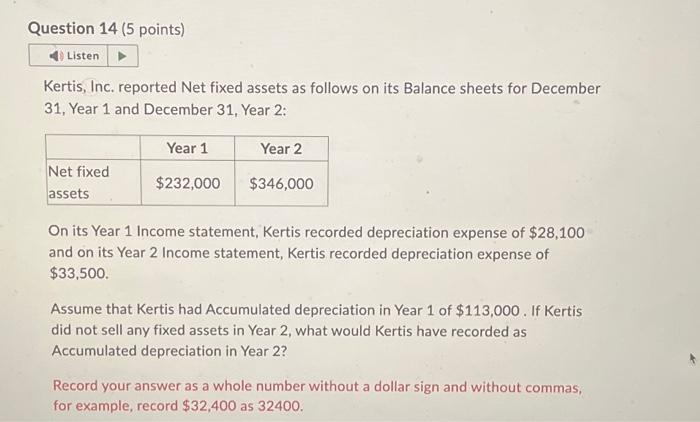

Kertis, Inc. reported Net fixed assets as follows on its Balance sheets for December 31, Year 1 and December 31, Year 2: On its Year 1 Income statement, Kertis recorded depreciation expense of $28,100 and on its Year 2 Income statement, Kertis recorded depreciation expense of $33,500. Assume that Kertis had Accumulated depreciation in Year 1 of $113,000. If Kertis did not sell any fixed assets in Year 2, what would Kertis have recorded as Accumulated depreciation in Year 2? Record your answer as a whole number without a dollar sign and without commas, for example, record $32,400 as 32400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts