Question: Please answer specially part c. 2. Consider Table 2. The finance director of Paddy PLC is preparing financial plans and different departments have submitted a

Please answer specially part c.

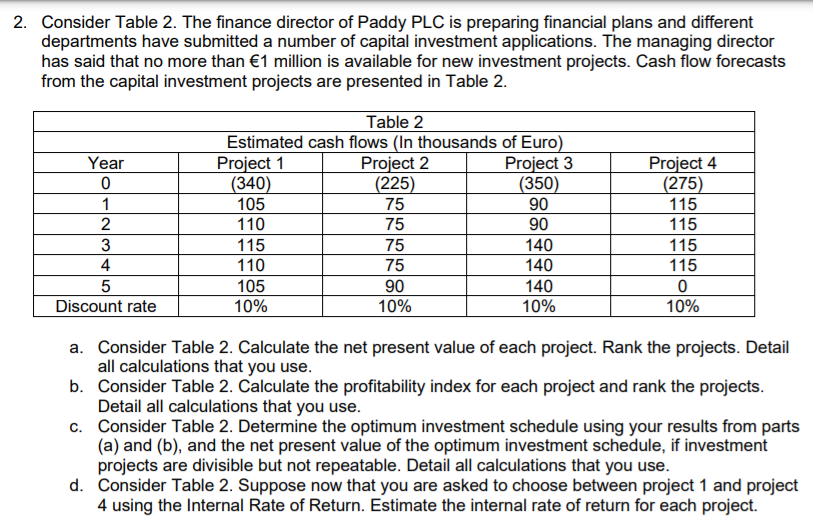

2. Consider Table 2. The finance director of Paddy PLC is preparing financial plans and different departments have submitted a number of capital investment applications. The managing director has said that no more than 1 million is available for new investment projects. Cash flow forecasts from the capital investment projects are presented in Table 2. Project 4 (275) 115 Table 2 Estimated cash flows (In thousands of Euro) Project 1 Project 2 Project 3 (340) (225) (350) 105 75 110 75 115 75 140 110 75 140 105 90 140 10% 10% 10% Year 0 1 2 3 4 5 Discount rate 90 90 115 115 115 0 10% a. Consider Table 2. Calculate the net present value of each project. Rank the projects. Detail all calculations that you use. b. Consider Table 2. Calculate the profitability index for each project and rank the projects. Detail all calculations that you use. c. Consider Table 2. Determine the optimum investment schedule using your results from parts (a) and (b), and the net present value of the optimum investment schedule, if investment projects are divisible but not repeatable. Detail all calculations that you use. d. Consider Table 2. Suppose now that you are asked to choose between project 1 and project 4 using the Internal Rate of Return. Estimate the internal rate of return for each project. Which project would you advise Paddy PLC to invest in and why? Detail all calculations that you use. e. Consider Table 2. Suppose now that you are asked to choose between project 1 and project 4 using the Payback period. Estimate the payback period for each project. Suppose Paddy PLC uses a minimum acceptable payback period of 2 years. Which project would you advise Paddy PLC to invest in and why? Detail all calculations that you use

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts