Question: Please answer thank you!!!!! Step by step Sylvia Chan is a clerk in the shoe department of the Hudson's Bay store in Winnipeg. She earns

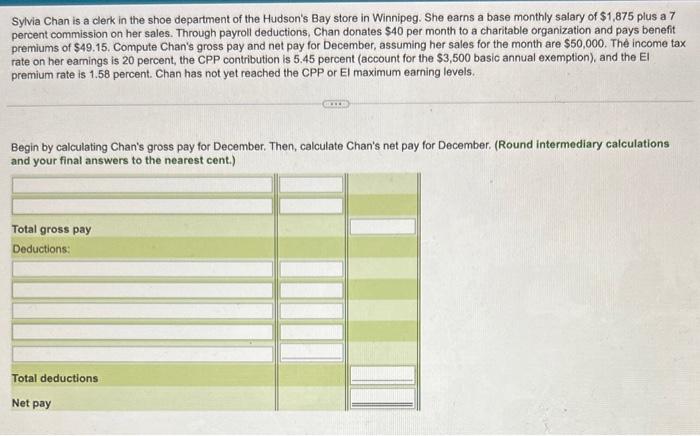

Sylvia Chan is a clerk in the shoe department of the Hudson's Bay store in Winnipeg. She earns a base monthly salary of $1,875 plus a 7 percent commission on her sales. Through payroll deductions, Chan donates $40 per month to a charitable organization and pays benefit premiums of $49.15. Compute Chan's gross pay and net pay for December, assuming her sales for the month are $50,000. The income tax rate on her earnings is 20 percent, the CPP contribution is 5.45 percent (account for the $3,500 basic annual exemption), and the El premium rate is 1.58 percent. Chan has not yet reached the CPP or El maximum earning levels. Begin by calculating Chan's gross pay for December. Then, calculate Chan's net pay for December. (Round intermediary calculations and your final answers to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts