Question: Please answer the following end-of-chapter 6 problems: ( 10 pts per question) 1. Problem 1 - In forming a portfolio of two risky assets, what

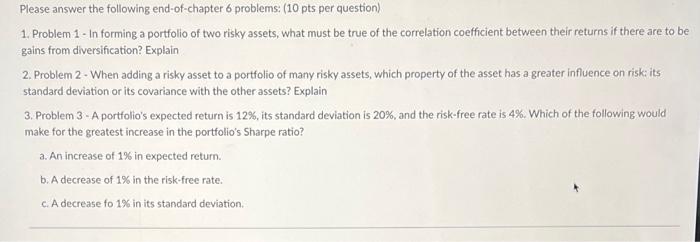

Please answer the following end-of-chapter 6 problems: ( 10 pts per question) 1. Problem 1 - In forming a portfolio of two risky assets, what must be true of the correlation coefficient between their returns if there are to be gains from diversification? Explain 2. Problem 2 - When adding a risky asset to a portfolio of many risky assets, which property of the asset has a greater influence on riski its standard deviation or its covariance with the other assets? Explain 3. Problem 3 - A portfolio's expected return is 12%, its standard deviation is 20%, and the risk-free rate is 4%. Which of the following would make for the greatest increase in the portfolio's Sharpe ratio? a. An increase of 1% in expected return. b. A decrease of 1% in the risk-free rate. c. A decrease fo 1% in its standard deviation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts