Question: Please answer the following and i will rate your answer. Question 4 0/1 pts The owner of a hair salon spends $1,000,000 to renovate its

Please answer the following and i will rate your answer.

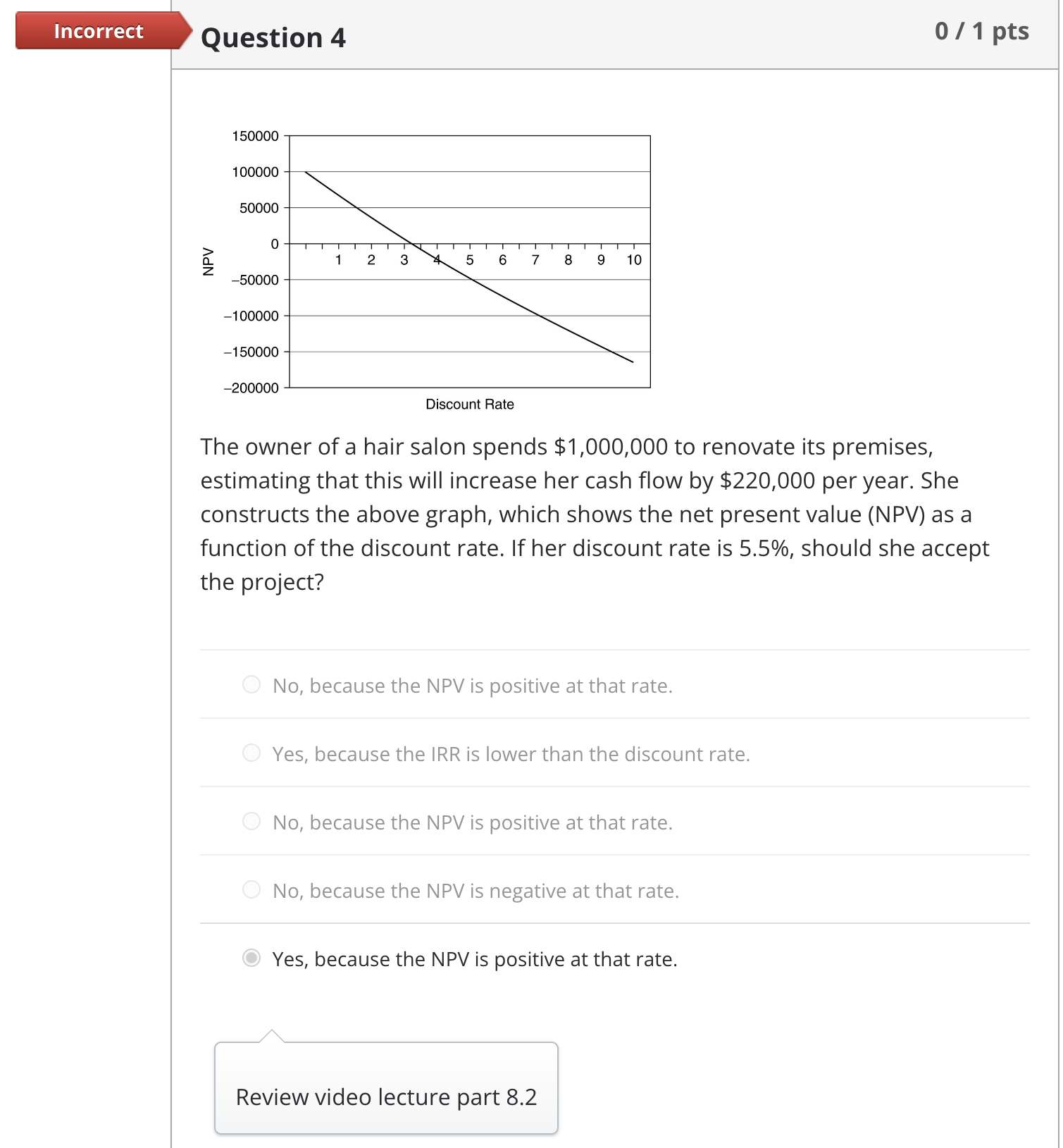

Question 4 0/1 pts The owner of a hair salon spends $1,000,000 to renovate its premises, estimating that this will increase her cash flow by $220,000 per year. She constructs the above graph, which shows the net present value (NPV) as a function of the discount rate. If her discount rate is 5.5%, should she accept the project? No, because the NPV is positive at that rate. Yes, because the IRR is lower than the discount rate. No, because the NPV is positive at that rate. No, because the NPV is negative at that rate. Yes, because the NPV is positive at that rate. The Gamma Company is planning on investing in a new project. This project requires an initial investment into a new machinery of $450,000. The Gamma Company expects cash inflows from this project to be as follows: $200,000 in year 1,$225,000 in year 2,$275,000 in year 3 , and $200,000 in year 4 of the project. If the appropriate discount rate for this project is 17% then the NPV of the project is closest to $248,632 $163,738 $139,947 $195,630 $219,837 $208,267 Review video example 8.2b. Note that this example is most similar to Project A in video example 8.2b. The Gamma Company is planning on investing in a new project. This project requires an initial investment into a new machinery of $450,000. The Gamma Company expects cash inflows from this project to be as follows: $200,000 in year 1,$225,000 in year 2,$275,000 in year 3 , and $200,000 in year 4 of the project. The appropriate discount rate for this project is estimated at 17%. What is the IRR of this project? 27.4% 39.2% 34.1% 24.3% 21.5% 30.9% Review video example 8.2b. Note that this example is most similar to Project A in video example 8.2b

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts