Question: Please answer the below question following textbook instruction in Microsoft Excel, showing any Excel formulas used. Good work will be given a thumbs up! Thanks

Please answer the below question following textbook instruction in Microsoft Excel, showing any Excel formulas used.

Good work will be given a thumbs up! Thanks for your time.

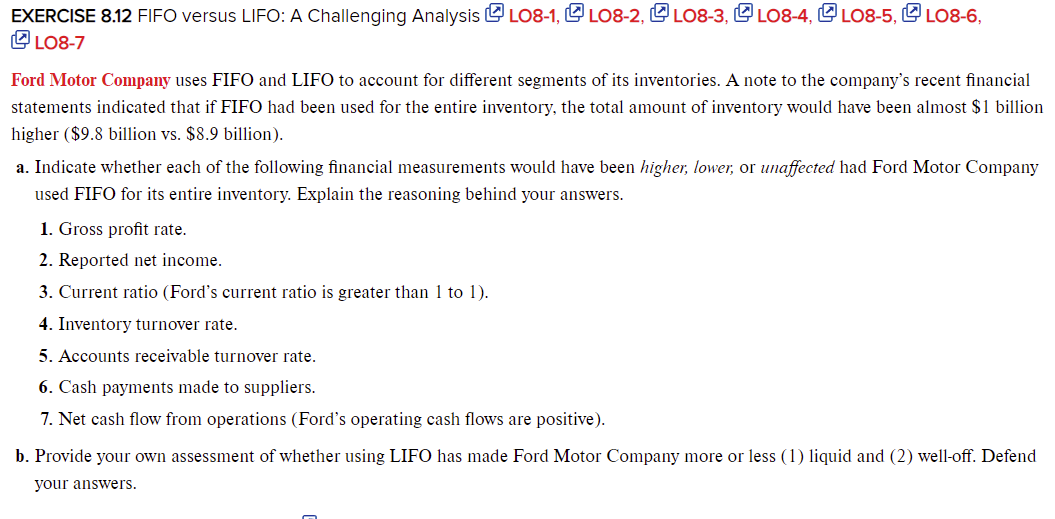

EXERCISE 8.12 FIFO versus LIFO: A Challenging Analysis @ 108-1, L08-2, L08-3, 408-4, L08-5, L08-6, L08-7 Ford Motor Company uses FIFO and LIFO to account for different segments of its inventories. A note to the company's recent financial statements indicated that if FIFO had been used for the entire inventory, the total amount of inventory would have been almost $1 billion higher ($9.8 billion vs. $8.9 billion). a. Indicate whether each of the following financial measurements would have been higher, lower, or unaffected had Ford Motor Company used FIFO for its entire inventory. Explain the reasoning behind your answers. 1. Gross profit rate. 2. Reported net income. 3. Current ratio (Ford's current ratio is greater than 1 to 1). 4. Inventory turnover rate. 5. Accounts receivable turnover rate. 6. Cash payments made to suppliers. 7. Net cash flow from operations (Ford's operating cash flows are positive). b. Provide your own assessment of whether using LIFO has made Ford Motor Company more or less (1) liquid and (2) well-off. Defend your answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts