Question: please answer the average collection period question The income statement of Sterling Corporation for the year ended December 31, 2019 is as follow: Sales $

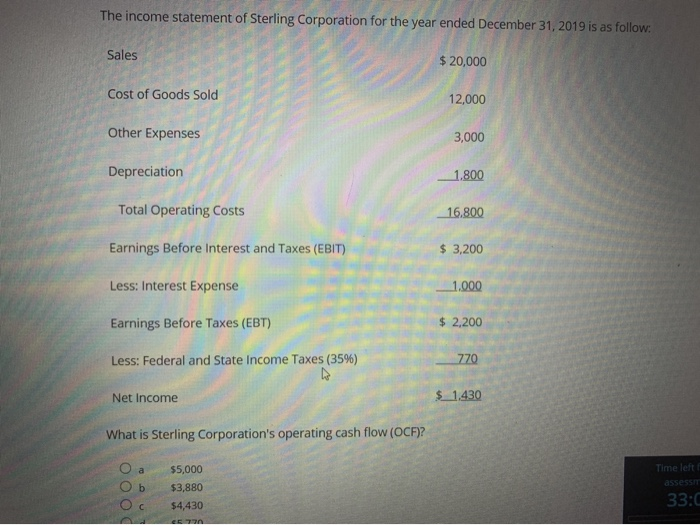

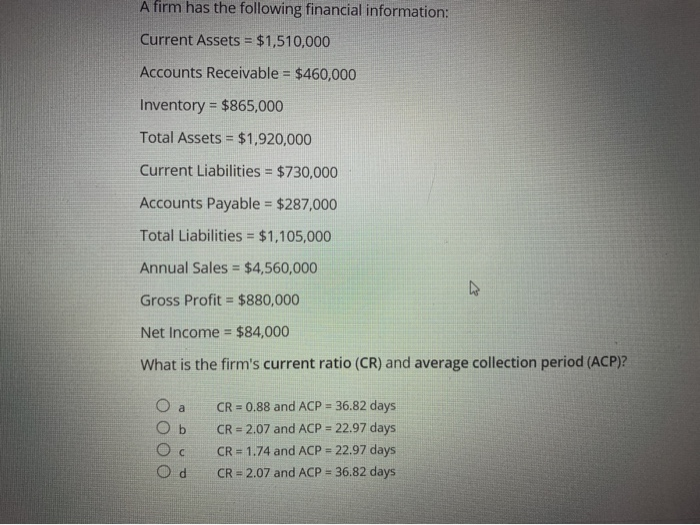

The income statement of Sterling Corporation for the year ended December 31, 2019 is as follow: Sales $ 20,000 Cost of Goods Sold 12,000 Other Expenses 3,000 Depreciation 1.800 Total Operating Costs 16.800 Earnings Before Interest and Taxes (EBIT) $ 3,200 Less: Interest Expense 1.000 Earnings Before Taxes (EBT) $ 2,200 Less: Federal and State Income Taxes (35%) 770 Net Income $_1.430 What is Sterling Corporation's operating cash flow (OCF)? a b $5,000 $3,880 $4,430 Time left assessor 33:0 CE A firm has the following financial information: Current Assets = $1,510,000 Accounts Receivable = $460,000 Inventory = $865,000 Total Assets = $1,920,000 Current Liabilities = $730,000 Accounts Payable = $287,000 Total Liabilities = $1,105,000 Annual Sales = $4,560,000 Gross Profit = $880,000 Net Income = $84,000 What is the firm's current ratio (CR) and average collection period (ACP)? O a Ob CR = 0.88 and ACP = 36.82 days CR = 2.07 and ACP = 22.97 days CR = 1.74 and ACP = 22.97 days CR = 2.07 and ACP = 36.82 days Od

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts