Question: Please answer the Assignment Problem 14-3. Thanks! yes this question! loss of $48,000. This figure includes a write-down of inventories to their fair market values

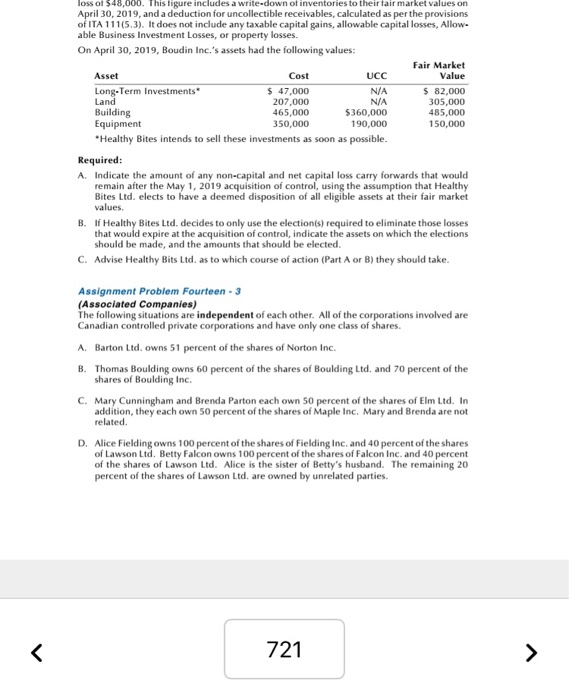

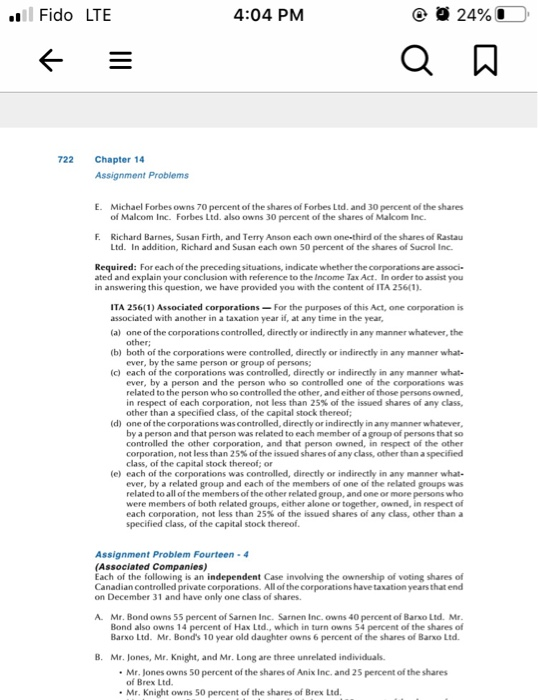

loss of $48,000. This figure includes a write-down of inventories to their fair market values on April 30, 2019, and a deduction for uncollectible receivables, calculated as per the provisions of ITA 111(5.3). It does not include any taxable capital gains, allowable capital losses, Allow- able Business Investment Losses, or property losses. On April 30, 2019, Boudin Inc.'s assets had the following values: Fair Market Asset Cost UCC Value Long-Term Investments $ 47,000 N/A $ 82,000 Land 207.000 N/A 305,000 Building 465,000 $360,000 485,000 Equipment 350,000 190,000 150,000 Healthy Bites intends to sell these investments as soon as possible. Required: A. Indicate the amount of any non-capital and net capital loss carry forwards that would remain after the May 1, 2019 acquisition of control, using the assumption that Healthy Bites Ltd. elects to have a deemed disposition of all eligible assets at their fair market values. B. If Healthy Bites Ltd. decides to only use the election(s) required to eliminate those losses that would expire at the acquisition of control, indicate the assets on which the elections should be made, and the amounts that should be elected. C. Advise Healthy Bits Ltd, as to which course of action (Part A or B) they should take. Assignment Problem Fourteen - 3 (Associated Companies) The following situations are independent of each other. All of the corporations involved are Canadian controlled private corporations and have only one class of shares. A. Barton Ltd. owns 51 percent of the shares of Norton Inc. B. Thomas Boulding owns 60 percent of the shares of Boulding Ltd. and 70 percent of the shares of Boulding Inc. C. Mary Cunningham and Brenda Parton each own 50 percent of the shares of Elm Ltd. In addition, they each own 50 percent of the shares of Maple Inc. Mary and Brenda are not related D. Alice Fielding owns 100 percent of the shares of Fielding Inc. and 40 percent of the shares of Lawson Ltd. Betty Falcon owns 100 percent of the shares of Falcon Inc. and 40 percent of the shares of Lawson Ltd. Alice is the sister of Betty's husband. The remaining 20 percent of the shares of Lawson Ltd, are owned by unrelated parties. 721 > ..il Fido LTE 4:04 PM 0 24% t = Q W 722 Chapter 14 Assignment Problems E. Michael Forbes owns 70 percent of the shares of Forbes Ltd. and 30 percent of the shares of Malcom Inc. Forbes Ltd. also owns 30 percent of the shares of Malcom Inc. F. Richard Barnes, Susan Firth, and Terry Anson each own one-third of the shares of Rastau Ltd. In addition, Richard and Susan each own 50 percent of the shares of Sucrol Inc. Required: For each of the preceding situations, indicate whether the corporations are associ. ated and explain your conclusion with reference to the income Tax Act. In order to assist you in answering this question, we have provided you with the content of ITA 256(1). ITA 256(1) Associated corporations - For the purposes of this Act, one corporation is associated with another in a taxation year it, at any time in the year, (a) one of the corporations controlled, directly or indirectly in any manner whatever, the other: (b) both of the corporations were controlled, directly or indirectly in any manner what- ever, by the same person or group of persons (c) each of the corporations was controlled, directly or indirectly in any manner what ever, by a person and the person who so controlled one of the corporations was related to the person who so controlled the other, and either of those persons owned, in respect of each corporation, not less than 25% of the issued shares of any class, other than a specified class, of the capital stock thereof; (d) one of the corporations was controlled, directly or indirectly in any manner whatever, by a person and that person was related to each member of a group of persons that so controlled the other corporation, and that person owned, in respect of the other corporation, not less than 25% of the issued shares of any class, other than a specified class, of the capital stock thereof; or (e) each of the corporations was controlled, directly or indirectly in any manner what- ever, by a related group and each of the members of one of the related groups was related to all of the members of the other related group, and one or more persons who were members of both related groups, either alone or together, owned, in respect of each corporation, not less than 25% of the issued shares of any class, other than a specified class, of the capital stock thereof. Assignment Problem Fourteen - 4 (Associated Companies) Each of the following is an independent Case involving the ownership of voting shares of Canadian controlled private corporations. All of the corporations have taxation years that end on December 31 and have only one class of shares. A. Mr. Bond owns 55 percent of Sarnen Inc. Sarnen Inc. owns 40 percent of Barxo Ltd. Mr. Bond also owns 14 percent of Hax Ltd., which in turn owns 54 percent of the shares of Barxo Ltd. Mr. Bond's 10 year old daughter owns 6 percent of the shares of Barxo Ltd. B. Mr. Jones, Mr. Knight, and Mr. Long are three unrelated individuals. Mr. Jones owns 50 percent of the shares of Anix Inc. and 25 percent of the shares of Brex Ltd. . Mr. Knight owns 50 percent of the shares of Brex Ltd. loss of $48,000. This figure includes a write-down of inventories to their fair market values on April 30, 2019, and a deduction for uncollectible receivables, calculated as per the provisions of ITA 111(5.3). It does not include any taxable capital gains, allowable capital losses, Allow- able Business Investment Losses, or property losses. On April 30, 2019, Boudin Inc.'s assets had the following values: Fair Market Asset Cost UCC Value Long-Term Investments $ 47,000 N/A $ 82,000 Land 207.000 N/A 305,000 Building 465,000 $360,000 485,000 Equipment 350,000 190,000 150,000 Healthy Bites intends to sell these investments as soon as possible. Required: A. Indicate the amount of any non-capital and net capital loss carry forwards that would remain after the May 1, 2019 acquisition of control, using the assumption that Healthy Bites Ltd. elects to have a deemed disposition of all eligible assets at their fair market values. B. If Healthy Bites Ltd. decides to only use the election(s) required to eliminate those losses that would expire at the acquisition of control, indicate the assets on which the elections should be made, and the amounts that should be elected. C. Advise Healthy Bits Ltd, as to which course of action (Part A or B) they should take. Assignment Problem Fourteen - 3 (Associated Companies) The following situations are independent of each other. All of the corporations involved are Canadian controlled private corporations and have only one class of shares. A. Barton Ltd. owns 51 percent of the shares of Norton Inc. B. Thomas Boulding owns 60 percent of the shares of Boulding Ltd. and 70 percent of the shares of Boulding Inc. C. Mary Cunningham and Brenda Parton each own 50 percent of the shares of Elm Ltd. In addition, they each own 50 percent of the shares of Maple Inc. Mary and Brenda are not related D. Alice Fielding owns 100 percent of the shares of Fielding Inc. and 40 percent of the shares of Lawson Ltd. Betty Falcon owns 100 percent of the shares of Falcon Inc. and 40 percent of the shares of Lawson Ltd. Alice is the sister of Betty's husband. The remaining 20 percent of the shares of Lawson Ltd, are owned by unrelated parties. 721 > ..il Fido LTE 4:04 PM 0 24% t = Q W 722 Chapter 14 Assignment Problems E. Michael Forbes owns 70 percent of the shares of Forbes Ltd. and 30 percent of the shares of Malcom Inc. Forbes Ltd. also owns 30 percent of the shares of Malcom Inc. F. Richard Barnes, Susan Firth, and Terry Anson each own one-third of the shares of Rastau Ltd. In addition, Richard and Susan each own 50 percent of the shares of Sucrol Inc. Required: For each of the preceding situations, indicate whether the corporations are associ. ated and explain your conclusion with reference to the income Tax Act. In order to assist you in answering this question, we have provided you with the content of ITA 256(1). ITA 256(1) Associated corporations - For the purposes of this Act, one corporation is associated with another in a taxation year it, at any time in the year, (a) one of the corporations controlled, directly or indirectly in any manner whatever, the other: (b) both of the corporations were controlled, directly or indirectly in any manner what- ever, by the same person or group of persons (c) each of the corporations was controlled, directly or indirectly in any manner what ever, by a person and the person who so controlled one of the corporations was related to the person who so controlled the other, and either of those persons owned, in respect of each corporation, not less than 25% of the issued shares of any class, other than a specified class, of the capital stock thereof; (d) one of the corporations was controlled, directly or indirectly in any manner whatever, by a person and that person was related to each member of a group of persons that so controlled the other corporation, and that person owned, in respect of the other corporation, not less than 25% of the issued shares of any class, other than a specified class, of the capital stock thereof; or (e) each of the corporations was controlled, directly or indirectly in any manner what- ever, by a related group and each of the members of one of the related groups was related to all of the members of the other related group, and one or more persons who were members of both related groups, either alone or together, owned, in respect of each corporation, not less than 25% of the issued shares of any class, other than a specified class, of the capital stock thereof. Assignment Problem Fourteen - 4 (Associated Companies) Each of the following is an independent Case involving the ownership of voting shares of Canadian controlled private corporations. All of the corporations have taxation years that end on December 31 and have only one class of shares. A. Mr. Bond owns 55 percent of Sarnen Inc. Sarnen Inc. owns 40 percent of Barxo Ltd. Mr. Bond also owns 14 percent of Hax Ltd., which in turn owns 54 percent of the shares of Barxo Ltd. Mr. Bond's 10 year old daughter owns 6 percent of the shares of Barxo Ltd. B. Mr. Jones, Mr. Knight, and Mr. Long are three unrelated individuals. Mr. Jones owns 50 percent of the shares of Anix Inc. and 25 percent of the shares of Brex Ltd. . Mr. Knight owns 50 percent of the shares of Brex Ltd

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts