Question: please answer soon ! will rate :) Minerals Mining Inc. (MMI) is considering new equipment costing $100,000 that is depreciated using the factors in the

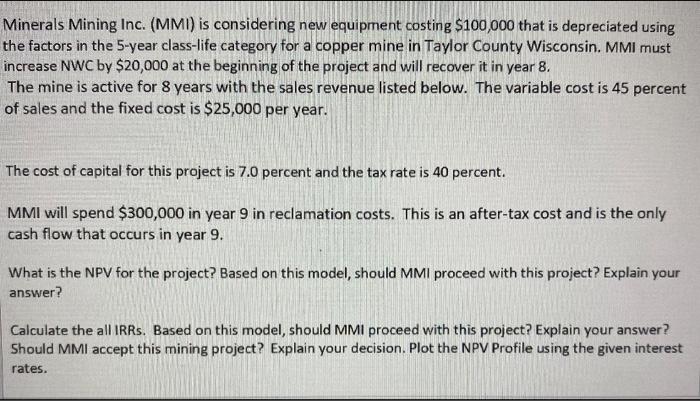

Minerals Mining Inc. (MMI) is considering new equipment costing $100,000 that is depreciated using the factors in the 5-year class-life category for a copper mine in Taylor County Wisconsin. MMI must increase NWC by $20,000 at the beginning of the project and will recover it in year 8 . The mine is active for 8 years with the sales revenue listed below. The variable cost is 45 percent of sales and the fixed cost is $25,000 per year. The cost of capital for this project is 7.0 percent and the tax rate is 40 percent. MMI will spend $300,000 in year 9 in reclamation costs. This is an after-tax cost and is the only cash flow that occurs in year 9 . What is the NPV for the project? Based on this model, should MMI proceed with this project? Explain your answer? Calculate the all IRRs. Based on this model, should MMI proceed with this project? Explain your answer? Should MMI accept this mining project? Explain your decision. Plot the NPV Profile using the given interest rates. Minerals Mining Inc. (MMI) is considering new equipment costing $100,000 that is depreciated using the factors in the 5-year class-life category for a copper mine in Taylor County Wisconsin. MMI must increase NWC by $20,000 at the beginning of the project and will recover it in year 8 . The mine is active for 8 years with the sales revenue listed below. The variable cost is 45 percent of sales and the fixed cost is $25,000 per year. The cost of capital for this project is 7.0 percent and the tax rate is 40 percent. MMI will spend $300,000 in year 9 in reclamation costs. This is an after-tax cost and is the only cash flow that occurs in year 9 . What is the NPV for the project? Based on this model, should MMI proceed with this project? Explain your answer? Calculate the all IRRs. Based on this model, should MMI proceed with this project? Explain your answer? Should MMI accept this mining project? Explain your decision. Plot the NPV Profile using the given interest rates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts