Question: Please answer the 2 questions below North Wind Aviation received its charter during January authorizing the following capital stock: Preferred stock: 8 percent, par $10,

Please answer the 2 questions below

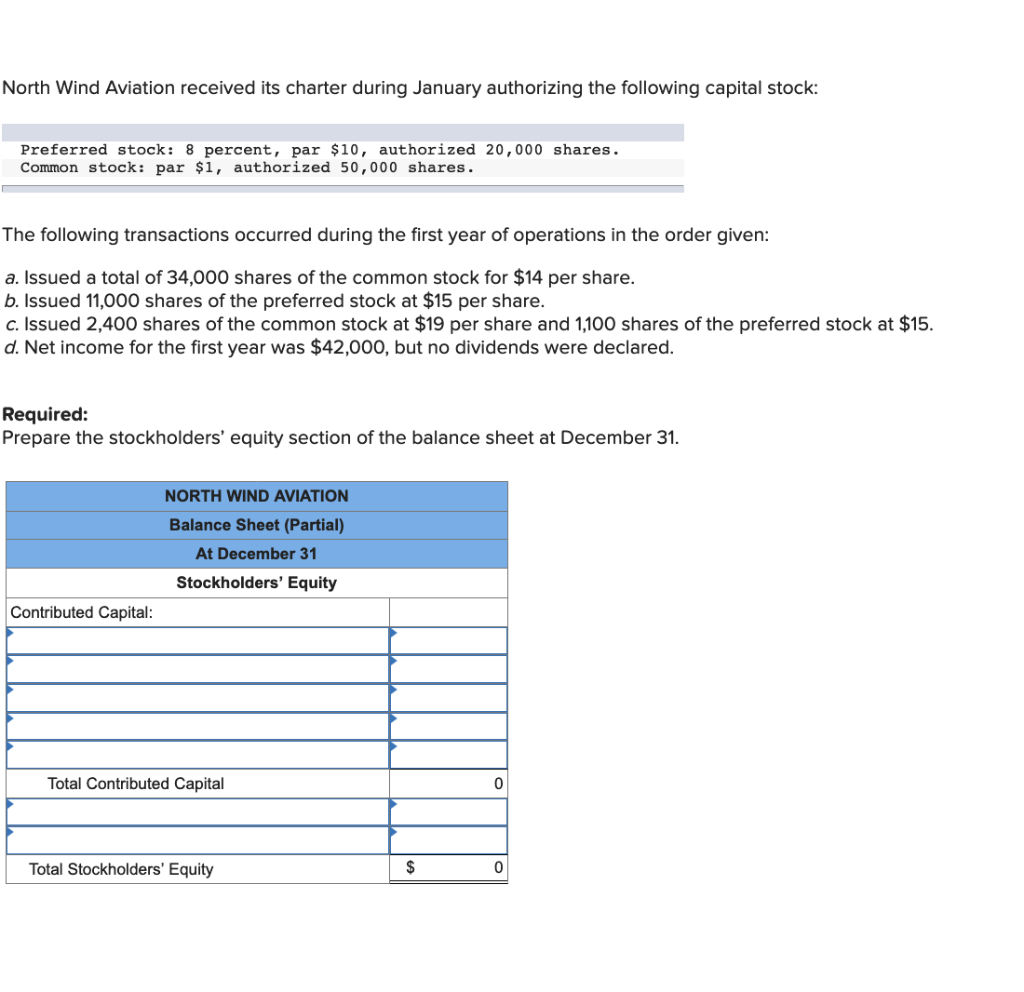

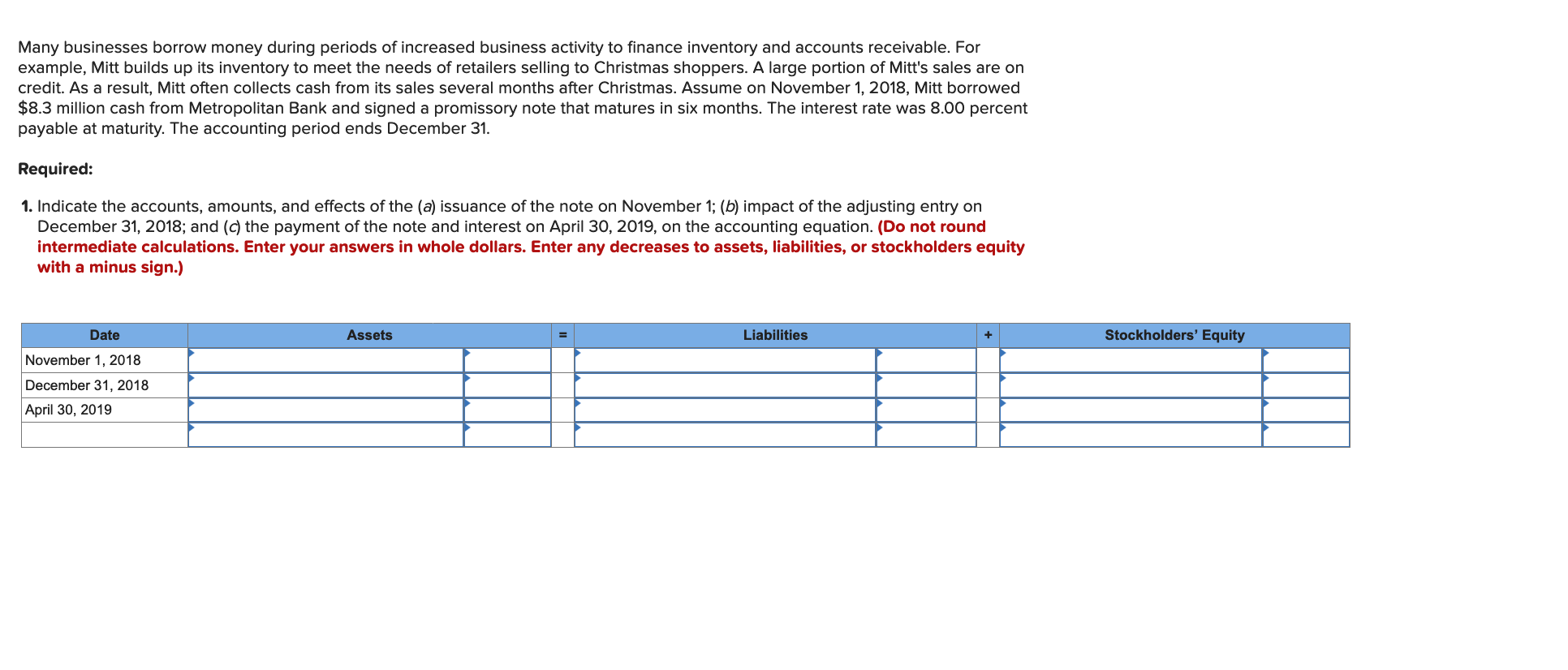

North Wind Aviation received its charter during January authorizing the following capital stock: Preferred stock: 8 percent, par $10, authorized 20,000 shares. Common stock: par $1, authorized 50,000 shares. The following transactions occurred during the first year of operations in the order given: a. Issued a total of 34,000 shares of the common stock for $14 per share. b. Issued 11,000 shares of the preferred stock at $15 per share. c. Issued 2,400 shares of the common stock at $19 per share and 1,100 shares of the preferred stock at $15. d. Net income for the first year was $42,000, but no dividends were declared. Required: Prepare the stockholders' equity section of the balance sheet at December 31. NORTH WIND AVIATION Balance Sheet (Partial) At December 31 Stockholders' Equity Contributed Capital: Total Contributed Capital Total Stockholders' Equity Many businesses borrow money during periods of increased business activity to finance inventory and accounts receivable. For example, Mitt builds up its inventory to meet the needs of retailers selling to Christmas shoppers. A large portion of Mitt's sales are on credit. As a result, Mitt often collects cash from its sales several months after Christmas. Assume on November 1, 2018, Mitt borrowed $8.3 million cash from Metropolitan Bank and signed a promissory note that matures in six months. The interest rate was 8.00 percent payable at maturity. The accounting period ends December 31. Required: 1. Indicate the accounts, amounts, and effects of the (a) issuance of the note on November 1; (b) impact of the adjusting entry on December 31, 2018; and (c) the payment of the note and interest on April 30, 2019, on the accounting equation. (Do not round intermediate calculations. Enter your answers in whole dollars. Enter any decreases to assets, liabilities, or stockholders equity with a minus sign.) Assets Liabilities Stockholders' Equity Date November 1, 2018 December 31, 2018 April 30, 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts