Question: Please answer the 6th question only. Question #5 Mary has been given the data below that pertains to five possible capital investment projects. She wants

Please answer the 6th question only.

Please answer the 6th question only.

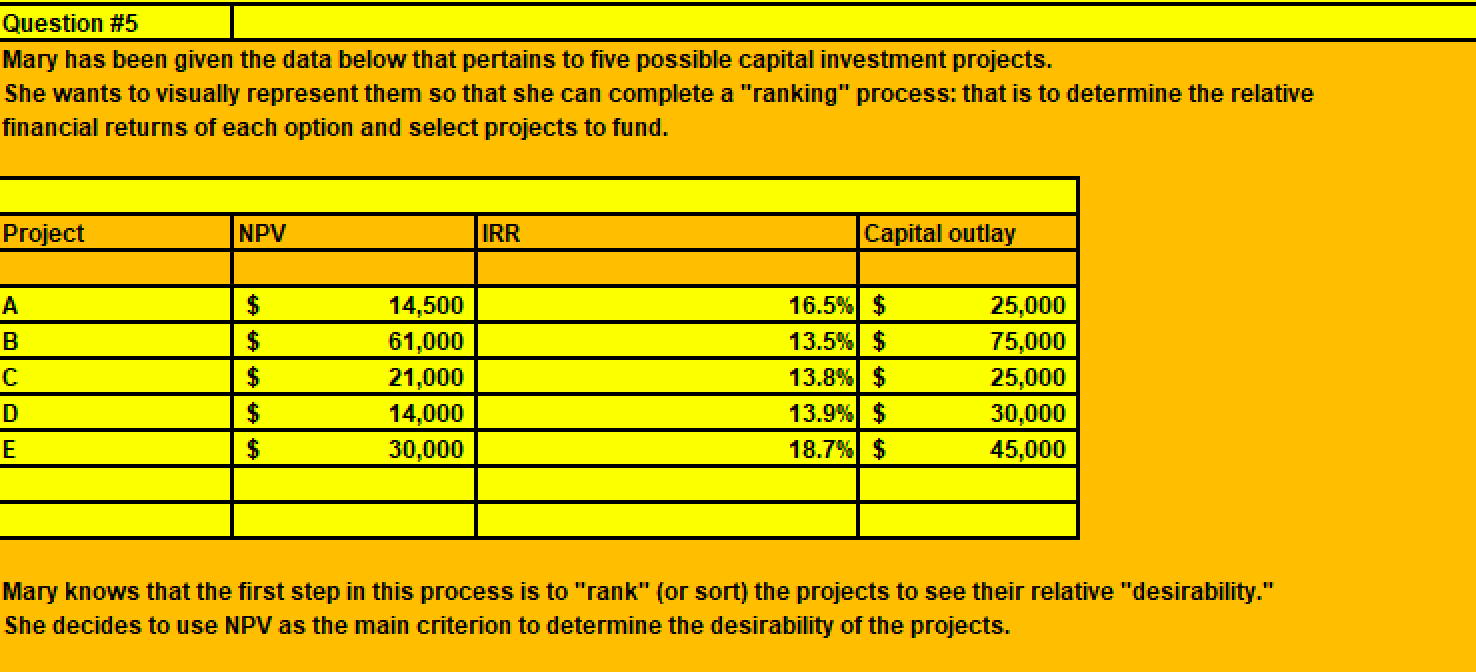

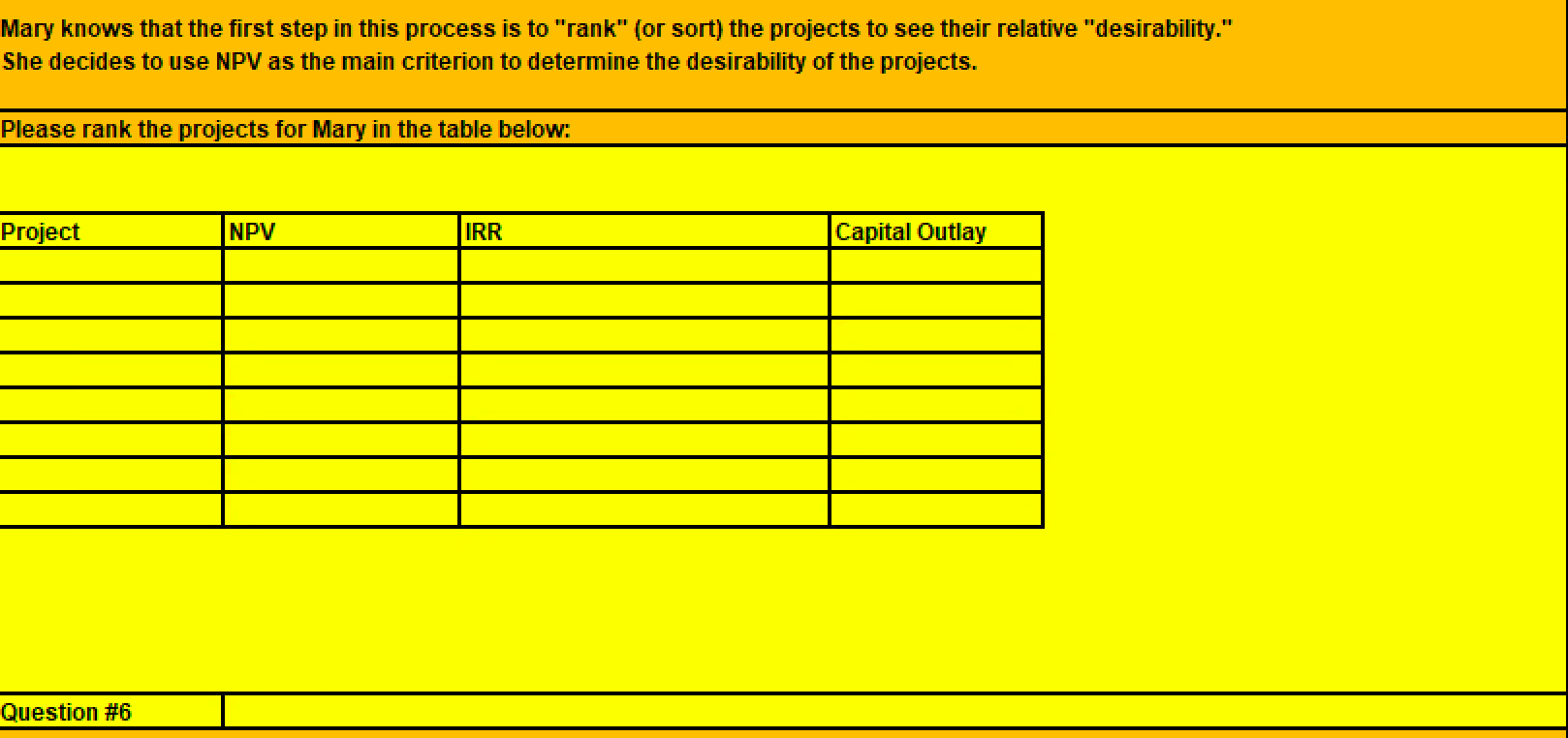

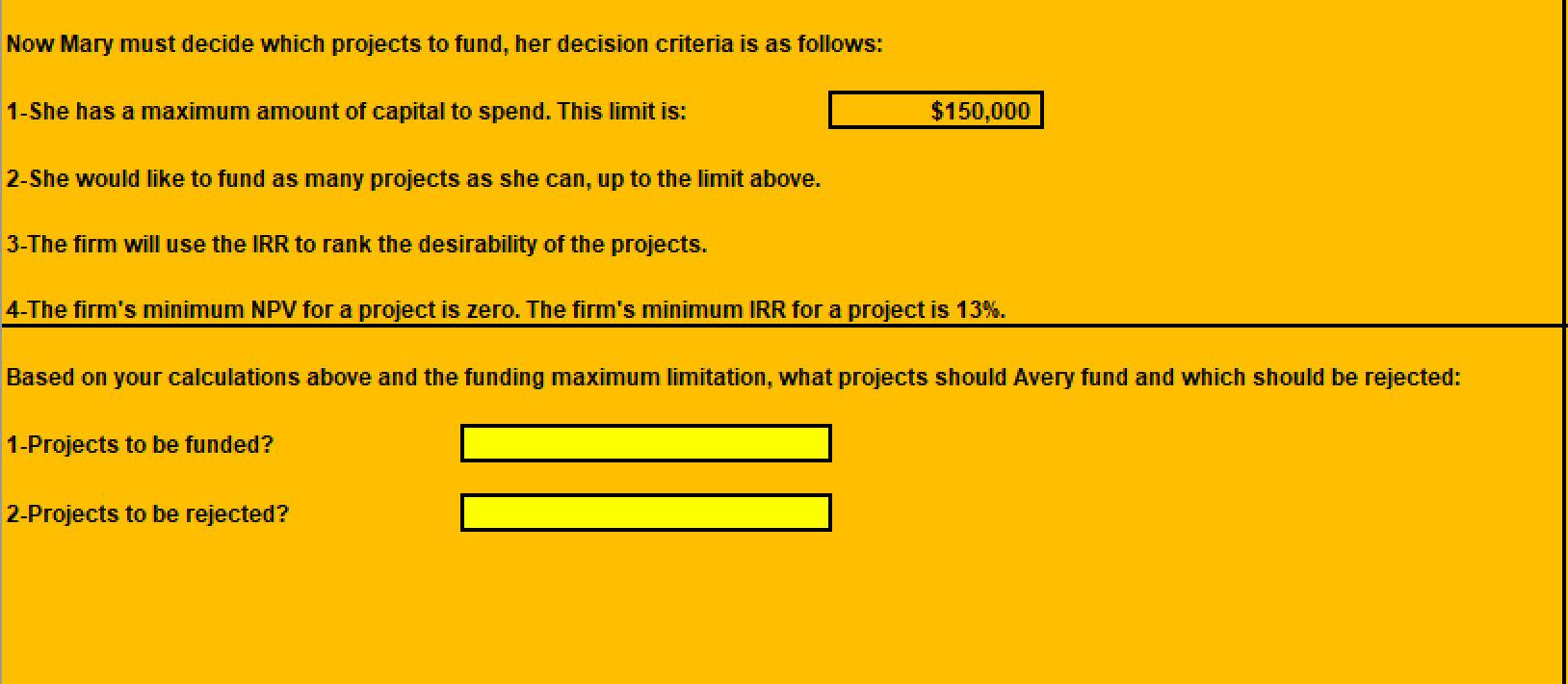

Question #5 Mary has been given the data below that pertains to five possible capital investment projects. She wants to visually represent them so that she can complete a "ranking" process: that is to determine the relative financial returns of each option and select projects to fund. Project NPV IRR Capital outlay A $ $ $ 14,500 61,000 21,000 14,000 30,000 16.5% $ 13.5% $ 13.8% $ 13.9% $ 18.7% $ 25,000 75,000 25,000 30,000 45,000 D $ E $ Mary knows that the first step in this process is to "rank" (or sort) the projects to see their relative "desirability." She decides to use NPV as the main criterion to determine the desirability of the projects. Mary knows that the first step in this process is to "rank" (or sort) the projects to see their relative "desirability." She decides to use NPV as the main criterion to determine the desirability of the projects. Please rank the projects for Mary in the table below: Project NPV IRR Capital Outlay Question #6 Now Mary must decide which projects to fund, her decision criteria is as follows: 1-She has a maximum amount of capital to spend. This limit is: $150,000 2-She would like to fund as many projects as she can, up to the limit above. 3-The firm will use the IRR to rank the desirability of the projects. 4-The firm's minimum NPV for a project is zero. The firm's minimum IRR for a project is 13%. Based on your calculations above and the funding maximum limitation, what projects should Avery fund and which should be rejected: 1-Projects to be funded? 2-Projects to be rejected

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts