Question: Please answer the below question urgently Growing Pains We are growing too fast. said Geoff. I know I shouldn't complain, but we better have the

Please answer the below question urgently

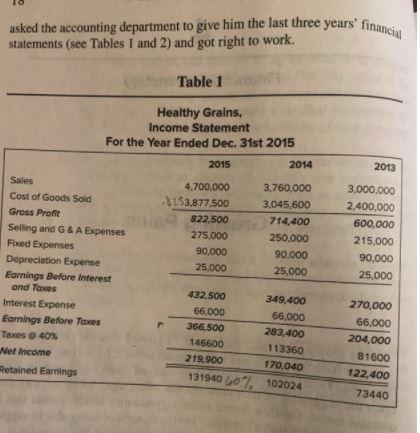

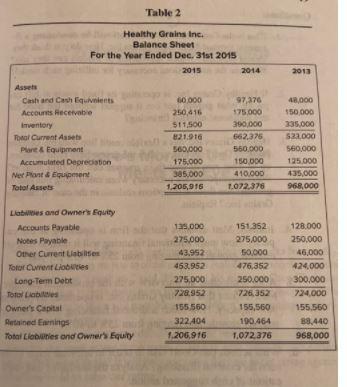

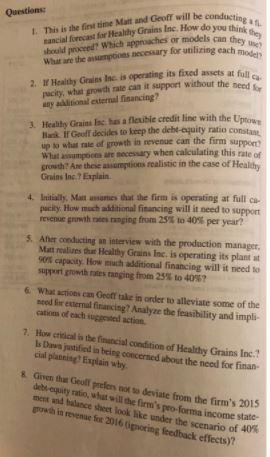

Growing Pains "We are growing too fast." said Geoff. "I know I shouldn't complain, but we better have the capacity to fill the orders or we'll be hurting ourselves." Dawn and Geoff De Tolve started their oatmeal snacks company in 2008. upon the suggestion of their close friends who simply loved the way their oatmeal tasted. Geoff, a former college gymnastics coach, insists that he never "intended to start a business." but the thought of being able to support his college team played a significant role in motivating him to go for it. After considerable help from local retailers and a sponsorship by a major bread company, their firm, Healthy Grains Inc., was established in 2008 and reached sales of over $4 million by 2015. Given the current trend of eating healthy snacks and keeping fit. Geoff was confident that sales would increase significantly over the next few years. The industry growth forecast had been estimated at 30% per year, and Geoff was confident that his firm would be able to at least match if not beat that rate of sales growth. "We must plan for the future," said Dawn. "I think we've been playing it by ear for too long." Geoff immediately called their treasurer, Matt Evans. "Matt. I need to know how much additional funding we are going to need for the next year," said Geoff. "The growth rate of revenues should be be- tween 25% and 40%. I would really appreciate if you can have the forecast on my desk by early next week." Matt knew that his fishing plans for the weekend had better be put aside-it was going to be a long and busy weekend for him. He immediately asked the accounting department to give him the last three years financial statements (see Tables 1 and 2) and got right to work. Table 1 Healthy Grains, Income Statement For the Year Ended Dec. 31st 2015 2015 2014 2013 4.700,000 253,877,500 822,500 275.000 90,000 25,000 Sales Cost of Goods Sold Gross Profile Selling and G & A Expenses Fixed Expenses Depreciation Expense Earnings Before Interest and Taxes Interest Expense Earnings Before Taxes Taxes 40% Net Income Retained Earnings 3.760,000 3,045,600 714,400 250.000 90,000 25,000 3,000,000 2.400,000 600,000 215,000 90,000 25.000 432,500 349.400 66,000 66,000 366,500 283,400 146600 113360 219,900 170,040 131940 107, 102024 270,000 66.000 204,000 B1600 122,400 73440 Table 2 2013 Healthy Grains Inc. Balance Sheet For the Year Ended Dec. 31st 2015 2015 2014 Assets Cash and Cach Equinients 60 000 97,376 Accounts Receivable 250,416 175.000 Inventory $11,500 390,000 The Current Assets 21.910 662,375 Pane & Equipment 560,000 550.000 Accumulated Depreciation 175.000 150.000 Ner Post & Equipment 385.000 410.000 Total Assets 1.205,016 1.072.378 48,000 $50,000 335,000 $22.000 560.000 125.000 435,000 968,000 Labies and Owner's Equity Accounts Payable Notes Payable Other Current Liabilities Torrevit Liones Long-Term Debt Toto Labs Owner's Capital Retained wings Total Clownies and Owner's Equity 125.000 275,000 43.952 453.952 275.000 728,952 155560 322,404 1.206,916 151352 275,000 50.000 476,352 250.000 726,352 155,560 190.464 1.072,376 128.000 250.000 46,000 424.000 300.000 724,000 155,560 38.440 968,000 Questions 1. This is the fint time Mart and Geoft will be conducting tacial forest for Healthy Grains Inc. How do you think would proced? Which approaches or models can they What are the mos ecosary for utilizing each model 2. If Healthy Grains Inc. is operating is fixed assets at full city, whul growth rate con i support without the need for ay tinal external financing? 3. Healty Grain Echos a floubit credit line with the powe Husk ir Geoll decides to keep the debt-aquity ratio consta up to what male of growth in revenue can the firm support Watampoen we necessary when calculating this rate of growth Are these amption realistic in the case of Healthy Grains Inc. ? Explain 4. Initially. Most names that the firm is operating at full co packy. How much ditional financing will it need to support revenue growth ranging from 250 to 40 per year? $ Aer conducting an interview with the production manager, Mattress that Healthy Gains Inc. is operating its plast So capacity How much additional financing will it need to support growth rates tanging from 25 to 40957 6 What is an effe in order to alleviate some of the need for external financing? Analyze the feasibility and impli 7. Ho critical is the financial condition of Healthy Grains Inc.? Is Dawa justified in being concerned about the need for finan cial planning Explain why & Given the Geoll prefers to deviate from the firm's 2015 debt city ratio, what will the firm's proforma income state met wil bulance sheet look like under the scenario of 40% prowth in revenue for 2016 tipoeing feedback effects)? Growing Pains "We are growing too fast." said Geoff. "I know I shouldn't complain, but we better have the capacity to fill the orders or we'll be hurting ourselves." Dawn and Geoff De Tolve started their oatmeal snacks company in 2008. upon the suggestion of their close friends who simply loved the way their oatmeal tasted. Geoff, a former college gymnastics coach, insists that he never "intended to start a business." but the thought of being able to support his college team played a significant role in motivating him to go for it. After considerable help from local retailers and a sponsorship by a major bread company, their firm, Healthy Grains Inc., was established in 2008 and reached sales of over $4 million by 2015. Given the current trend of eating healthy snacks and keeping fit. Geoff was confident that sales would increase significantly over the next few years. The industry growth forecast had been estimated at 30% per year, and Geoff was confident that his firm would be able to at least match if not beat that rate of sales growth. "We must plan for the future," said Dawn. "I think we've been playing it by ear for too long." Geoff immediately called their treasurer, Matt Evans. "Matt. I need to know how much additional funding we are going to need for the next year," said Geoff. "The growth rate of revenues should be be- tween 25% and 40%. I would really appreciate if you can have the forecast on my desk by early next week." Matt knew that his fishing plans for the weekend had better be put aside-it was going to be a long and busy weekend for him. He immediately asked the accounting department to give him the last three years financial statements (see Tables 1 and 2) and got right to work. Table 1 Healthy Grains, Income Statement For the Year Ended Dec. 31st 2015 2015 2014 2013 4.700,000 253,877,500 822,500 275.000 90,000 25,000 Sales Cost of Goods Sold Gross Profile Selling and G & A Expenses Fixed Expenses Depreciation Expense Earnings Before Interest and Taxes Interest Expense Earnings Before Taxes Taxes 40% Net Income Retained Earnings 3.760,000 3,045,600 714,400 250.000 90,000 25,000 3,000,000 2.400,000 600,000 215,000 90,000 25.000 432,500 349.400 66,000 66,000 366,500 283,400 146600 113360 219,900 170,040 131940 107, 102024 270,000 66.000 204,000 B1600 122,400 73440 Table 2 2013 Healthy Grains Inc. Balance Sheet For the Year Ended Dec. 31st 2015 2015 2014 Assets Cash and Cach Equinients 60 000 97,376 Accounts Receivable 250,416 175.000 Inventory $11,500 390,000 The Current Assets 21.910 662,375 Pane & Equipment 560,000 550.000 Accumulated Depreciation 175.000 150.000 Ner Post & Equipment 385.000 410.000 Total Assets 1.205,016 1.072.378 48,000 $50,000 335,000 $22.000 560.000 125.000 435,000 968,000 Labies and Owner's Equity Accounts Payable Notes Payable Other Current Liabilities Torrevit Liones Long-Term Debt Toto Labs Owner's Capital Retained wings Total Clownies and Owner's Equity 125.000 275,000 43.952 453.952 275.000 728,952 155560 322,404 1.206,916 151352 275,000 50.000 476,352 250.000 726,352 155,560 190.464 1.072,376 128.000 250.000 46,000 424.000 300.000 724,000 155,560 38.440 968,000 Questions 1. This is the fint time Mart and Geoft will be conducting tacial forest for Healthy Grains Inc. How do you think would proced? Which approaches or models can they What are the mos ecosary for utilizing each model 2. If Healthy Grains Inc. is operating is fixed assets at full city, whul growth rate con i support without the need for ay tinal external financing? 3. Healty Grain Echos a floubit credit line with the powe Husk ir Geoll decides to keep the debt-aquity ratio consta up to what male of growth in revenue can the firm support Watampoen we necessary when calculating this rate of growth Are these amption realistic in the case of Healthy Grains Inc. ? Explain 4. Initially. Most names that the firm is operating at full co packy. How much ditional financing will it need to support revenue growth ranging from 250 to 40 per year? $ Aer conducting an interview with the production manager, Mattress that Healthy Gains Inc. is operating its plast So capacity How much additional financing will it need to support growth rates tanging from 25 to 40957 6 What is an effe in order to alleviate some of the need for external financing? Analyze the feasibility and impli 7. Ho critical is the financial condition of Healthy Grains Inc.? Is Dawa justified in being concerned about the need for finan cial planning Explain why & Given the Geoll prefers to deviate from the firm's 2015 debt city ratio, what will the firm's proforma income state met wil bulance sheet look like under the scenario of 40% prowth in revenue for 2016 tipoeing feedback effects)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts