Question: Please answer the 3rd question Practice 3 Bond market (20 points) 1. What were the bid price, asked price, and yield to maturity of the

Please answer the 3rd question

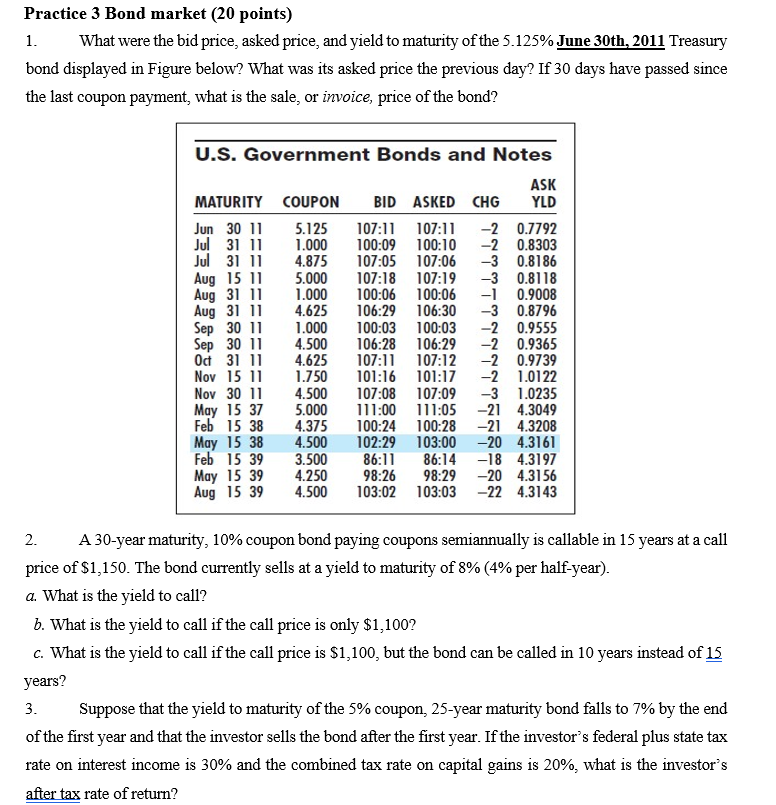

Practice 3 Bond market (20 points) 1. What were the bid price, asked price, and yield to maturity of the 5.125% June 30th, 2011 Treasury bond displayed in Figure below? What was its asked price the previous day? If 30 days have passed since the last coupon payment, what is the sale, or invoice, price of the bond? U.S. Government Bonds and Notes MATURITY COUPON Jun 30 11 5.125 Jul 31 11 1.000 Jul 31 11 4.875 Aug 15 11 5.000 Aug 31 11 1.000 Aug 31 11 4.625 Sep 30 11 1.000 Sep 30 11 4.500 Oct 31 11 4.625 Nov 15 11 1.750 Nov 30 11 4.500 May 15 37 5.000 Feb 15 38 4.375 May 15 38 4.500 Feb 15 39 3.500 May 15 39 4.250 Aug 15 39 4.500 ASK BID ASKED CHG YLD 107:11 107:11 -2 0.7792 100:09 100:10 -20.8303 107:05 107:06 -3 0.8186 107:18 107:19 -3 0.8118 100:06 100:06 -10.9008 106:29 106:30 -3 0.8796 100:03 100:03 -2 0.9555 106:28 106:29 -2 0.9365 107:11 107:12 -2 0.9739 101:16 101:17 -2 1.0122 107:08 107:09 -3 1.0235 111:00 111:05 -21 4.3049 100:24 100:28 -21 4.3208 102:29 103:00 -20 4.3161 86:11 86:14 -18 4.3197 98:26 98:29 -20 4.3156 103:02 103:03 -22 4.3143 2. A 30-year maturity, 10% coupon bond paying coupons semiannually is callable in 15 years at a call price of $1,150. The bond currently sells at a yield to maturity of 8% (4% per half-year). a. What is the yield to call? b. What is the yield to call if the call price is only $1,100? c. What is the yield to call if the call price is $1,100, but the bond can be called in 10 years instead of 15 years? Suppose that the yield to maturity of the 5% coupon, 25-year maturity bond falls to 7% by the end of the first year and that the investor sells the bond after the first year. If the investor's federal plus state tax rate on interest income is 30% and the combined tax rate on capital gains is 20%, what is the investor's after tax rate of return? 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts