Question: PLEASE ANSWER THE EMPTY BOXES FOR PART B AND THEN ANSWER C Suppose the current one-year interest rate is 6.1%. One year from now, you

PLEASE ANSWER THE EMPTY BOXES FOR PART B AND THEN ANSWER C

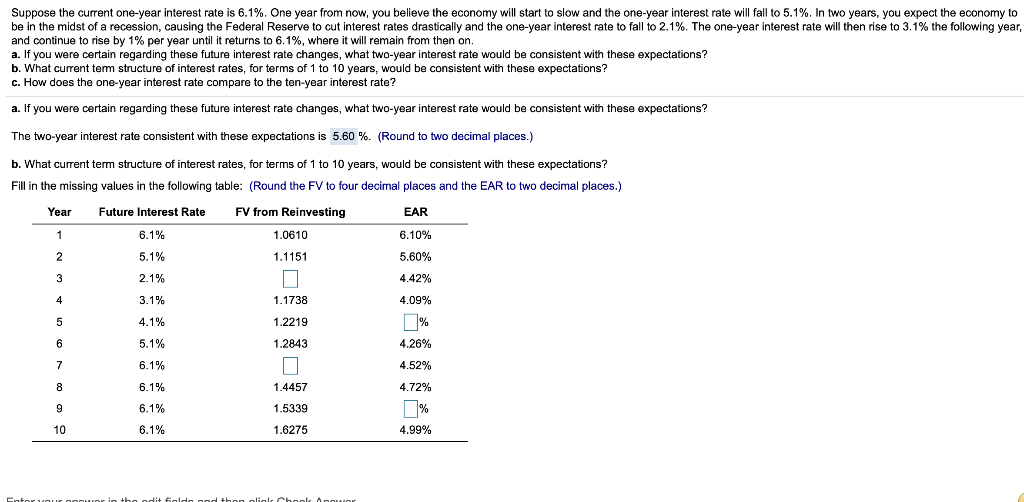

Suppose the current one-year interest rate is 6.1%. One year from now, you believe the economy will start to slow and the one-year interest rate will fall to 5.1%. In two years, you expect the economy to be in the midst of a recession, causing the Federal Reserve to cut interest rates drastically and the one-year interest rate to fall to 2.1%. The one-year interest rate will then rise to 3.1% the following year, and continue to rise by 1% per year until it returns to 6.1%, where it will remain from then on. a. If you were certain regarding these future interest rate changes, what two-year interest rate would be consistent with these expectations? b. What current term structure of interest rates, for terms of 1 to 10 years, would be consistent with these expectations? c. How does the one-year interest rate compare to the ten-year interest rate? a. If you were certain regarding these future interest rate changes, what two-year interest rate would be consistent with these expectations? The two-year interest rate consistent with these expectations is 5.60 %. (Round to two decimal places.) b. What current term structure of interest rates, for terms of 1 to 10 years, would be consistent with these expectations? Fill in the missing values in the following table: (Round the FV to four decimal places and the EAR to two decimal places.) Year Future Interest Rate FV from Reinvesting EAR 1 6.1% 1.0610 6.10% 2 5.1% 1.1151 5.60% 4.42% 3 2.1% 4 3.1% 1.1738 4.09% % 5 4.1% 1.2219 6 5.1% 1.2843 4.26% 7 6.1% 4.52% 8 6.1% 1.4457 4.72% 9 6.1% 1.5339 10 6.1% 1.6275 4.99% Estour in the edit fields and then click book AC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts