Question: Please answer the bottom questions using the indirect method balance sheet listed. 3. Using the following balance sheets for September 30 and December 31, prepare

Please answer the bottom questions using the indirect method balance sheet listed.

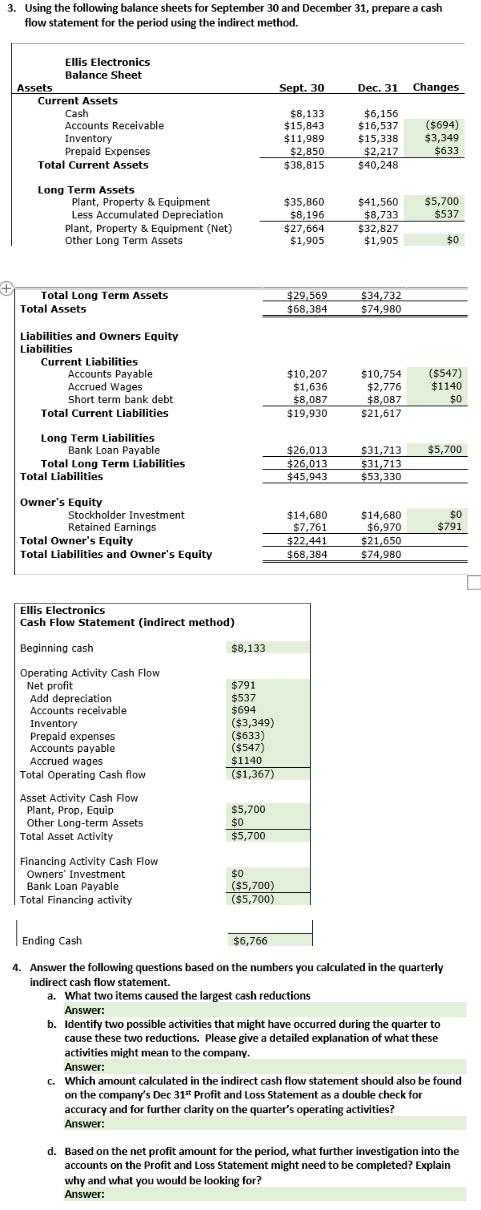

3. Using the following balance sheets for September 30 and December 31, prepare a cash flow statement for the period using the indirect method. Sept. 30 Dec. 31 Changes Ellis Electronics Balance Sheet Assets Current Assets Cash Accounts Receivable Inventory Prepaid Expenses Total Current Assets $8,133 $15,843 $11,989 $2,850 $38,815 $6,156 $16,537 $15,338 $2,217 $40,248 ($694) $3,349 $633 Long Term Assets Plant, Property & Equipment Less Accumulated Depreciation Plant, Property & Equipment (Net) Other Long Term Assets $5,700 $537 $35,860 $8,196 $27,664 $1,905 $41,560 $8,733 $32,827 $1,905 0 $0 Total Long Term Assets Total Assets $29,569 $68,384 $34,732 $74,980 Liabilities and Owners Equity Liabilities Current Liabilities Accounts Payable Accrued Wages Short term bank debt Total Current Liabilities $10.207 $1,636 $8,087 $19,930 $10,754 $2,776 $8,087 $21,617 ($547) $1140 $0 $5,700 Long Term Liabilities Bank Loan Payable Total Long Term Liabilities Total Liabilities $26,013 $26,013 $45,943 $31,713 $31,713 $53,330 Owner's Equity Stockholder Investment Retained Earnings Total Owner's Equity Total Liabilities and Owner's Equity $0 $ $791 $14,680 $7,761 $22,441 $68,384 $14,680 $6,970 $21,650 $74,980 Ellis Electronics Cash Flow Statement indirect method) Beginning cash $8,133 $791 $537 $694 ($3,349) ($633) Operating Activity Cash Flow Net profit Add depreciation Accounts receivable Inventory Prepaid expenses Accounts payable Accrued wages Total Operating Cash flow Asset Activity Cash Flow Plant, Prop, Equip Other Long-term Assets Total Asset Activity ($5471 $1140 ($1,367) $5,700 $0 $5,700 Financing Activity Cash Flow Owners' Investment Bank Loan Payable Total Financing activity $0 ($5,700) ($5,700) Ending Cash $6,766 4. Answer the following questions based on the numbers you calculated in the quarterly indirect cash flow statement. a. What two items caused the largest cash reductions Answer: b. Identify two possible activities that might have occurred during the quarter to cause these two reductions. Please give a detailed explanation of what these activities might mean to the company. Answer: C. Which amount calculated in the indirect cash flow statement should also be found on the company's Dec 31st Profit and Loss Statement as a double check for accuracy and for further darity on the quarter's operating activities? Answer: d. Based on the net profit amount for the period, what further investigation into the accounts on the Profit and Loss Statement might need to be completed? Explain why and what you would be looking for

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts