Question: Please answer the above question using the Individual Tax Rate Schedule. Thank you!! Lara, a single individual, has $105,000 taxable income. Assume the taxable year

Please answer the above question using the Individual Tax Rate Schedule. Thank you!!

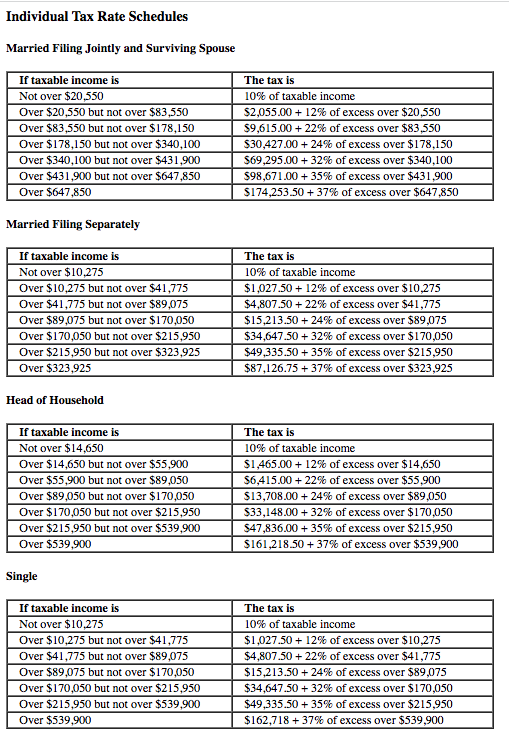

Lara, a single individual, has $105,000 taxable income. Assume the taxable year is 2022 . Use Individual Tax Rate Schedules. Required: Compute income tax assuming that: a. Taxable income includes no capital gain. b. Taxable income includes $25,700 capital gain eligible for the 15 percent preferential rate. Note: For all requirements, round your intermediate calculations and final answers to the nearest whole dollar amount. Individual Tax Rate Schedules Married Filing Jointly and Surviving Spouse Married Filing Separately Head of Household Single

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts