Question: please answer the 3 questions Requirements - X 1. Determine the present value of six-year bonds payable with face value of $92,000 and stated interest

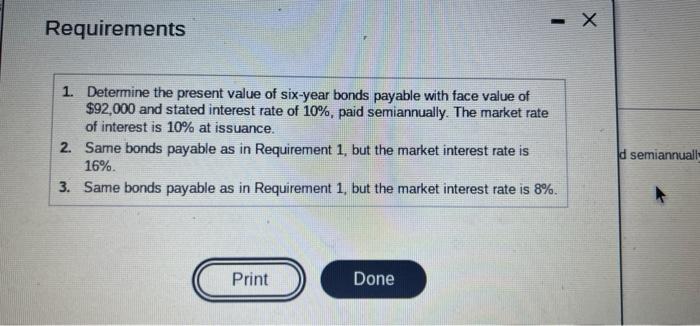

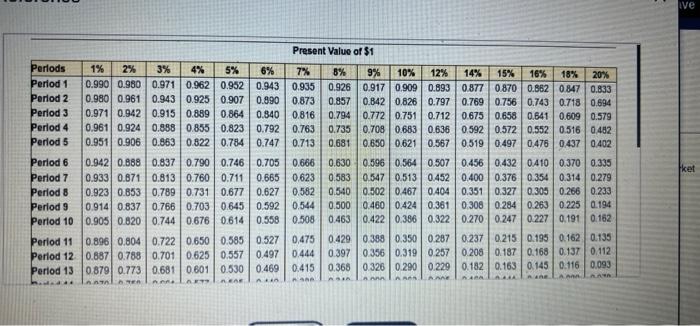

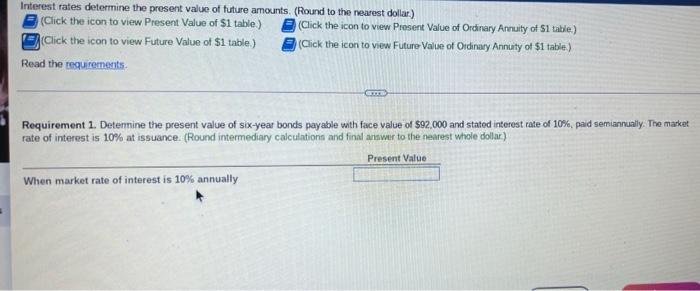

Requirements - X 1. Determine the present value of six-year bonds payable with face value of $92,000 and stated interest rate of 10%, paid semiannually. The market rate of interest is 10% at issuance. 2. Same bonds payable as in Requirement 1, but the market interest rate is 16% 3. Same bonds payable as in Requirement 1, but the market interest rate is 8%. d semiannuall- Print Done ive Present Value of $1 Periods 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 15% 16% 18% 20% Period 1 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.893 0.877 0.870 0.882 0.847 0.833 Period 2 0.980 0.961 0.943 0.925 0.907 0.890 0.873 0.857 0.842 0.826 0.797 0.769 0.756 0.743 0.718 0.694 Period 3 0.971 0.942 0.915 0.8890.864 0.840 0.816 0.794 0.772 0.751 0.712 0.675 0.658 0.6410.609 0.579 Period 4 0.961 0.924 0.888 0.855 0.823 0.792 0.763 0.735 0.708 0.683 0.636 0.592 0.572 0.552 0.516 0.482 Period 5 0.951 0.906 0.863 0.822 0.784 0.747 0.713 0.681 0.650 0.621 0.567 0.519 0.497 0.478 0.437 0.402 Period 6 0.942 0.888 0.837 0.790 0.746 0.705 0.666 0.630 0.596 0.564 0.507 0.456 0.432 0.410 0.370 0.335 Period 7 0.933 0.871 0.813 0.760 0.711 0.665 0.623 0.5830.547 0.513 0.452 0.400 0.376 0.354 0.314 0.279 Period 8 0.923 0.853 0.789 0.731 0.677 0.627 0.582 0.540 0.502 0.467 0.404 0.351 0.327 0.305 0.266 0.233 Period 9 0.914 0.837 0.766 0.703 0.6450.592 0.544 0.500 0.460 0.424 0.361 0.308 0.284 0.263 0225 0.194 Period 10 0.905 0.820 0.744 0.676 0.614 0.558 0.508 0.463 0.422 0.386 0.322 0.270 0.247 0.227 0.1910.162 Period 11 0.896 0.8040.722 0.650 0.585 0.527 0,475 0.429 0.388 0.350 0.287 0.237 0.215 0.19 0.162 0.135 Period 12 0.887 0.788 0.701 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0.257 0.208 0.187 0.168 0.137 0.112 Period 13 0.879 0.773 0.681 0.801 0.530 0.469 0.415 0.368 0.326 0.290 0.229 0.1820.163 0.145 0.116 0.093 AR AE ket AA REA ARA Interest rates determine the present value of future amounts. (Round to the nearest dollar) (Click the icon to view Present Value of $1 table) (Click the icon to view Present Value of Ordinary Annuity of S1 table) Click the icon to view Future Value of $1 table) (Click the icon to view Future Value of Ordinary Annuity of $1 table) Read the resurements Requirement 1. Determine the present value of six-year bonds payable with face value of $92,000 and stated interest rate of 10%, paid semiannually. The market rate of interest is 10% at issuance. (Round intermediary calculations and final answer to the nearest whole dollar) Present Value When market rate of interest is 10% annually

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts