Question: please answer, thank u Question 1 2 Points At the end of the accounting period, a company using a job order cost system calculates the

please answer, thank u

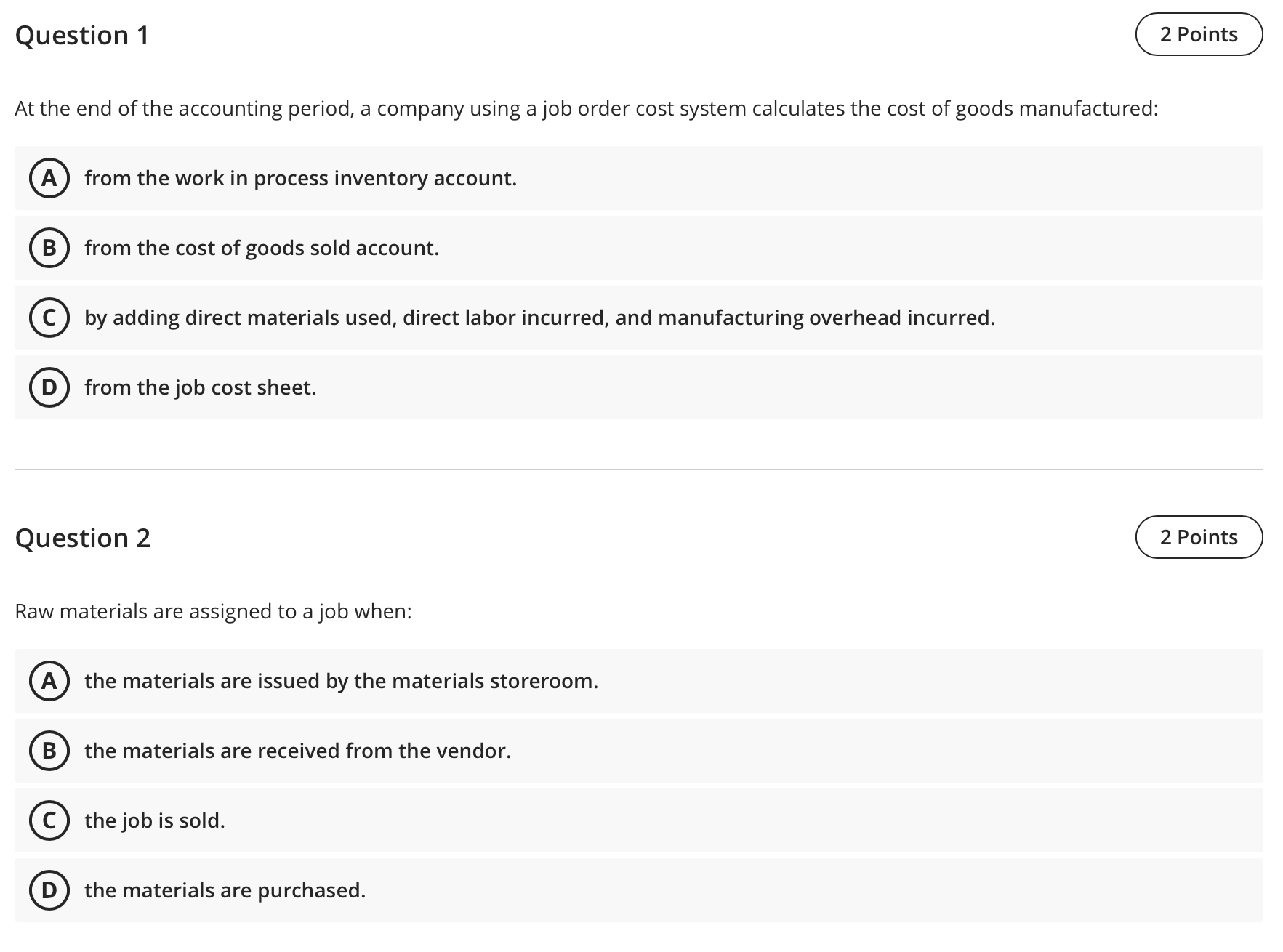

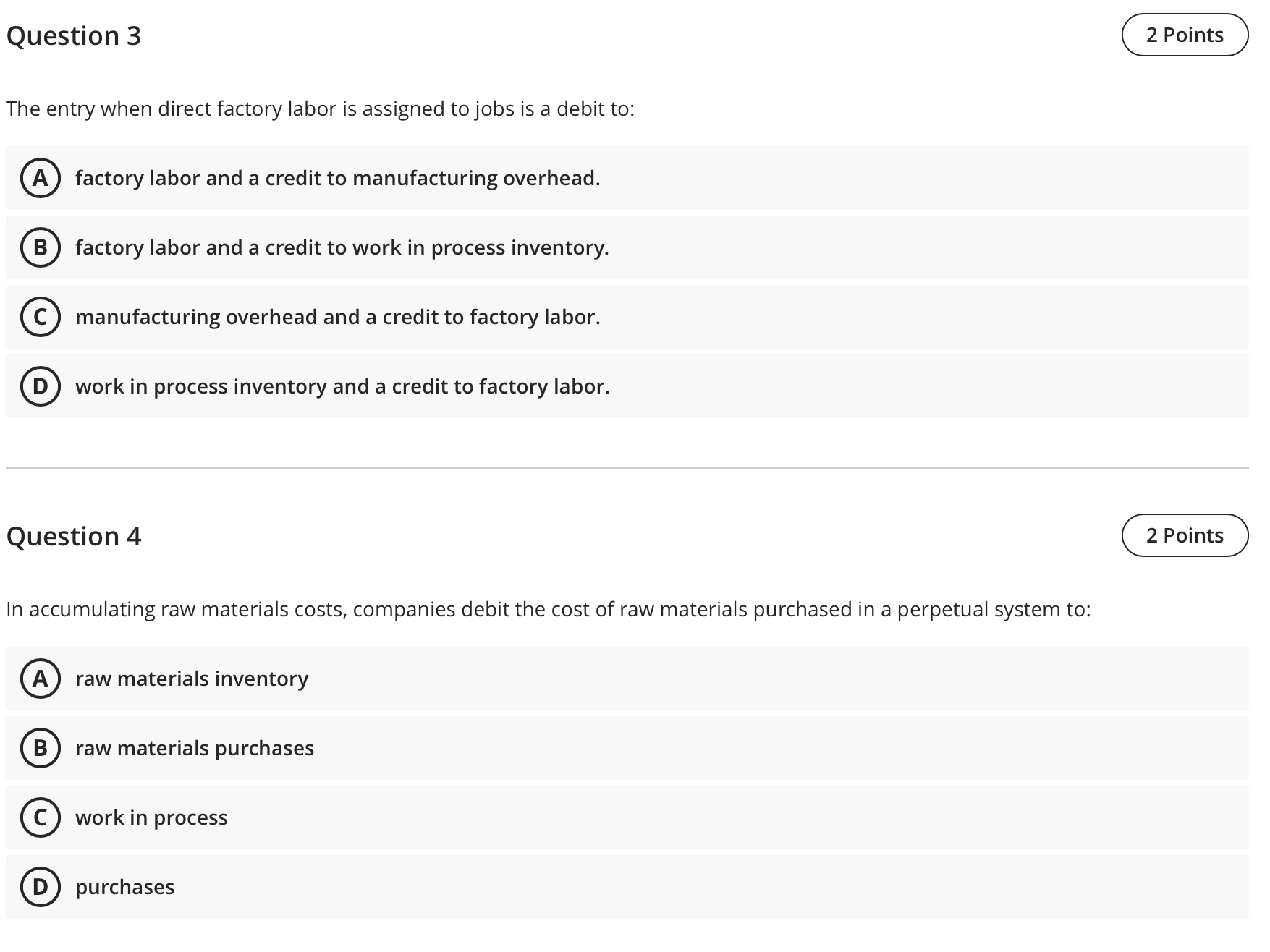

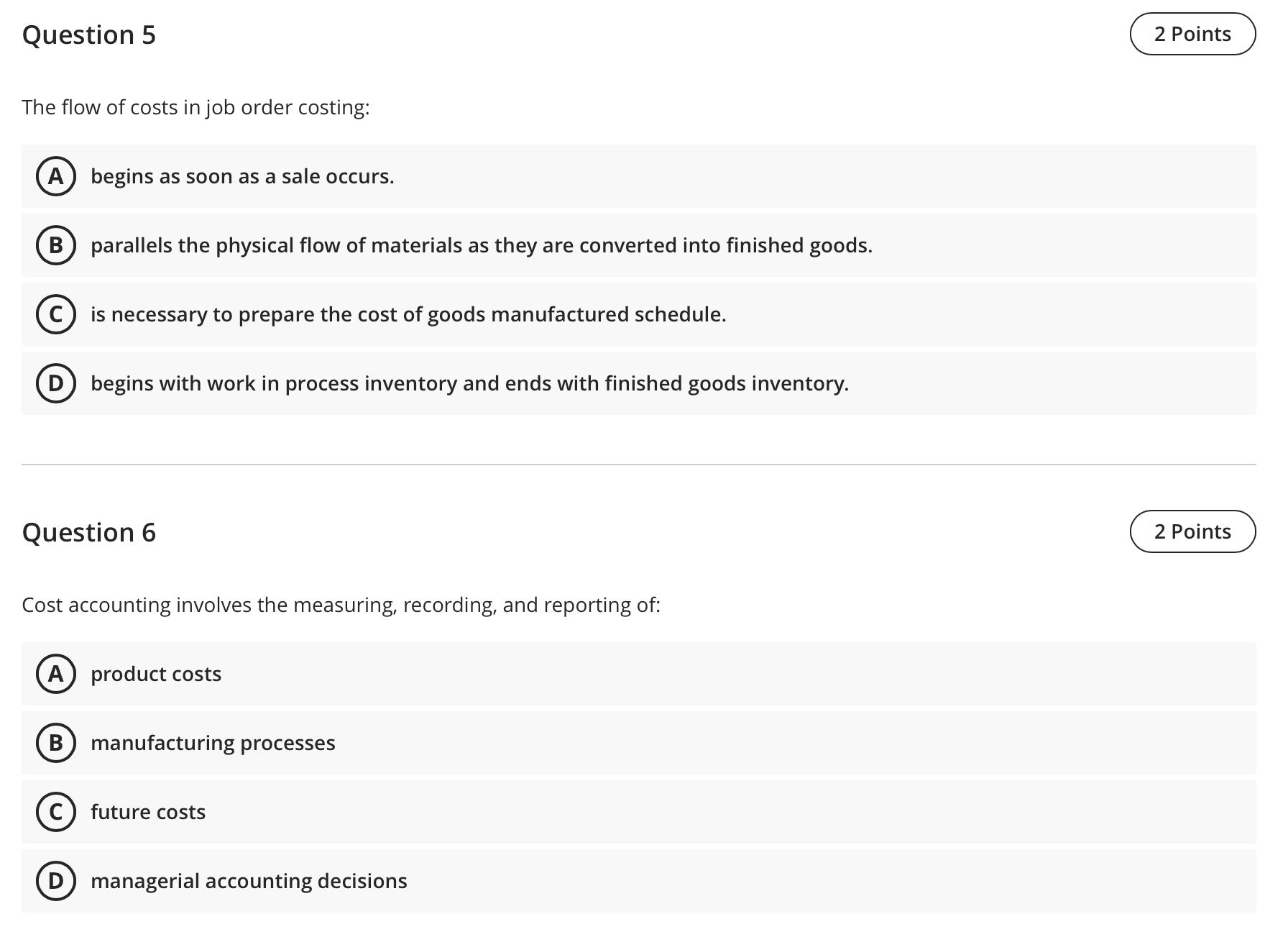

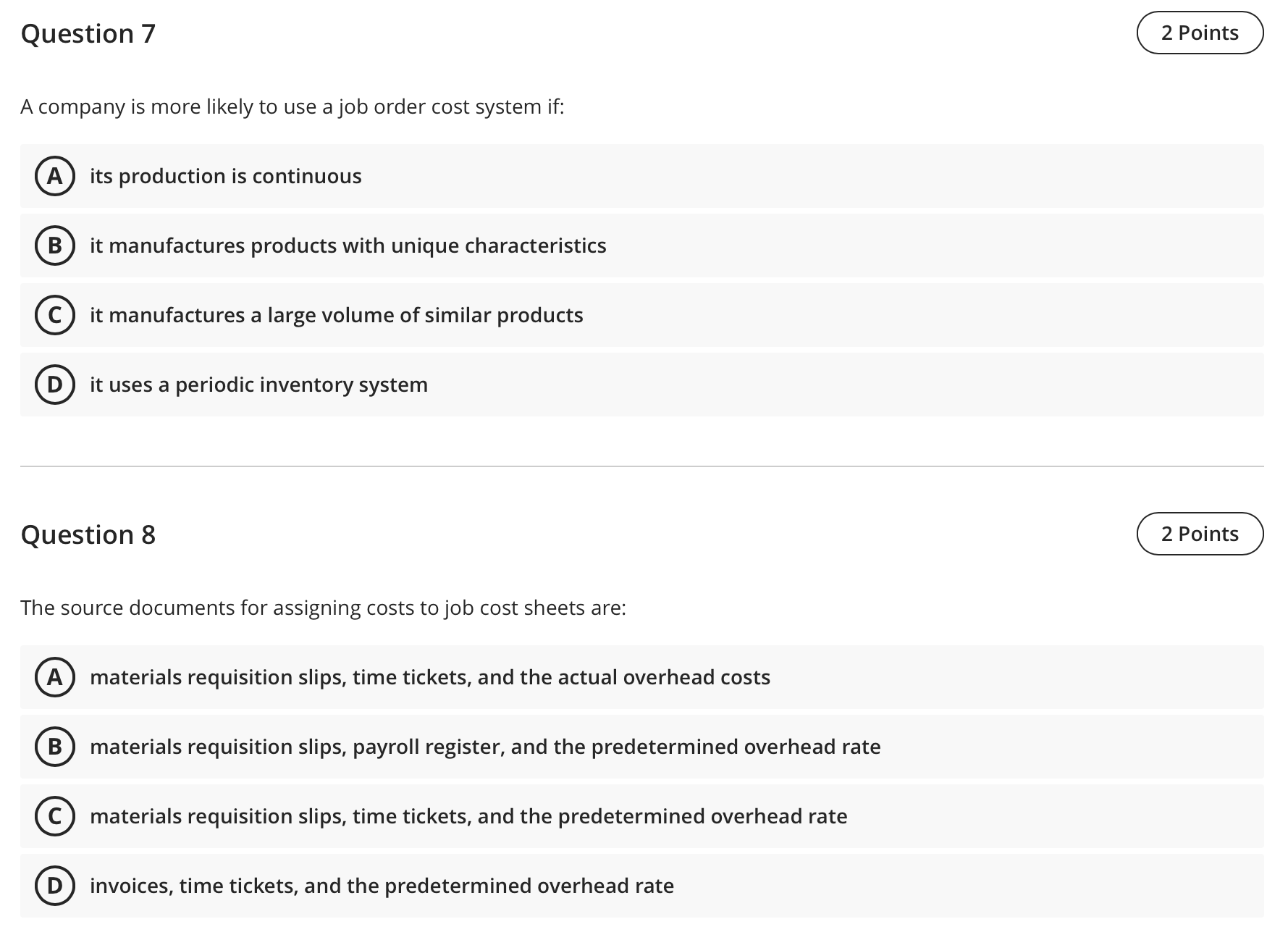

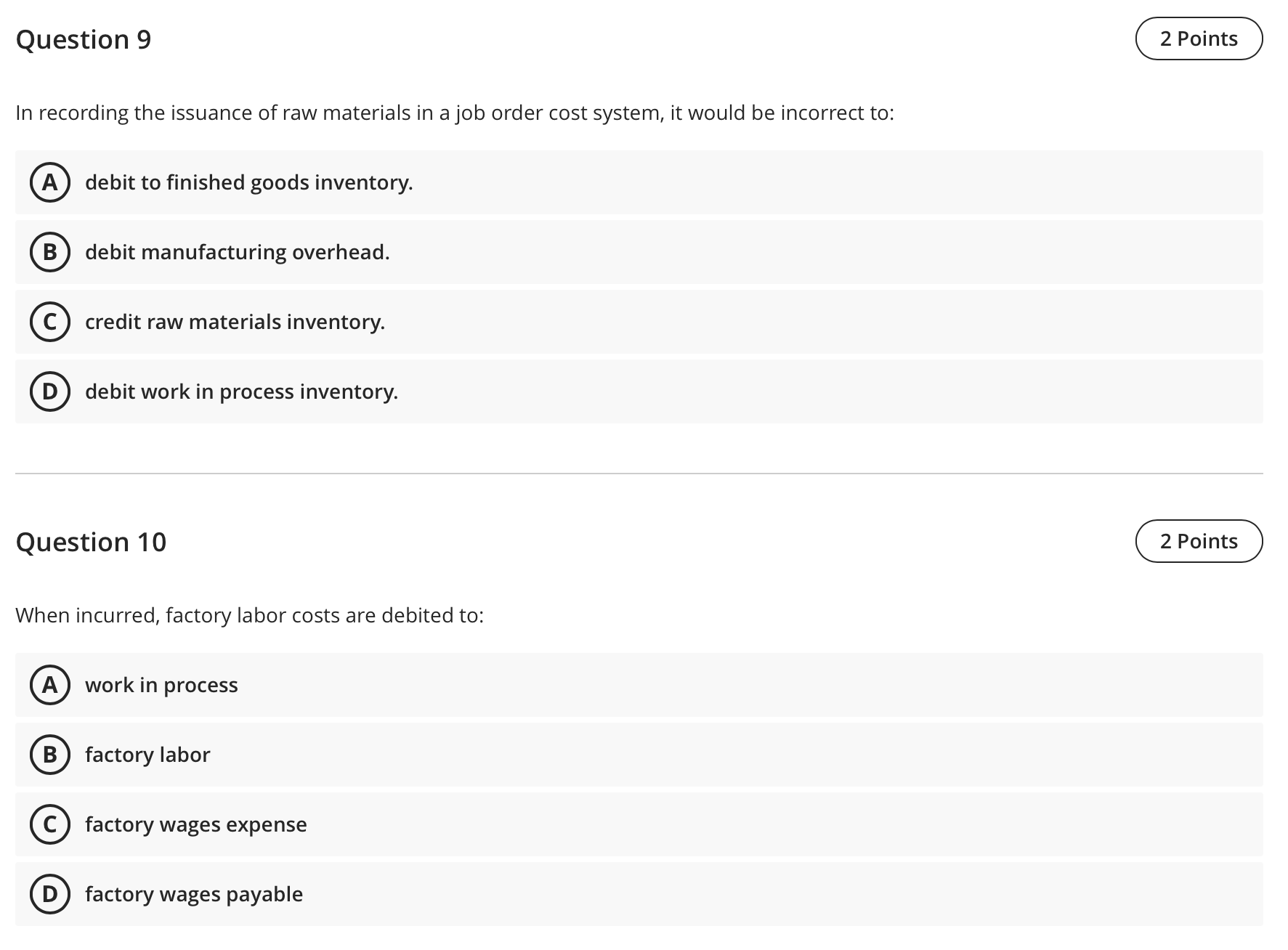

Question 1 2 Points At the end of the accounting period, a company using a job order cost system calculates the cost of goods manufactured: A from the work in process inventory account. B from the cost of goods sold account. C by adding direct materials used, direct labor incurred, and manufacturing overhead incurred. D from the job cost sheet. Question 2 2 Points Raw materials are assigned to a job when: the materials are issued by the materials storeroom. B the materials are received from the vendor. the job is sold. D the materials are purchased.The entry when direct factory labor is assigned to jobs is a debit to: factory labor and a credit to manufacturing overhead. factory labor and a credit to work in process inventory. manufacturing overhead and a credit to factory labor. CD) work in process inventory and a credit to factory labor. In accumulating raw materials costs, companies debit the cost of raw materials purchased in a perpetual system to: raw materials inventory raw materials purchases The flow of costs in job order costing: begins as soon as a sale occurs. parallels the physical flow of materials as they are converted into finished goods. is necessary to prepare the cost of goods manufactured schedule. begins with work in process inventory and ends with finished goods inventory. Cost accounting involves the measuring, recording, and reporting of: Q9 product costs manufacturing processes future costs managerial accounting decisions A company is more likely to use a job order cost system if: ([9 its production is continuous it manufactures products with unique characteristics (9 it manufactures a large volume of similar products 6)) it uses a periodic inventory system The source documents for assigning costs tojob cost sheets are: 6) materials requisition slips, time tickets, and the actual overhead costs materials requisition slips, payroll register, and the predetermined overhead rate (9 materials requisition slips, time tickets, and the predetermined overhead rate 6)) invoices, time tickets, and the predetermined overhead rate In recording the issuance of raw materials in a job order cost system, it would be incorrect to: (A) debit to finished goods inventory. debit manufacturing overhead. (9 credit raw materials inventory. @ debit work in process inventory. Question 10 When incurred, factory labor costs are debited to: factory wages expense @ factory wages payable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts