Question: please answer the following D. 2.18% E. 1.50% 19. A bank charges a commercial borrower an 11% interest rate on a one-year loan. The bank

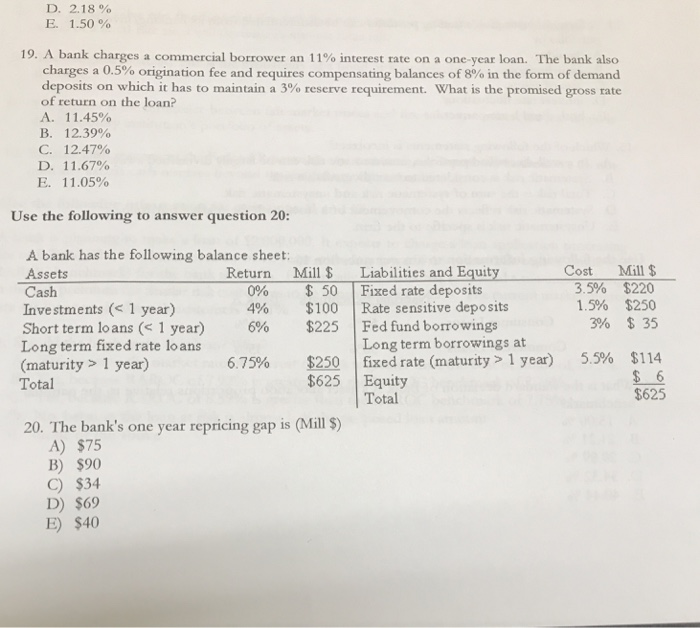

D. 2.18% E. 1.50% 19. A bank charges a commercial borrower an 11% interest rate on a one-year loan. The bank also charges a 0.5% origination fee and requires compensating balances of 8% in the form of demand deposits on which it has to maintain a 3% reserve requirement. What is the promised gross rate of return on the loan? A. 11.45% B. 12.39% C. 12.47% D. 11.67% E. 11.05% Use the following to answer question 20: A bank has the following balance sheet: Assets Cash Investments 1 year) Total Cost Return 0% 4% 6% Liabilities and Equity Fixed rate deposits | Rate sensitive deposits Mill $ $220 1.5% $250 396 $35 Mill S 3.5% $ 50 $100 8225|Fed fund borrowings Long term borrowings at | fixed rate (maturity > 1 year) 5.5% $114 250 $625 Equity 6.75% Total $625 20. The bank's one year repricing gap is (Mill S) A) $75 B) $90 C) $34 D) $69 E) $40

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts