Question: Please answer the above question with explanation if possible. A firm is analyzing a 3-year oil development project, and the project can either start now

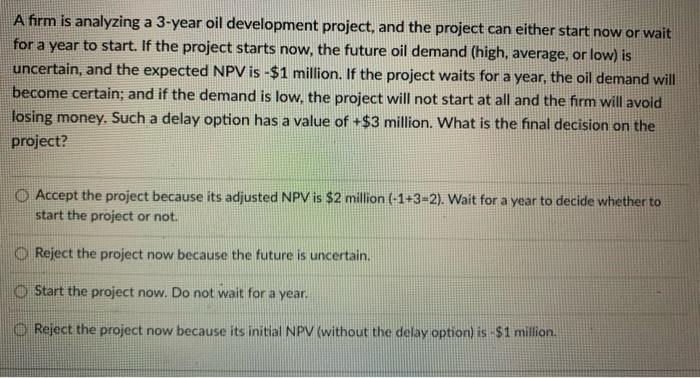

A firm is analyzing a 3-year oil development project, and the project can either start now or wait for a year to start. If the project starts now, the future oil demand (high, average, or low) is uncertain, and the expected NPV is -$1 million. If the project waits for a year, the oil demand will become certain; and if the demand is low, the project will not start at all and the firm will avoid losing money. Such a delay option has a value of +$3 million. What is the final decision on the project? Accept the project because its adjusted NPV is $2 million (-1+3-2). Wait for a year to decide whether to start the project or not. Reject the project now because the future is uncertain. Start the project now. Do not wait for a year. Reject the project now because its initial NPV (without the delay option) is $1 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts