Question: Please answer the first, second, and third picture questions. I posted these questions detail after the third picture. 1. Prepare an Adjusted Trial Balance 2.

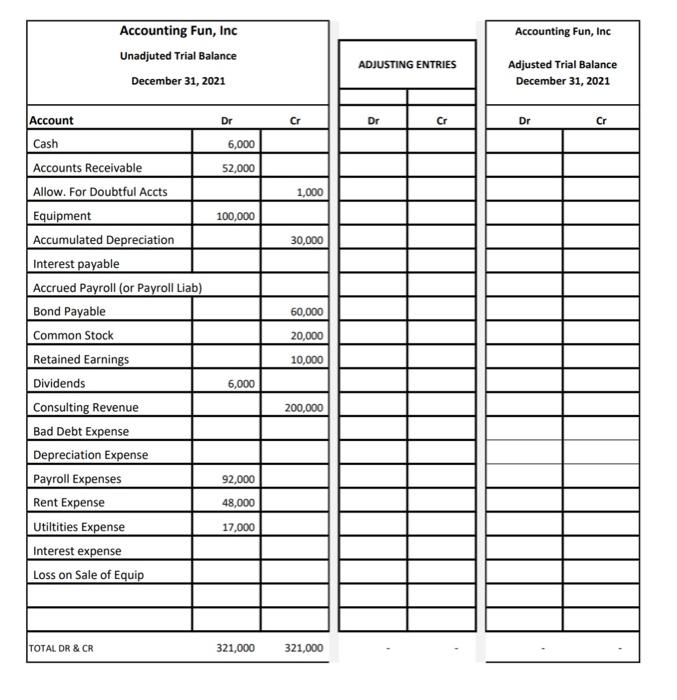

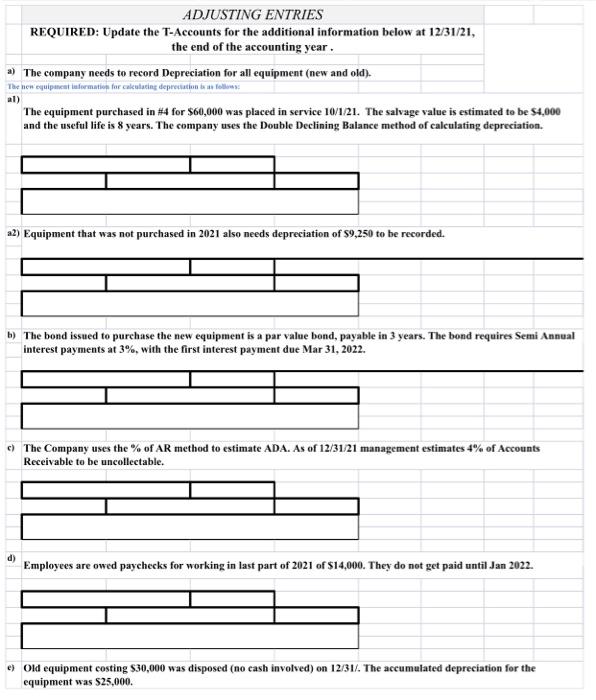

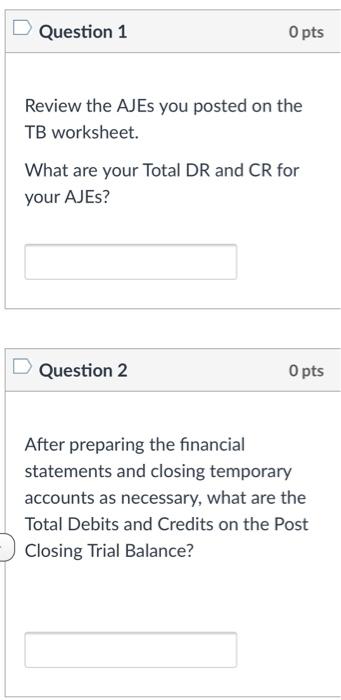

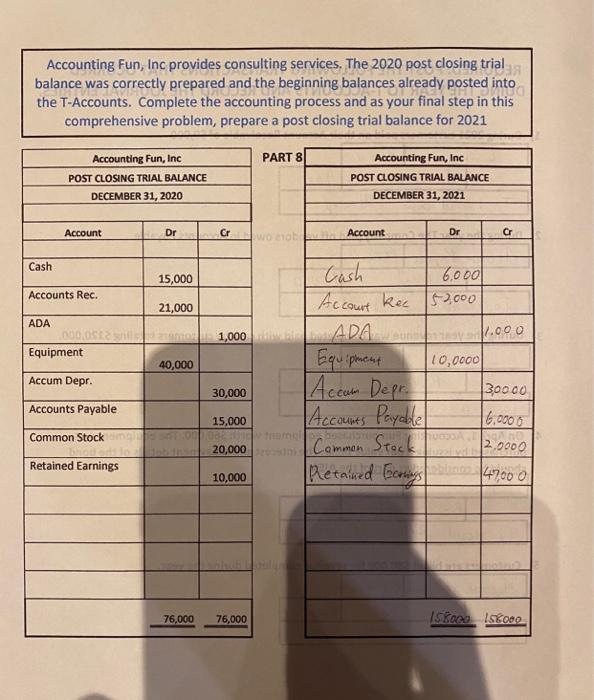

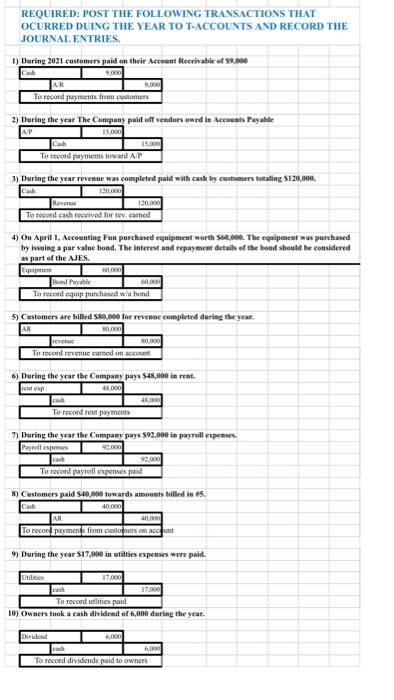

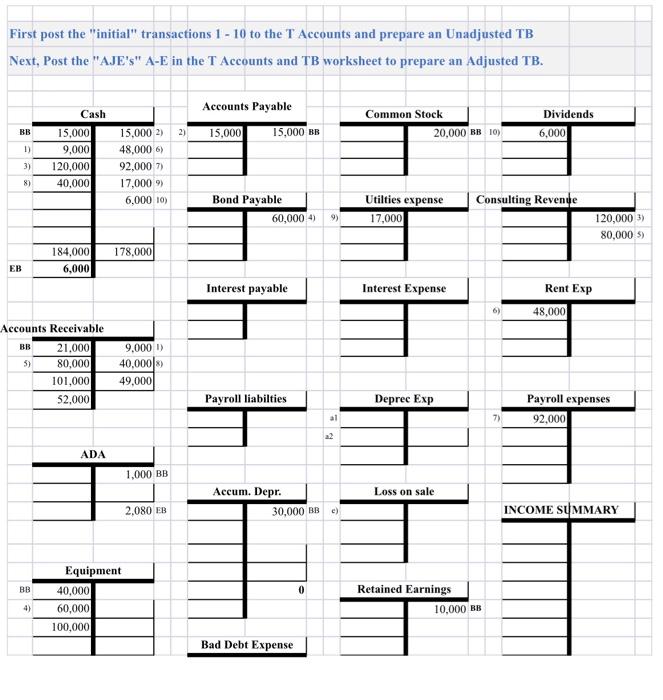

Accounting Fun, Inc Accounting Fun, Inc Unadjuted Trial Balance December 31, 2021 ADJUSTING ENTRIES Adjusted Trial Balance December 31, 2021 Dr Cr Dr Cr Dr Cr 6,000 52,000 1,000 100,000 30,000 60,000 20,000 Account Cash Accounts Receivable Allow. For Doubtful Accts Equipment Accumulated Depreciation Interest payable Accrued Payroll (or Payroll Liab) Bond Payable Common Stock Retained Earnings Dividends Consulting Revenue Bad Debt Expense Depreciation Expense Payroll Expenses Rent Expense Utilities Expense Interest expense Loss on Sale of Equip 10,000 6,000 200,000 92,000 48,000 17,000 TOTAL DR & CR 321,000 321,000 ADJUSTING ENTRIES REQUIRED: Update the T-Accounts for the additional information below at 12/31/21, the end of the accounting year. a) The company needs to record Depreciation for all equipment (new and old). The new equipment information for calculating depreciation before al) The equipment purchased in #4 for $60,000 was placed in service 10/121. The salvage value is estimated to be $4,000 and the useful life is 8 years. The company uses the Double Declining Balance method of calculating depreciation. a2) Equipment that was not purchased in 2021 also needs depreciation of S9,250 to be recorded. b) The bond issued to purchase the new equipment is a par value bond, payable in 3 years. The bond requires Semi Annual interest payments at 3%, with the first interest payment due Mar 31, 2022. c) The Company uses the % of AR method to estimate ADA. As of 12/31/21 management estimates 4% of Accounts Receivable to be uncollectable. d) Employees are owed paychecks for working in last part of 2021 of $14,000. They do not get paid until Jan 2022. e) Old equipment costing $30,000 was disposed (no cash involved) on 12/31/. The accumulated depreciation for the equipment was $25,000. Question 1 O pts Review the AJEs you posted on the TB worksheet. What are your Total DR and CR for your AJES? Question 2 O pts After preparing the financial statements and closing temporary accounts as necessary, what are the Total Debits and Credits on the Post Closing Trial Balance? Accounting Fun, Inc provides consulting services. The 2020 post closing trial balance was correctly prepared and the beginning balances already posted into the T-Accounts. Complete the accounting process and as your final step in this comprehensive problem, prepare a post closing trial balance for 2021 PART 8 Accounting Fun, Inc Accounting Fun, Inc POST CLOSING TRIAL BALANCE DECEMBER 31, 2020 POST CLOSING TRIAL BALANCE DECEMBER 31, 2021 Account Dr Dr Account Wool Gr Cash 15,000 Accounts Rec. 21,000 ADA 1,000 Equipment 40,000 Cash 6.0ool Account kec 52,000 ADA 1.000 10,0000 Accum Depr. 30000 Accounts Payable 16.0000 Commen Stock 2,0000 Retained Gerings 147,000 Equipement Accum Depr. 30,000 Accounts Payable Common Stock 15,000 OBST 20,000 Retained Earnings 10,000 76,000 76,000 Is Raco Iskoop REQUIRED: POST THE FOLLOWING TRANSACTIONS THAT OCURRED DUING THE YEAR TO T-ACCOUNTS AND RECORD THE JOURNAL ENTRIES. 1) During 2021 customers paid on their Account Receivable of 59.000 9,000 AR To record payments from customers 2) During the year The Company paid off vendors ewed in Accounts Payable AP 15.000 To record payments toward AP 3) During the year revenue was completed paid with cash by customers totaling $120.000. Cad Roma To record cash received for rev. camned 4) On April 1, Accounting Fun purchased equipment worth SH.00. The equipment was purchased by issuing a par value bond. The interest and repayment details of the hond should be considered as part of the AJES. land Povable 60 To record equip purchased wabond 5) Customers are billed 80.000 for revenue completed during the year. AR 0.000 0.000 To record revenue camed on account 6) During the year the Company pays $45,000 in rent. roup 48.000 cach 4.000 To recordent payments 7) During the year the Company pays 592.000 in payrollespees. Payrollespees cash 99.000 To record payroll expenses paid 8) Customers paid $10,000 towards amounts billed in 5 Cash AR To record payments from customers ont 9) During the year $17,000 in tilties expenses were paid. Uites To record slities paid 10) Owners took a cash dividend or 6,000 during the year. Dividend cash To record dividends paid to owners First post the "initial transactions 1 - 10 to the T Accounts and prepare an Unadjusted TB Next, Post the "AJE's" A-E in the T Accounts and TB worksheet to prepare an Adjusted TB. Accounts Payable 15,000 BB Common Stock 20,000 BB 10) Dividends 6,000 BB 2) 15,000 1) Cash 15,000 9,000 120,000 40,000 3) 15,0002) 48,000) 92,000 7) 17,000 6,000 10) 8) Bond Payable 60,000 4) Utilties expense 17,000 Consulting Revende 9) 120,000) 80,000 5) 178,000 184,000 6,000 EB Interest payable Interest Expense Rent Exp 48,000 6) Accounts Receivable BB 21.000 5) 80,000 101,000 52,000 9.000 I) 40,000) 49,000 Payroll liabilties Deprec Exp Payroll expenses 92,000 al 7) 22 ADA 1,000 BB Loss on sale Accum. Depr. 30,000 RB 2,080 EB e) INCOME SUMMARY BB 0 Retained Earnings Equipment 40,000 60,000 100,000 4) 10,000 BB Bad Debt Expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts