Question: Please answer the attachments below. Indicate the answer choice that best completes the statement or answers the question. 1. Which of the following accounts normally

Please answer the attachments below.

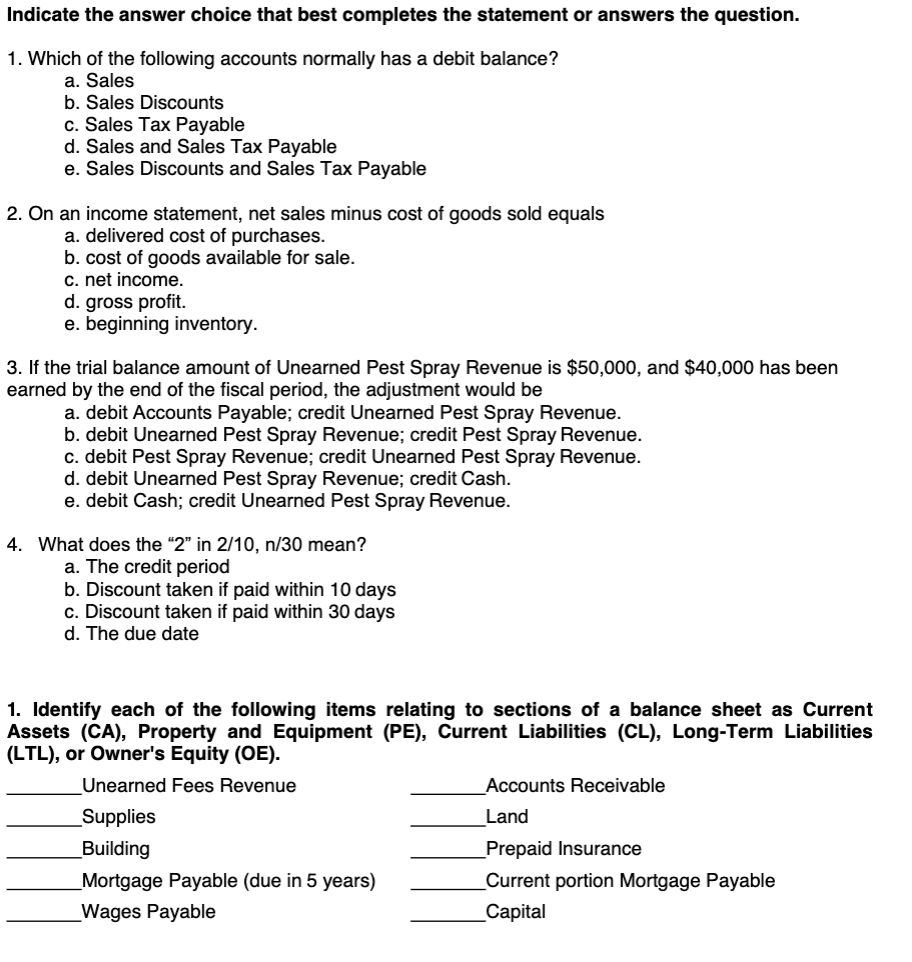

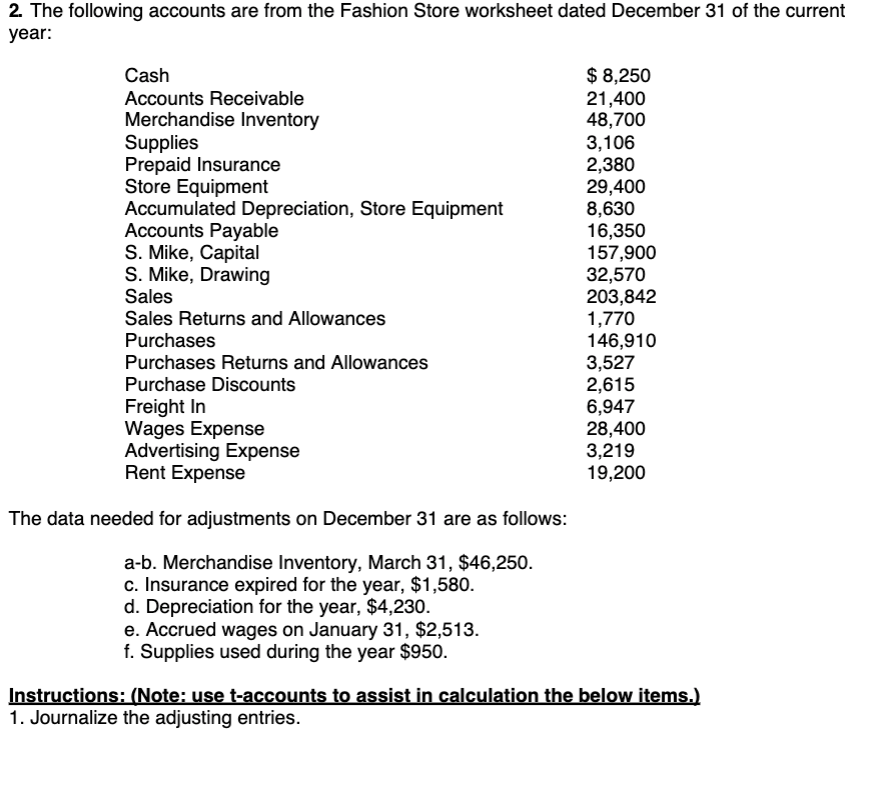

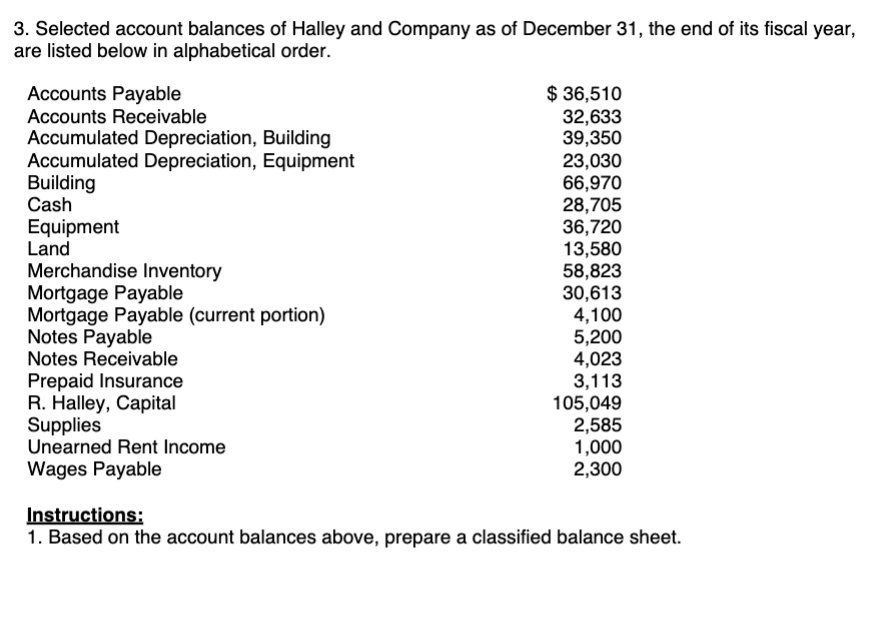

Indicate the answer choice that best completes the statement or answers the question. 1. Which of the following accounts normally has a debit balance? a. Sales b. Sales Discounts c. Sales Tax Payable d. Sales and Sales Tax Payable e. Sales Discounts and Sales Tax Payable 2. On an income statement, net sales minus cost of goods sold equals a. delivered cost of purchases. b. cost of goods available for sale. c. net income d. gross profit. e. beginning inventory. 3. If the trial balance amount of Unearned Pest Spray Revenue is $50,000, and $40,000 has been earned by the end of the fiscal period, the adjustment would be a. debit Accounts Payable; credit Unearned Pest Spray Revenue. b. debit Unearned Pest Spray Revenue; credit Pest Spray Revenue. c. debit Pest Spray Revenue; credit Unearned Pest Spray Revenue. d. debit Unearned Pest Spray Revenue; credit Cash. e. debit Cash; credit Unearned Pest Spray Revenue. What does the "2" in 2/10, n/30 mean? a. The credit period b. Discount taken if paid within 10 days c. Discount taken if paid within 30 days d. The due date 1. Identify each of the following items relating to sections of a balance sheet as Current Assets (CA), Property and Equipment (PE), Current Liabilities (CL), Long-Term Liabilities (LTL), or Owner's Equity (OE). Unearned Fees Revenue Accounts Receivable Supplies Land Building Prepaid Insurance Mortgage Payable (due in 5 years) Current portion Mortgage Payable Wages Payable Capital2. The following accounts are from the Fashion Store worksheet dated December 31 of the current year: Cash $ 8,250 Accounts Receivable 21,400 Merchandise Inventory 48,700 Supplies 3,106 Prepaid Insurance 2,380 Store Equipment 29,400 Accumulated Depreciation, Store Equipment 8,630 Accounts Payable 16,350 S. Mike, Capital 157,900 S. Mike, Drawing 32,570 Sales 203,842 Sales Returns and Allowances 1,770 Purchases 146,910 Purchases Returns and Allowances 3,527 Purchase Discounts 2,615 Freight In 6,947 Wages Expense 28,400 Advertising Expense 3,219 Rent Expense 19,200 The data needed for adjustments on December 31 are as follows: a-b. Merchandise Inventory, March 31, $46,250. c. Insurance expired for the year, $1,580. d. Depreciation for the year, $4,230. e. Accrued wages on January 31, $2,513. f. Supplies used during the year $950. Instructions: (Note: use t-accounts to assist in calculation the below items.) 1. Journalize the adjusting entries.3. Selected account balances of Halley and Company as of December 31, the end of its fiscal year, are listed below in alphabetical order. Accounts Payable $ 36,510 Accounts Receivable 32,633 Accumulated Depreciation, Building 39,350 Accumulated Depreciation, Equipment 23,030 Building 66,970 Cash 28,705 Equipment 36,720 Land 13,580 Merchandise Inventory 58,823 Mortgage Payable 30,613 Mortgage Payable (current portion) 4,100 Notes Payable 5,200 Notes Receivable 4,023 Prepaid Insurance 3,113 R. Halley, Capital 105,049 Supplies 2,585 Unearned Rent Income 1,000 Wages Payable 2,300 Instructions: 1. Based on the account balances above, prepare a classified balance sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts