Question: please answer the 3 questions Question 3 N All else equal, which of the following actions will increase the amount of cash on a company's

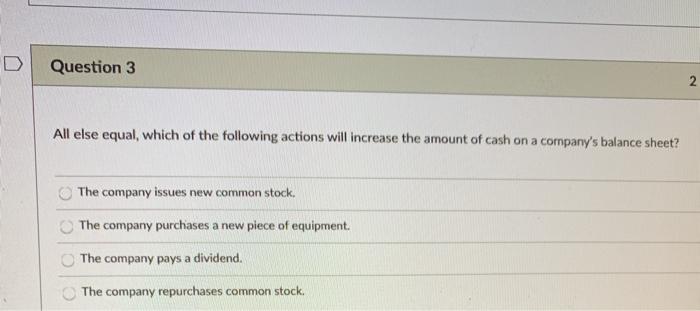

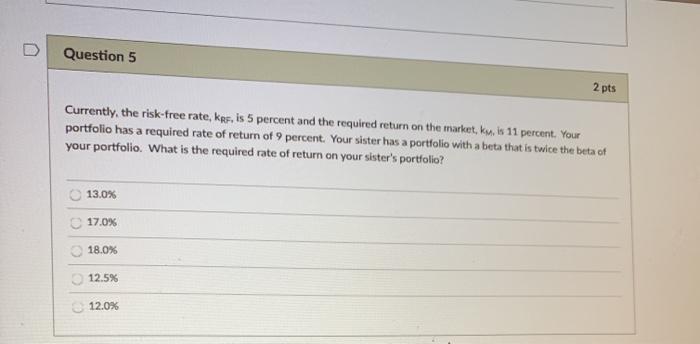

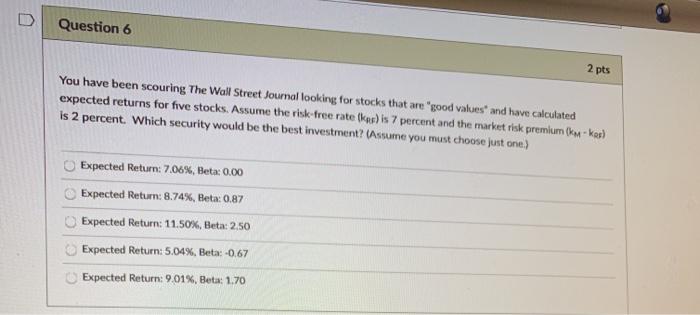

Question 3 N All else equal, which of the following actions will increase the amount of cash on a company's balance sheet? The company issues new common stock. The company purchases a new piece of equipment. The company pays a dividend. The company repurchases common stock. Question 5 2 pts Currently, the risk-free rate, krs, is 5 percent and the required return on the market, km, is 11 percent. Your portfolio has a required rate of return of 9 percent. Your sister has a portfolio with a beta that is twice the beta of your portfolio. What is the required rate of return on your sister's portfolio? 13.0% 17.0% 18.0% 12.5% 12.0% D Question 6 2 pts You have been scouring The Wall Street Journal looking for stocks that are good values and have calculated expected returns for five stocks. Assume the risk-free rate (kes) is 7 percent and the market risk premium (km - ks) is 2 percent. Which security would be the best investment? (Assume you must choose just one) Expected Return: 7,06%, Beta: 0,00 Expected Return: 8.74%. Beta: 0.87 Expected Return: 11.50%, Beta: 2,50 Expected Return: 5.04%, Beta: -0.67 Expected Return: 9.01%, Beta: 1.70

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts