Question: please answer the below question using the above share prices and the company is transurban Based on information gleaned from your macro analysis, Porters five

please answer the below question using the above share prices and the company is transurban

-

Based on information gleaned from your macro analysis, Porters five forces model analysis, business strategy and governance factors of the company, explain how your determination of the share price range is appropriate for your company.

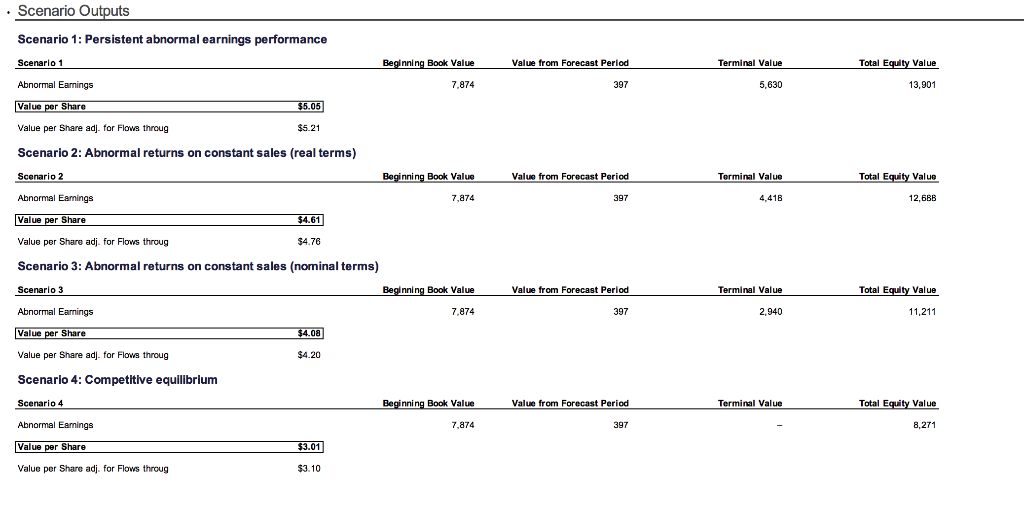

Scenario Outputs Scenario 1: Persistent abnormal earnings performance Scenario 1 Beginning Book Value Value from Forecast Period Terminal Value Total Equity Value Abnormal Earnings 7,874 397 5,630 13,901 Value per Share $5.05 Value per Share adj. for Flows throug $5.21 Scenario 2: Abnormal returns on constant sales (real terms) Scenario 2 Beginning Book Value Value from Forecast Period Terminal Value Total Equity Value Abnormal Earnings 7,874 397 4.41B 12,6BB Value per Share $4.61 Value per Share adj. for Flows throug $4.76 Scenario 3: Abnormal returns on constant sales (nominal terms) Scenario 3 Beginning Book Value Value from Forecast Period Terminal Value Total Equity Value Abnormal Earnings 7,874 397 2.940 11,211 $4.08 Value per Share Value per Share adj. for Flows throug . $4.20 Scenarlo 4: Competitive equilibrium Scenario 4 Beginning Book Value Value from Forecast Period Terminal Value Total Equity Value Abnormal Earnings 7,874 397 8,271 Value per Share $3.01 Value per Share adj. for Flows throug $3.10 Scenario Outputs Scenario 1: Persistent abnormal earnings performance Scenario 1 Beginning Book Value Value from Forecast Period Terminal Value Total Equity Value Abnormal Earnings 7,874 397 5,630 13,901 Value per Share $5.05 Value per Share adj. for Flows throug $5.21 Scenario 2: Abnormal returns on constant sales (real terms) Scenario 2 Beginning Book Value Value from Forecast Period Terminal Value Total Equity Value Abnormal Earnings 7,874 397 4.41B 12,6BB Value per Share $4.61 Value per Share adj. for Flows throug $4.76 Scenario 3: Abnormal returns on constant sales (nominal terms) Scenario 3 Beginning Book Value Value from Forecast Period Terminal Value Total Equity Value Abnormal Earnings 7,874 397 2.940 11,211 $4.08 Value per Share Value per Share adj. for Flows throug . $4.20 Scenarlo 4: Competitive equilibrium Scenario 4 Beginning Book Value Value from Forecast Period Terminal Value Total Equity Value Abnormal Earnings 7,874 397 8,271 Value per Share $3.01 Value per Share adj. for Flows throug $3.10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts