Question: Please answer the following ETHICS PROBLEM Melissa is rying to value the stock of Generic Ulty line, which is clearly not growing a Generic declared

Please answer the following

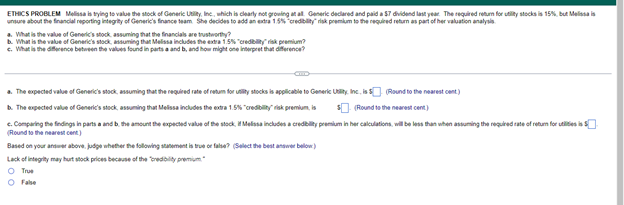

ETHICS PROBLEM Melissa is rying to value the stock of Generic Ulty line, which is clearly not growing a Generic declared and paid a 5 dividend last year. The required return for utlystocks is 15% but Melissais nure about the financial reporting integrity of Generic's finance team She decides to add an extra 15 credibility risk premium to the required return as part of her valuation analysis What is the value of Generic's stock, assuming that the financials are trustworthy? b. What is the value of Generic's stock, assuming that Melissa includes the extra 15% credit risk premium? c. What is the difference between the value found in partea and b, and how might ne interpret that difference? . The expected value of Generic's stock, assuming that the required rate of retum for winty stocks is applicable to Generic LawtyInc., in Round to the nearest cant) b. The expected value of Generic's stocking that Melissa includes the extra 1.5 credibisk premium, $(Round to the nearest cent) Comparing the findings in partia and the amount the expected value of the stock, Melissa include a credibility premium in het calculations, will be less than when assuming the required tute of return for life is (Round to the recent) Based on your atter above, judge whether the following statement is true te falte? (Select the best answer below) Lack of integy may but shock prices because of the credibility premium O True O False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts