Question: Please answer the 3 requirements, thanks! Use the NPV method to determine whether McKnight Products should invest in the following projects: Project A: Costs $295,000

Please answer the 3 requirements, thanks!

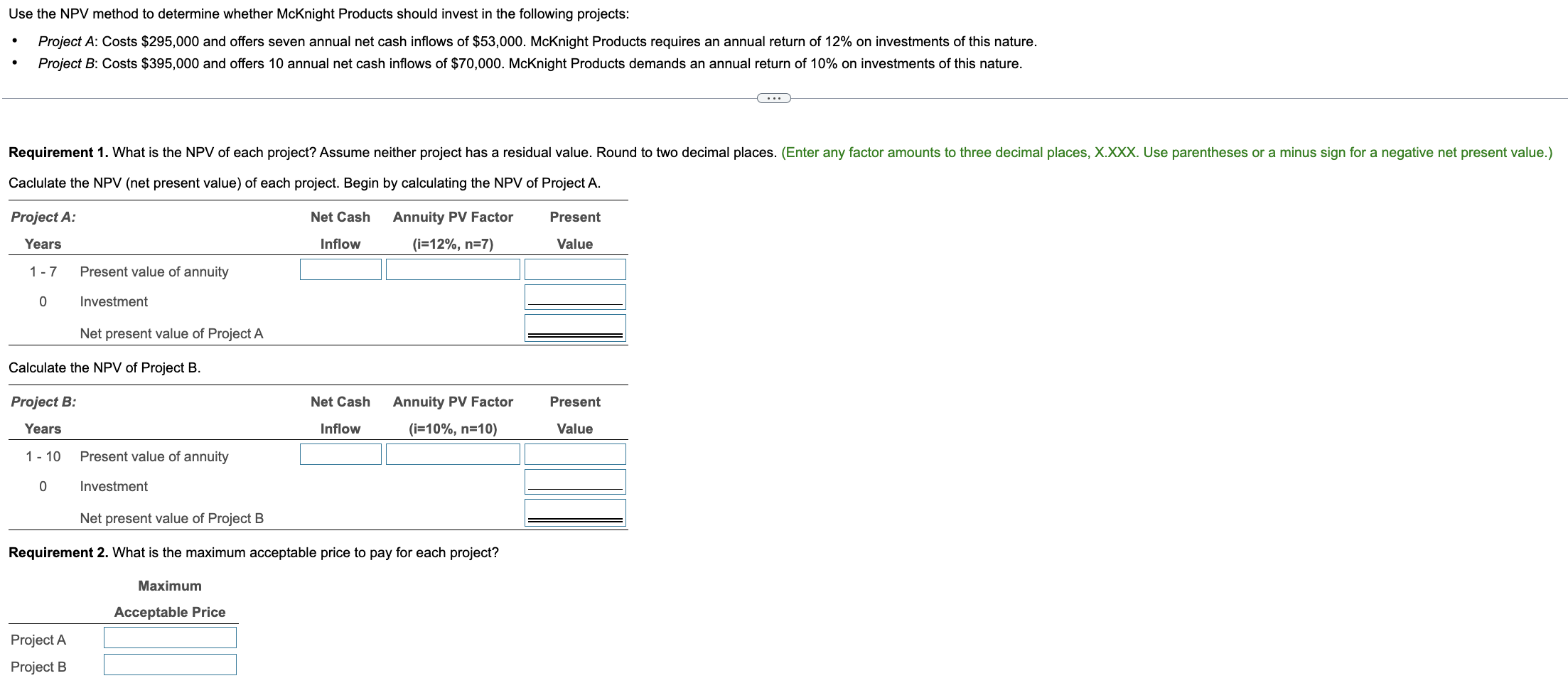

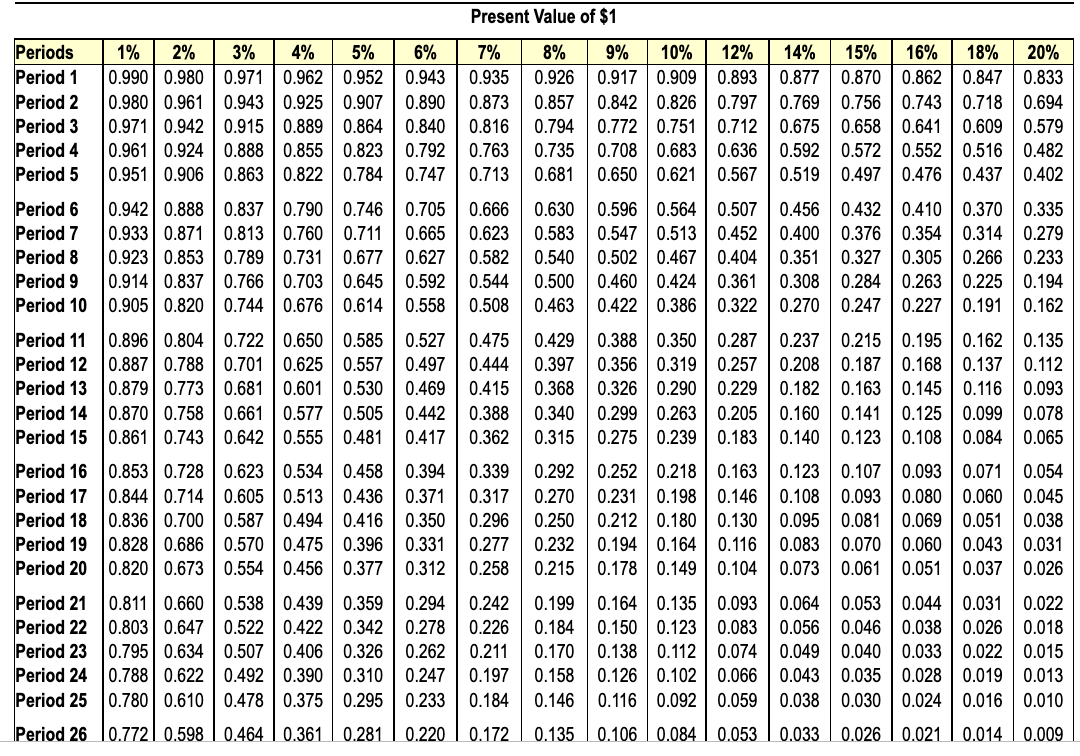

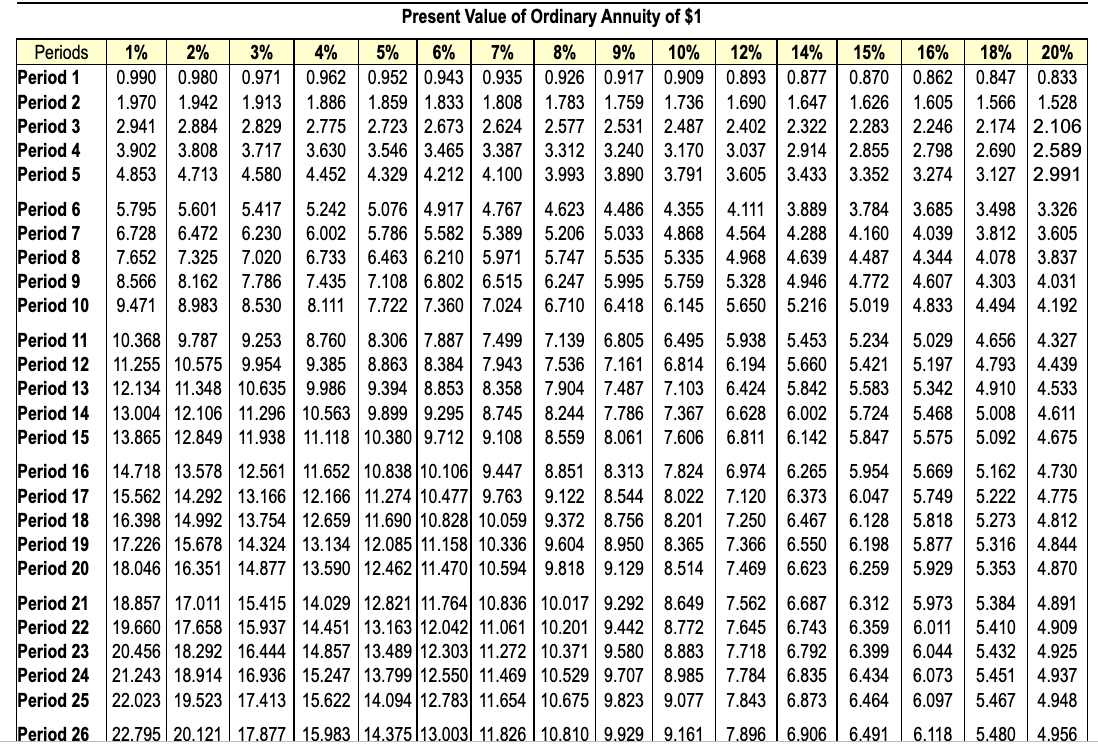

Use the NPV method to determine whether McKnight Products should invest in the following projects: Project A: Costs $295,000 and offers seven annual net cash inflows of $53,000. McKnight Products requires an annual return of 12% on investments of this nature. Project B: Costs $395,000 and offers 10 annual net cash inflows of $70,000. McKnight Products demands an annual return of 10% on investments of this nature. Requirement 1. What is the NPV of each project? Assume neither project has a residual value. Round to two decimal places. (Enter any factor amounts to three decimal places, X.XXX. Use parentheses or a minus sign for a negative net present value.) Caclulate the NPV (net present value) of each project. Begin by calculating the NPV of Project A. Net Cash Inflow Project A: Years 1-7 0 Present value of annuity Investment Net present value of Project A Calculate the NPV of Project B. Project B: Years 1 - 10 0 Project A Project B Present value of annuity Investment Maximum Net Cash Inflow Net present value of Project B Requirement 2. What is the maximum acceptable price to pay for each project? Acceptable Price Annuity PV Factor (i=12%, n=7) Annuity PV Factor (i=10%, n=10) Present Value Present Value Requirement 3. What is the profitability index of each project? (Round to two decimal places, X.XX.) Select the formula, then enter the amounts to calculate the profitability index of each project. Project A Project B = = Profitability Index Present Value of $1 Periods 1% 2% 5% 3% 4% 0.971 0.962 6% 0.952 0.943 Period 1 0.990 0.980 Period 2 7% 8% 0.935 0.926 0.980 0.961 0.943 0.925 0.907 0.890 0.873 0.857 0.971 0.942 0.915 0.889 0.864 0.840 0.816 0.794 0.961 0.924 0.888 0.855 0.823 0.792 0.763 0.735 0.863 0.822 0.784 0.747 0.713 0.681 Period 3 Period 4 0.552 0.516 0.482 Period 5 0.951 0.906 Period 6 0.942 0.888 Period 7 0.933 0.871 Period 8 0.837 0.790 0.746 0.705 0.666 0.813 0.760 0.711 0.665 0.623 0.789 0.731 0.677 0.627 0.582 Period 9 0.914 0.837 0.766 0.703 0.645 0.592 0.544 Period 10 0.905 0.820 0.744 0.676 0.614 0.558 0.508 0.923 0.853 0.191 0.162 0.162 0.135 9% 10% 12% 14% 15% 16% 18% 20% 0.917 0.909 0.893 0.877 0.870 0.862 0.847 0.833 0.842 0.826 0.797 0.769 0.756 0.743 0.718 0.694 0.772 0.751 0.712 0.675 0.658 0.641 0.609 0.579 0.708 0.683 0.636 0.592 0.572 0.650 0.621 0.567 0.519 0.497 0.476 0.437 0.402 0.630 0.596 0.564 0.507 0.456 0.432 0.410 0.370 0.335 0.583 0.547 0.513 0.452 0.400 0.376 0.354 0.314 0.279 0.540 0.502 0.467 0.404 0.351 0.327 0.305 0.266 0.233 0.500 0.460 0.424 0.361 0.308 0.284 0.263 0.225 0.194 0.463 0.422 0.386 0.322 0.270 0.247 0.227 Period 110.896 0.804 0.722 0.650 0.585 0.527 0.475 0.429 0.388 0.350 0.287 0.237 0.215 0.195 Period 12 0.887 0.788 0.701 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0.257 0.208 0.187 0.168 0.137 0.112 Period 13 0.879 0.773 0.681 0.601 0.530 0.469 0.415 0.368 0.326 0.290 0.229 0.182 0.163 0.145 0.116 0.093 Period 14 0.870 0.758 0.661 0.577 0.505 0.442 0.388 0.340 0.299 0.263 0.205 0.160 0.141 0.125 0.099 0.078 Period 15 0.861 0.743 0.642 0.555 0.481 0.417 0.362 0.315 0.275 0.239 0.183 0.140 0.123 0.108 0.084 0.065 0.853 0.728 0.623 0.534 0.458 0.394 0.339 0.292 0.252 0.218 0.163 0.123 0.107 0.093 0.071 0.054 0.844 0.714 0.605 0.513 0.436 0.371 0.317 0.270 0.231 0.198 0.146 0.108 0.093 0.080 0.060 0.045 0.836 0.700 | 0.587 0.494 0.416 0.350 0.296 0.250 0.212 0.180 0.130 0.095 0.081 0.069 0.051 0.038 0.828 0.686 0.570 0.475 0.396 0.331 0.277 0.232 0.194 0.164 0.116 0.083 0.070 0.060 0.043 0.031 0.820 0.673 0.554 0.456 0.377 0.312 0.258 0.215 0.178 0.149 0.104 0.073 0.061 0.051 0.037 0.026 0.199 0.164 0.135 0.093 0.064 0.053 0.044 0.031 0.022 0.184 0.150 0.123 0.083 0.056 0.046 0.038 0.026 0.018 0.170 0.138 0.112 0.074 0.049 0.040 0.033 0.022 0.126 0.102 0.066 0.043 0.035 0.028 0.019 0.013 0.116 0.092 0.059 0.038 0.030 0.024 0.016 0.010 Period 16 Period 17 Period 18 Period 19 Period 20 Period 21 0.811 0.660 0.803 0.647 Period 22 Period 23 Period 24 0.538 0.439 0.359 0.294 0.242 0.522 0.422 0.342 0.278 0.226 0.507 0.406 0.326 0.262 0.211 0.795 0.634 0.015 0.788 0.622 0.492 0.390 0.197 0.310 0.247 0.295 0.233 0.184 0.158 0.146 Period 25 0.780 0.610 0.478 0.375 Period 26 0.772 0.598 | 0.464 | 0.361 0.281 0.220 0.172 0.135 0.106 0.084 0.053 0.033 0.026 0.021 0.014 0.009 ol.. 86 Present Value of Ordinary Annuity of $1 Periods 1% 2% 3% 4% 15% 16% 18% 20% Period 1 0.990 0.980 0.971 0.962 0.862 0.847 0.833 Period 2 1.859 1.833 Period 3 Period 4 2.690 2.589 Period 5 4.853 4.713 3.127 2.991 Period 6 Period 7 Period 8 Period 9 5% 6% 7% 8% 9% 10% 12% 14% 0.952 0.943 0.935 0.926 0.917 0.909 0.893 0.877 0.870 1.970 1.942 1.913 1.886 1.808 1.783 1.759 1.736 1.690 1.647 1.626 1.605 1.566 1.528 2.941 2.884 2.829 2.775 2.723 2.673 2.624 2.577 2.531 2.487 2.402 2.322 2.283 2.246 2.174 2.106 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.037 2.914 2.855 2.798 4.580 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.605 3.433 3.352 3.274 5.795 5.601 5.417 5.242 5.076 4.917 4.767 4.623 4.486 4.355 4.111 3.889 3.784 3.685 3.498 3.326 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.564 4.288 4.160 4.039 3.812 3.605 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 4.968 4.639 4.487 4.344 4.078 3.837 8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.995 5.759 5.328 4.946 4.772 4.607 4.303 4.031 9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145 5.650 5.216 5.019 4.833 4.494 4.192 7.139 6.805 6.495 5.938 5.453 5.234 5.029 4.656 4.327 7.536 7.161 6.814 6.194 5.660 5.421 5.197 4.793 4.439 7.904 7.487 7.103 6.424 5.842 5.583 5.342 4.910 4.533 8.244 7.786 7.367 6.628 6.002 5.724 5.468 5.008 4.611 8.559 8.061 7.606 6.811 6.142 5.847 5.954 6.047 Period 10 Period 11 10.368 9.787 Period 12 Period 13 Period 14 Period 15 13.865 12.849 5.575 5.092 4.675 9.253 8.760 8.306 7.887 7.499 11.255 10.575 9.954 9.385 8.863 8.384 7.943 12.134 11.348 10.635 9.986 9.394 8.853 8.358 13.004 12.106 11.296 10.563 9.899 9.295 8.745 11.938 11.118 10.380 9.712 9.108 14.718 13.578 12.561 11.652 10.838 10.106 9.447 15.562 14.292 13.166 12.166 11.274 10.477 9.763 16.398 14.992 13.754 12.659 11.690 10.828 10.059 17.226 15.678 14.324 13.134 12.085 11.158 10.336 18.046 16.351 14.877 13.590 12.462 11.470 10.594 Period 16 5.669 5.162 4.730 Period 17 5.749 5.222 4.775 Period 18 8.851 8.313 7.824 6.974 6.265 9.122 8.544 8.022 7.120 6.373 9.372 8.756 8.201 7.250 6.467 6.128 5.818 5.273 4.812 9.604 8.950 8.365 7.366 6.550 6.198 5.877 5.316 4.844 9.818 9.129 8.514 7.469 6.623 6.259 5.929 5.353 4.870 Period 19 Period 20 Period 21 Period 22 Period 23 Period 24 Period 25 18.857 17.011 15.415 14.029 12.821 11.764 10.836 10.017 9.292 8.649 19.660 17.658 15.937 14.451 13.163 12.042 11.061 10.201 9.442 8.772 20.456 18.292 16.444 14.857 13.489 12.303 11.272 10.371 9.580 8.883 21.243 18.914 16.936 15.247 13.799 12.550 11.469 10.529 9.707 8.985 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 9.823 7.562 6.687 6.312 5.973 5.384 4.891 7.645 6.743 6.359 6.011 5.410 4.909 7.718 6.792 6.399 6.044 5.432 4.925 7.784 6.835 6.434 6.073 5.451 4.937 9.077 7.843 6.873 6.464 6.097 5.467 4.948 6.491 Period 26 22.795 20.121 17.877 15.983 14.375 13.003 11.826 10.810 9.929 9.161 7.896 6.906 6.118 5.480 4.956 Requirements 1. What is the NPV of each project? Assume neither project has a residual value. Round to two decimal places. 2. What is the maximum acceptable price to pay for each project? 3. What is the profitability index of each project? Round to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts