Question: Please Answer. Thank you very much! During the first year of operation, Year 1, McGinnis Appliance recognized $376,000 of service revenue on account. At the

Please Answer. Thank you very much!

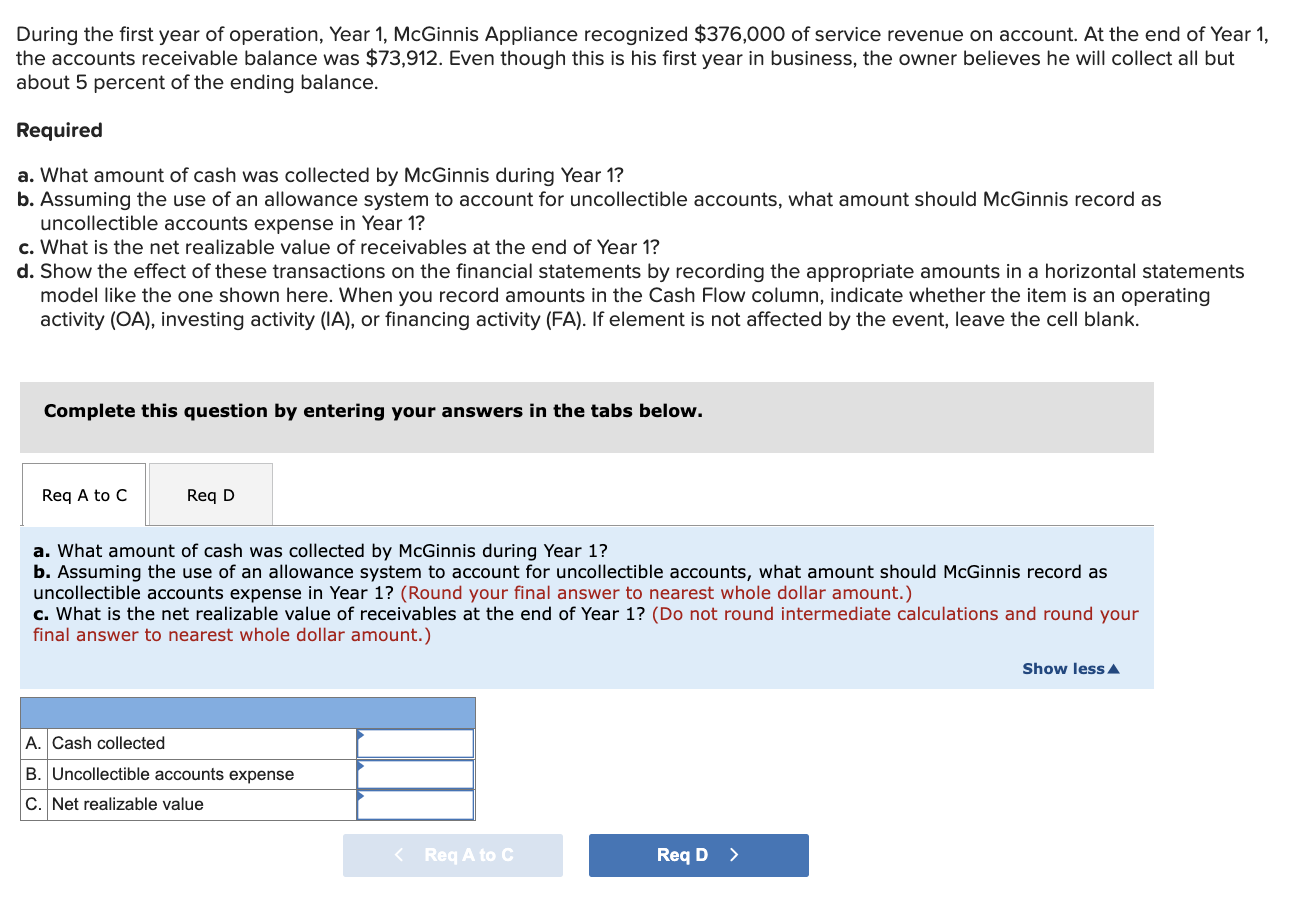

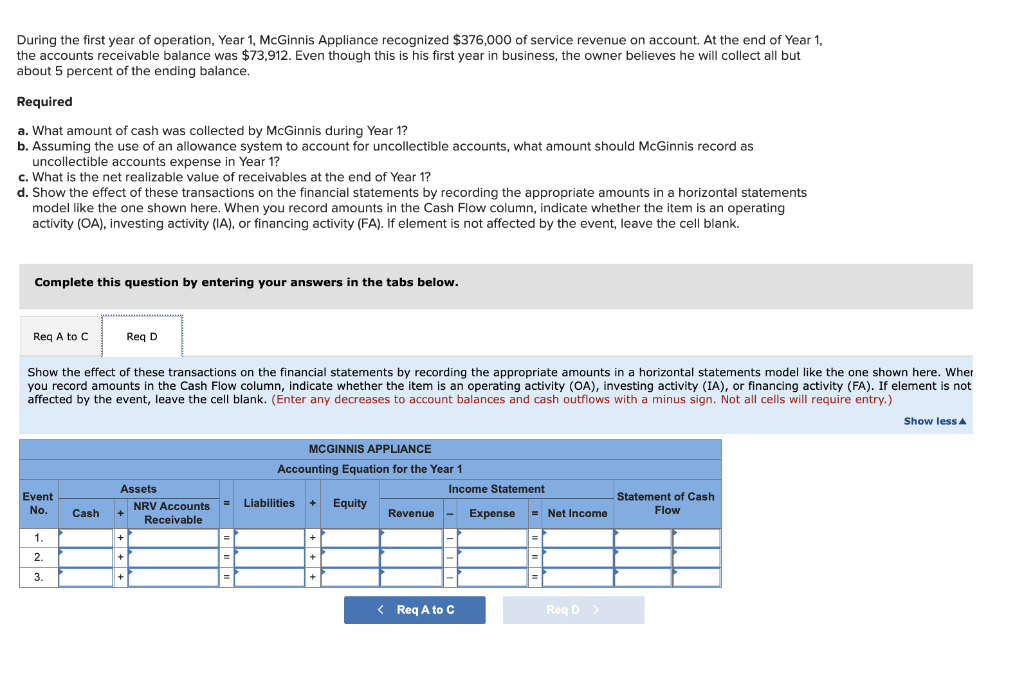

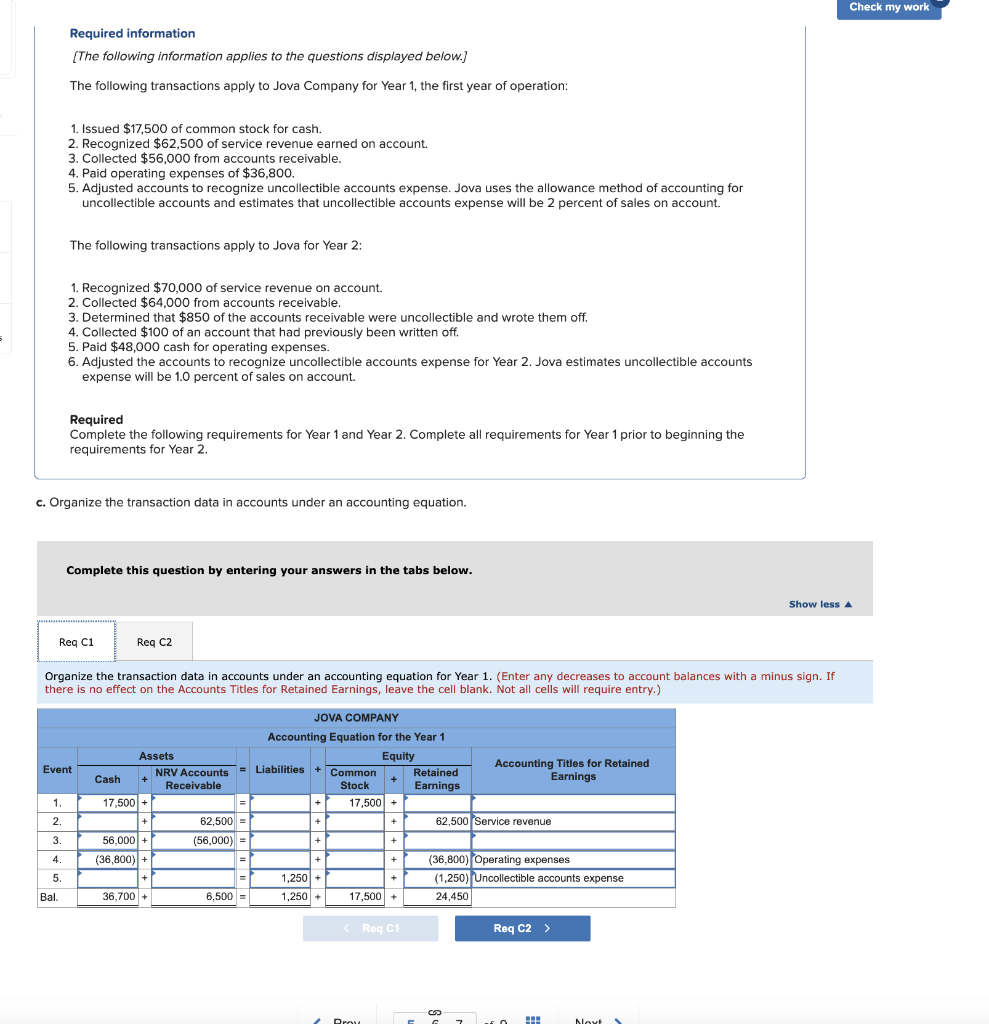

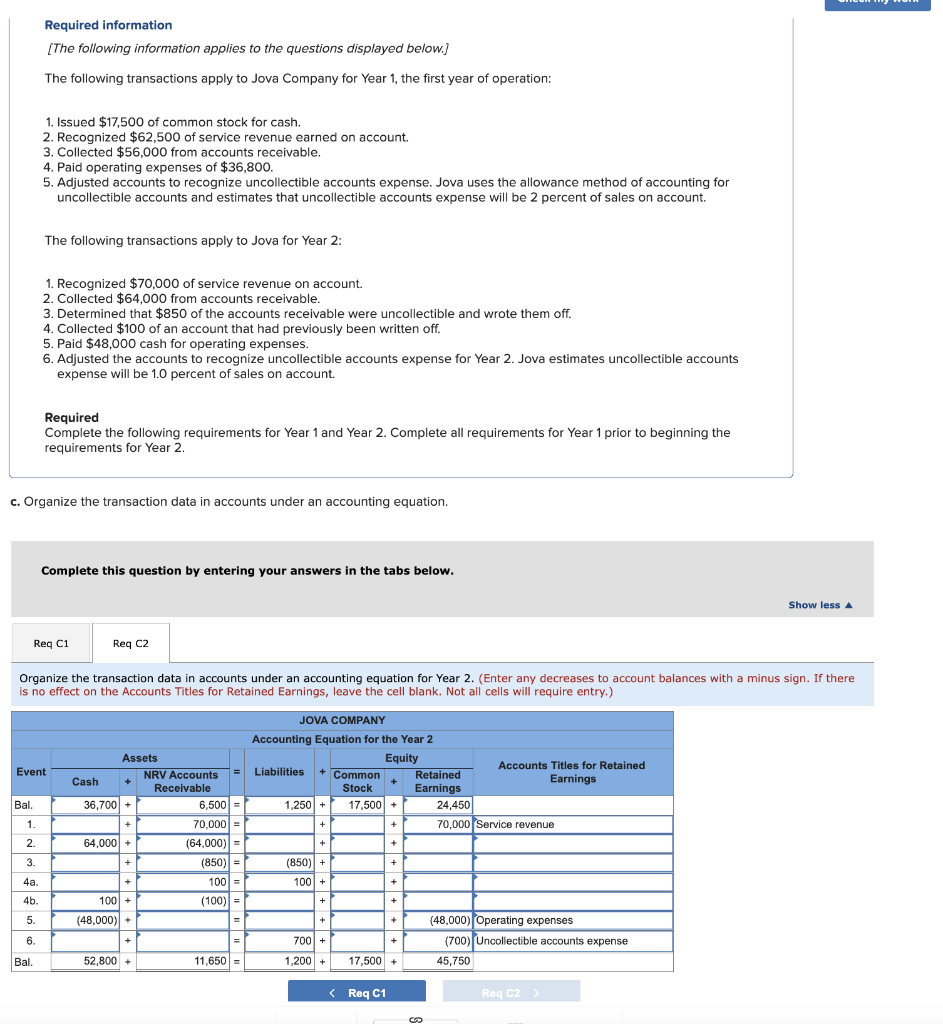

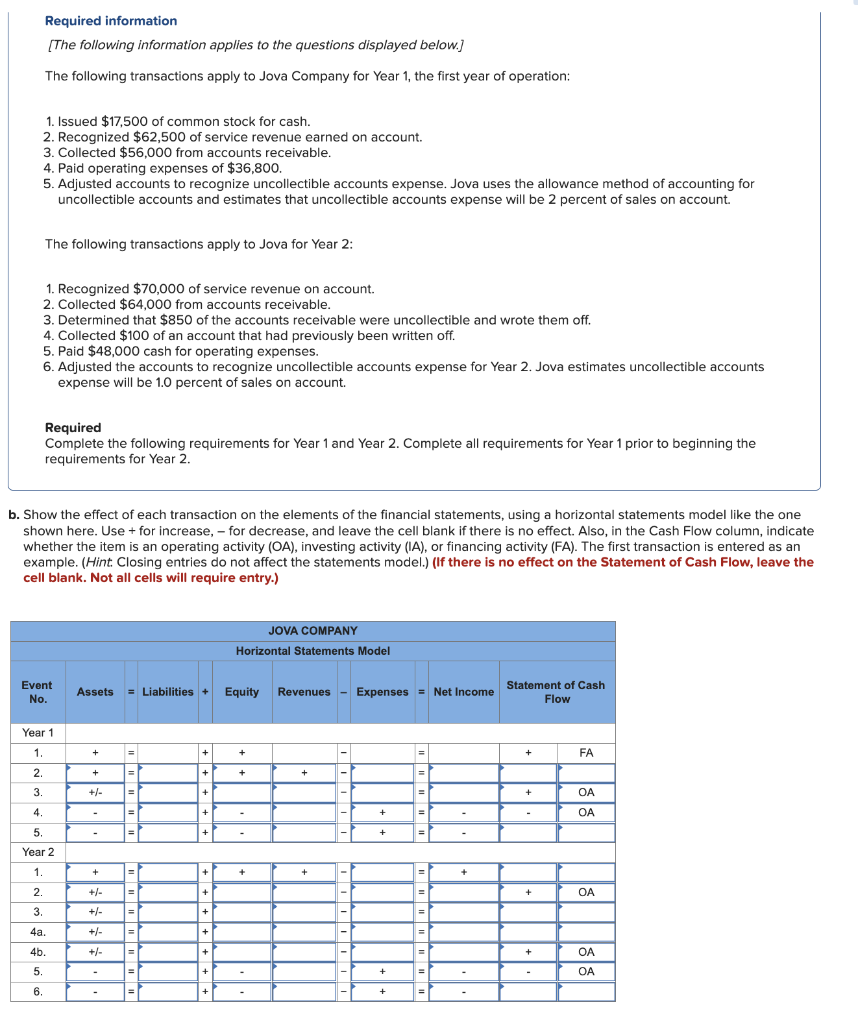

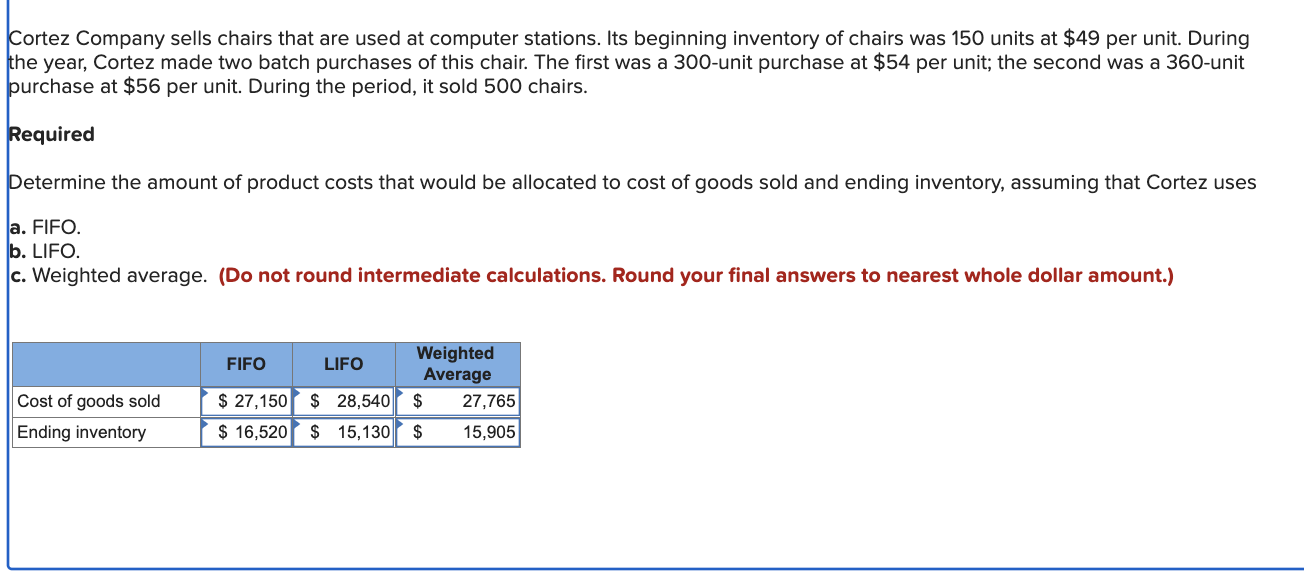

During the first year of operation, Year 1, McGinnis Appliance recognized $376,000 of service revenue on account. At the end of Year 1, the accounts receivable balance was $73,912. Even though this is his first year in business, the owner believes he will collect all but about 5 percent of the ending balance. Required a. What amount of cash was collected by McGinnis during Year 1? b. Assuming the use of an allowance system to account for uncollectible accounts, what amount should McGinnis record as uncollectible accounts expense in Year 1 ? c. What is the net realizable value of receivables at the end of Year 1? d. Show the effect of these transactions on the financial statements by recording the appropriate amounts in a horizontal statements model like the one shown here. When you record amounts in the Cash Flow column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). If element is not affected by the event, leave the cell blank. Complete this question by entering your answers in the tabs below. a. What amount of cash was collected by McGinnis during Year 1 ? b. Assuming the use of an allowance system to account for uncollectible accounts, what amount should McGinnis record as uncollectible accounts expense in Year 1 ? (Round your final answer to nearest whole dollar amount.) c. What is the net realizable value of receivables at the end of Year 1? (Do not round intermediate calculations and round your final answer to nearest whole dollar amount.) During the first year of operation, Year 1, McGinnis Appliance recognized $376,000 of service revenue on account. At the end of 1 , the accounts receivable balance was $73,912. Even though this is his first year in business, the owner believes he will collect all but about 5 percent of the ending balance. Required a. What amount of cash was collected by McGinnis during Year 1 ? b. Assuming the use of an allowance system to account for uncollectible accounts, what amount should McGinnis record as uncollectible accounts expense in Year 1? c. What is the net realizable value of receivables at the end of 1 ? d. Show the effect of these transactions on the financial statements by recording the appropriate amounts in a horizontal statements model like the one shown here. When you record amounts in the Cash Flow column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). If element is not affected by the event, leave the cell blank. Complete this question by entering your answers in the tabs below. Show the effect of these transactions on the financial statements by recording the appropriate amounts in a horizontal statements model like the one shown here. Wher you record amounts in the Cash Flow column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). If element is not affected by the event, leave the cell blank. (Enter any decreases to account balances and cash outflows with a minus sign. Not all cells will require entry.) Required information [The following information applies to the questions displayed below.] The following transactions apply to Jova Company for Year 1 , the first year of operation: 1. Issued $17,500 of common stock for cash. 2. Recognized $62,500 of service revenue earned on account. 3. Collected $56,000 from accounts receivable. 4. Paid operating expenses of $36,800. 5. Adjusted accounts to recognize uncollectible accounts expense. Jova uses the allowance method of accounting for uncollectible accounts and estimates that uncollectible accounts expense will be 2 percent of sales on account. The following transactions apply to Jova for Year 2: 1. Recognized $70,000 of service revenue on account. 2. Collected $64,000 from accounts receivable. 3. Determined that $850 of the accounts receivable were uncollectible and wrote them off. 4. Collected $100 of an account that had previously been written off. 5. Paid $48,000 cash for operating expenses. 6. Adjusted the accounts to recognize uncollectible accounts expense for Year 2 . Jova estimates uncollectible accounts expense will be 1.0 percent of sales on account. Required Complete the following requirements for Year 1 and Year 2. Complete all requirements for Year 1 prior to beginning the requirements for Year 2. c. Organize the transaction data in accounts under an accounting equation. Complete this question by entering your answers in the tabs below. Organize the transaction data in accounts under an accounting equation for Year 1 . (Enter any decreases to account balances with a minus sign. If there is no effect on the Accounts Titles for Retained Earnings, leave the cell blank. Not all cells will require entry.) Required information [The following information applies to the questions displayed below.] The following transactions apply to Jova Company for Year 1 , the first year of operation: 1. Issued $17,500 of common stock for cash. 2. Recognized $62,500 of service revenue earned on account. 3 . Collected $56,000 from accounts receivable. 4. Paid operating expenses of $36,800. 5. Adjusted accounts to recognize uncollectible accounts expense. Jova uses the allowance method of accounting for uncollectible accounts and estimates that uncollectible accounts expense will be 2 percent of sales on account. The following transactions apply to Jova for Year 2: 1. Recognized $70,000 of service revenue on account. 2. Collected $64,000 from accounts receivable. 3. Determined that $850 of the accounts receivable were uncollectible and wrote them off. 4. Collected $100 of an account that had previously been written off. 5. Paid $48,000 cash for operating expenses. 6. Adjusted the accounts to recognize uncollectible accounts expense for Year 2. Jova estimates uncollectible accounts expense will be 1.0 percent of sales on account. Required Complete the following requirements for Year 1 and Year 2. Complete all requirements for Year 1 prior to beginning the requirements for Year 2. c. Organize the transaction data in accounts under an accounting equation. Complete this question by entering your answers in the tabs below. Organize the transaction data in accounts under an accounting equation for Year 2. (Enter any decreases to account balances with a minus sign. If there is no effect on the Accounts Titles for Retained Earnings, leave the cell blank. Not all cells will require entry.) Required information [The following information applies to the questions displayed below.] The following transactions apply to Jova Company for Year 1, the first year of operation: 1. Issued $17,500 of common stock for cash. 2. Recognized $62,500 of service revenue earned on account. 3. Collected $56,000 from accounts receivable. 4. Paid operating expenses of $36,800. 5. Adjusted accounts to recognize uncollectible accounts expense. Jova uses the allowance method of accounting for uncollectible accounts and estimates that uncollectible accounts expense will be 2 percent of sales on account. The following transactions apply to Jova for Year 2: 1. Recognized $70,000 of service revenue on account. 2. Collected $64,000 from accounts receivable. 3. Determined that $850 of the accounts receivable were uncollectible and wrote them off. 4. Collected $100 of an account that had previously been written off. 5. Paid $48,000 cash for operating expenses. 6. Adjusted the accounts to recognize uncollectible accounts expense for Year 2. Jova estimates uncollectible accounts expense will be 1.0 percent of sales on account. Required Complete the following requirements for Year 1 and Year 2. Complete all requirements for Year 1 prior to beginning the requirements for Year 2. b. Show the effect of each transaction on the elements of the financial statements, using a horizontal statements model like the one shown here. Use + for increase, - for decrease, and leave the cell blank if there is no effect. Also, in the Cash Flow column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). The first transaction is entered as an example. (Hint. Closing entries do not affect the statements model.) (If there is no effect on the Statement of Cleave the cell blank. Not all cells will require entry.) Cortez Company sells chairs that are used at computer stations. Its beginning inventory of chairs was 150 units at $49 per unit. During the year, Cortez made two batch purchases of this chair. The first was a 300-unit purchase at $54 per unit; the second was a 360-unit purchase at $56 per unit. During the period, it sold 500 chairs. Required Determine the amount of product costs that would be allocated to cost of goods sold and ending inventory, assuming that Cortez uses a. FIFO. b. LIFO. c. Weighted average. (Do not round intermediate calculations. Round your final answers to nearest whole dollar amount.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts