Question: Please answer the following, fill in the boxes for each of the following requirements. Requirement 1. Your mother just won $4,000. How much money will

Please answer the following, fill in the boxes for each of the following requirements.

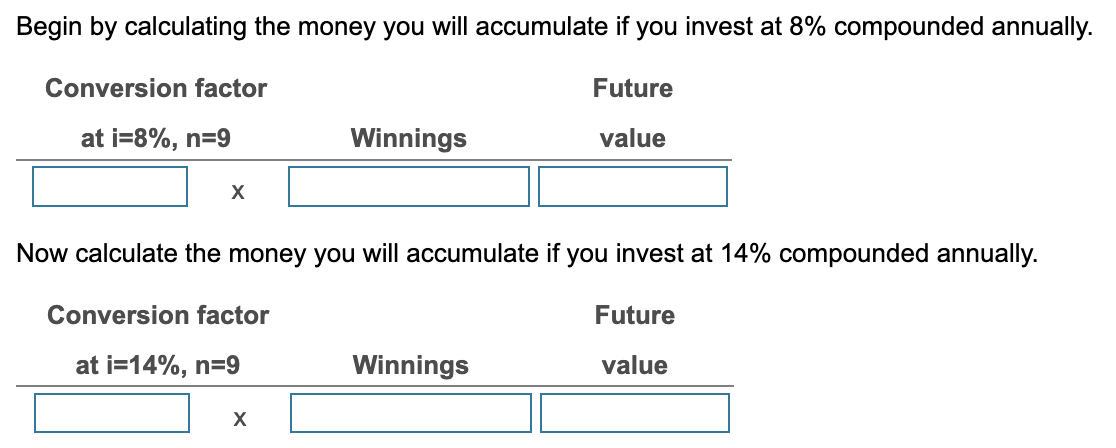

Requirement 1. Your mother just won $4,000. How much money will she accumulate at the end of 9 years if she invest it at 8% compounded annually? At 14%? (Round your final answers to the nearest whole number.) Begin by calculating the money she will accumulate if she invest at 8% compounded annually.

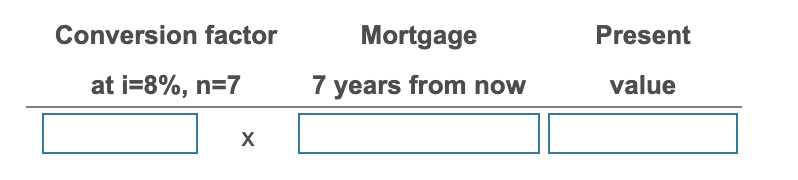

Requirement 2. Seven years from now, the unpaid principal of the mortgage on your house will be $90,500. How much must you invest today at 8% interest compounded annually to accumulate the $90,500 in 7 years? (Round your final answer to the nearest whole number.)

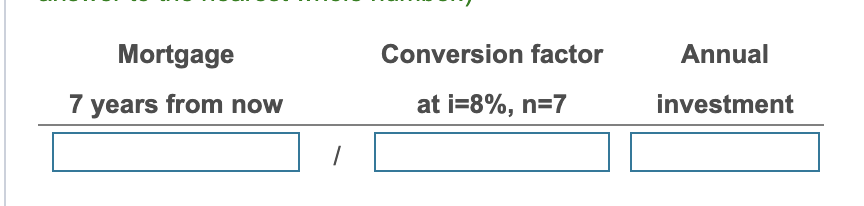

Requirement 3. If the unpaid mortgage on her house in 7 years will be $90,500, how much money does she need to invest at the end of each year at 8% to accumulate exactly this amount at the end of the 7th year? (Round your final answer to the nearest whole number.)

Requirement 3. If the unpaid mortgage on her house in 7 years will be $90,500, how much money does she need to invest at the end of each year at 8% to accumulate exactly this amount at the end of the 7th year? (Round your final answer to the nearest whole number.) Requirement 4. She plans to save $4,000 of her earnings each year for the next seven years. How much money will she accumulate at the end of the 7th year if she invest her savings compounded at 18% per year? (Round your final answer to the nearest whole number.)

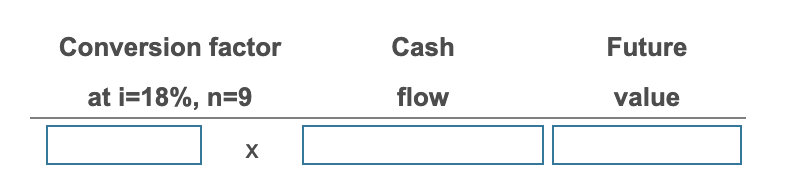

Requirement 4. She plans to save $4,000 of her earnings each year for the next seven years. How much money will she accumulate at the end of the 7th year if she invest her savings compounded at 18% per year? (Round your final answer to the nearest whole number.)

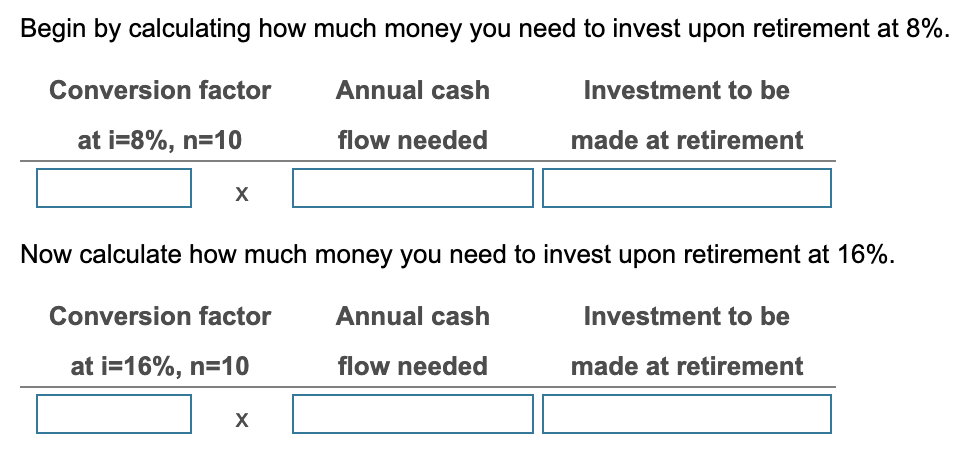

Requirement 6. She has estimated that for the first ten years after she retire, she will need a cash inflow of $80,000 at the end of each year. How much money must she invest at 8% at retirement to obtain this annual cash inflow? At 16%? (Round your final answers to the nearest whole number.)

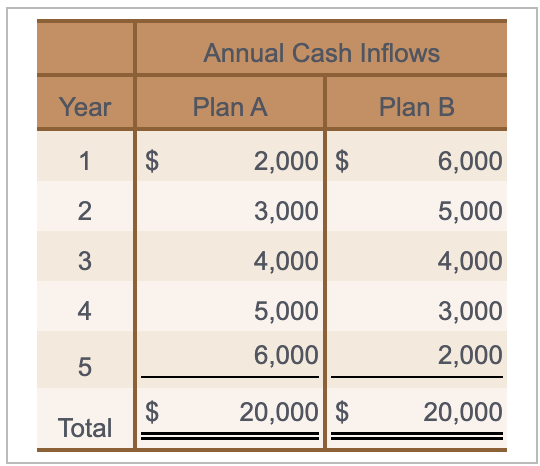

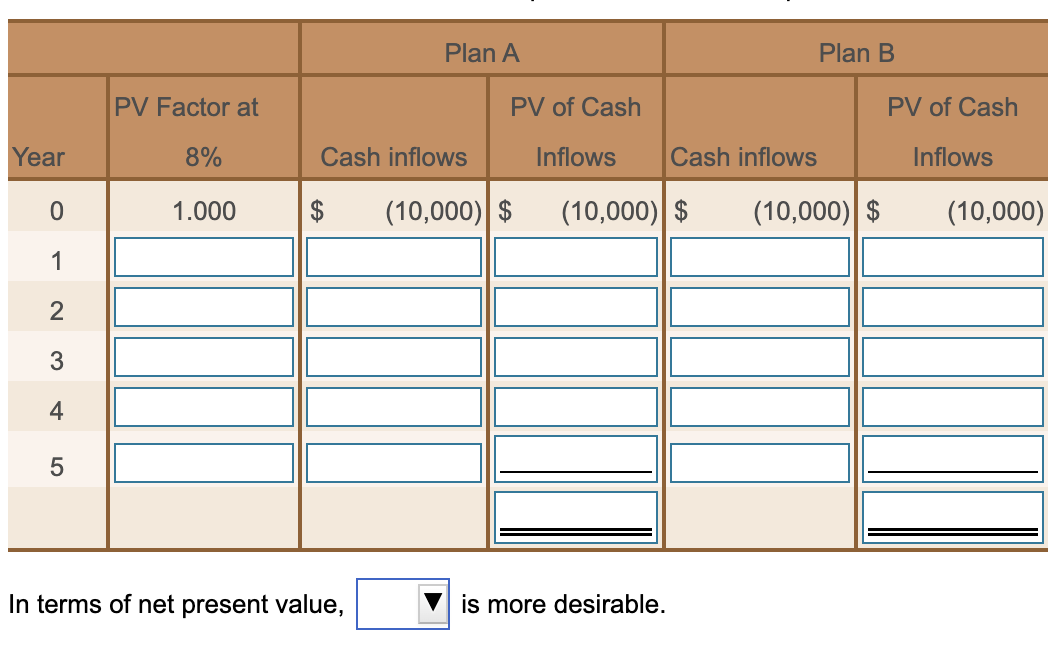

Requirement 7. Compare the two schedules of prospective operating cash inflows, each of which now requires the same net initial investment of $10,000. The required rate of return is 8% compounded annually. All cash flows occur at the end of each year. In terms of net present value, which plan is more desirable? Show your computations.

Requirement 7. Compare the two schedules of prospective operating cash inflows, each of which now requires the same net initial investment of $10,000. The required rate of return is 8% compounded annually. All cash flows occur at the end of each year. In terms of net present value, which plan is more desirable? Show your computations.

Begin by calculating the money you will accumulate if you invest at 8% compounded annually. Now calculate the money you will accumulate if you invest at 14% compounded annually. \begin{tabular}{ccc} Conversionfactorati=8%,n=7 & Mortgage & Present \\ \hline & 7 years from now & value \\ \hline \end{tabular} \begin{tabular}{ccc} Mortgage7yearsfromnow & Conversionfactorati=8%,n=7 & Annualinvestment \\ \hline & & \end{tabular} Begin by calculating how much money you need to invest upon retirement at 8%. Now calculate how much money you need to invest upon retirement at 16%. In terms of net present value, is more desirable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts