Question: Please answer the essay question concisely and fully. QUESTION 7 A power operator comprises three divisions. The firm uses economic-value-added (EVA) measures to evaluate performance

Please answer the essay question concisely and fully.

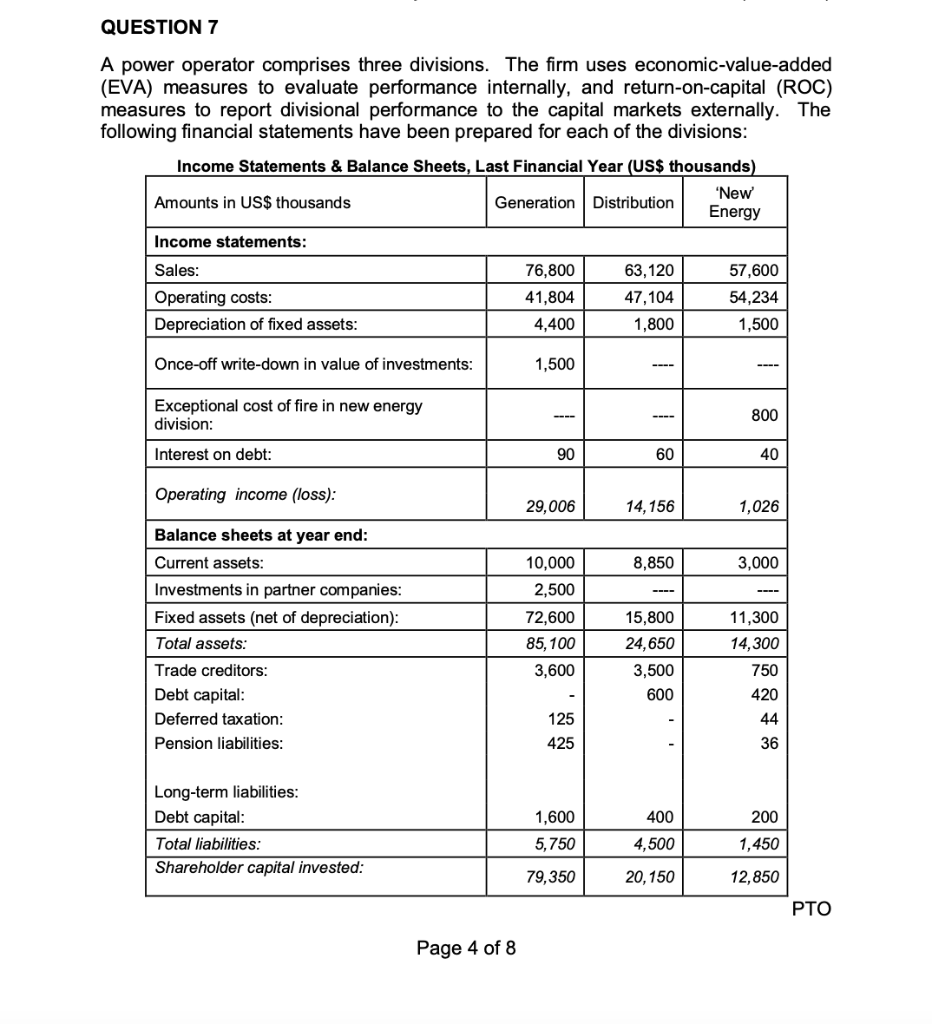

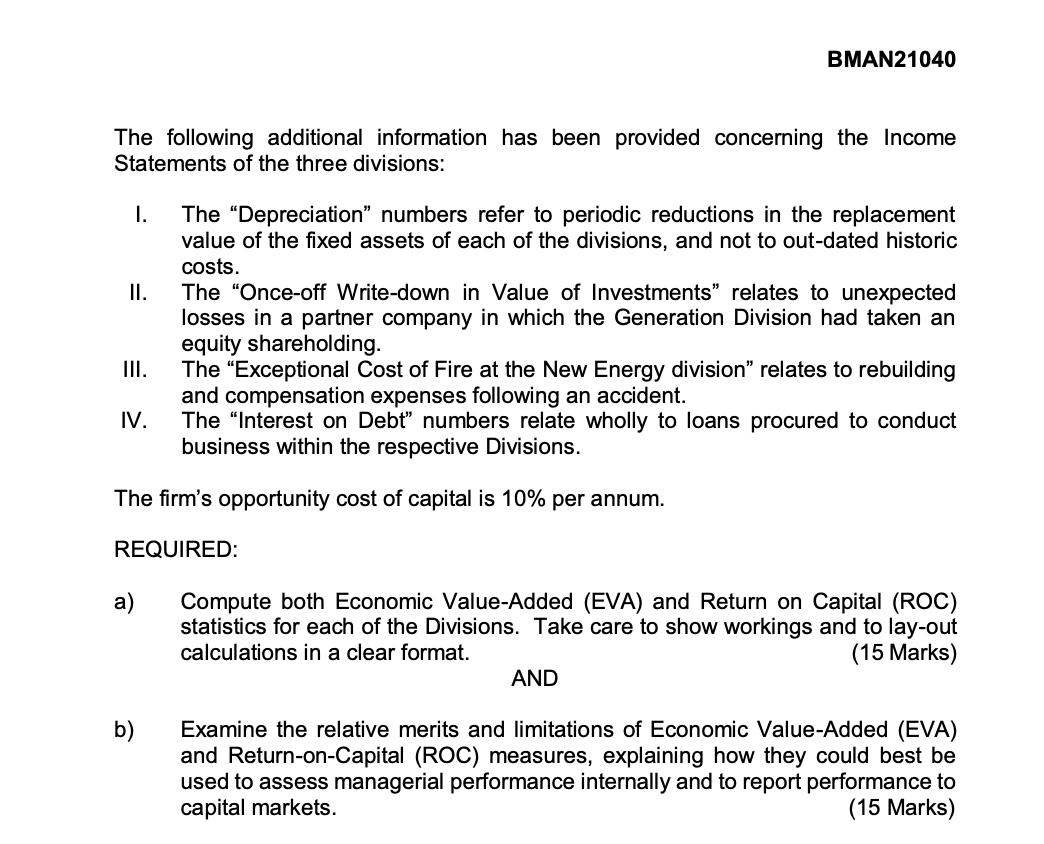

QUESTION 7 A power operator comprises three divisions. The firm uses economic-value-added (EVA) measures to evaluate performance internally, and return-on-capital (ROC) measures to report divisional performance to the capital markets externally. The following financial statements have been prepared for each of the divisions: Income Statements & Balance Sheets, Last Financial Year (US$ thousands) 'New Amounts in US$ thousands Generation Distribution Energy Income statements: Sales: 76,800 63,120 57,600 Operating costs: 41,804 47,104 54,234 Depreciation of fixed assets: 4,400 1,800 1,500 Once-off write-down in value of investments: 1,500 ---- Exceptional cost of fire in new energy division: 800 Interest on debt: 90 60 40 Operating income (loss): 29,006 14,156 1,026 8,850 3,000 10,000 2,500 Balance sheets at year end: Current assets: Investments in partner companies: Fixed assets (net of depreciation): Total assets: Trade creditors: Debt capital: Deferred taxation: Pension liabilities: 72,600 85, 100 3,600 15,800 24,650 3,500 600 11,300 14,300 750 420 44 125 425 36 400 200 Long-term liabilities: Debt capital: Total liabilities: Shareholder capital invested: 1,600 5,750 4,500 1,450 79,350 20,150 12,850 PTO Page 4 of 8 BMAN21040 The following additional information has been provided concerning the Income Statements of the three divisions: I. II. The Depreciation numbers refer to periodic reductions in the replacement value of the fixed assets of each of the divisions, and not to out-dated historic costs. The Once-off Write-down in Value of Investments relates to unexpected losses in a partner company in which the Generation Division had taken an equity shareholding. The Exceptional Cost of Fire at the New Energy division relates to rebuilding and compensation expenses following an accident. The "Interest on Debt" numbers relate wholly to loans procured to conduct business within the respective Divisions. III. IV. The firm's opportunity cost of capital is 10% per annum. REQUIRED: a) Compute both Economic Value Added (EVA) and Return on Capital (ROC) statistics for each of the Divisions. Take care to show workings and to lay-out calculations in a clear format. (15 Marks) AND b) Examine the relative merits and limitations of Economic Value Added (EVA) and Return-on-Capital (ROC) measures, explaining how they could best be used to assess managerial performance internally and to report performance to capital markets. (15 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts