Question: Please answer the following here is the full formula for 14 and 15 if that helps Answer questions 11 through 17 based on the following

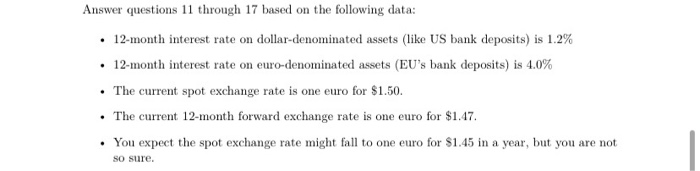

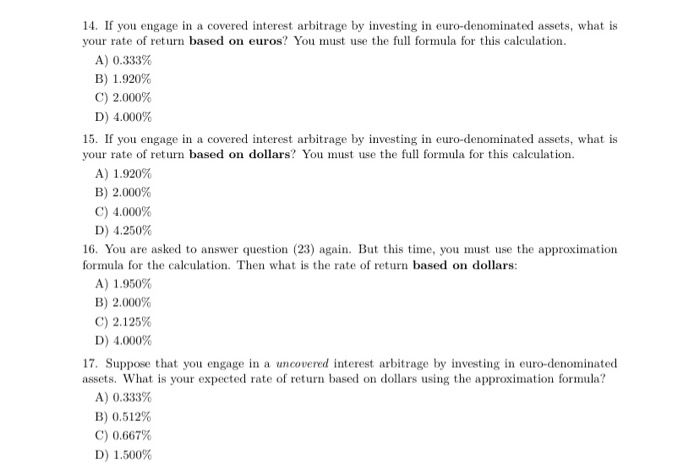

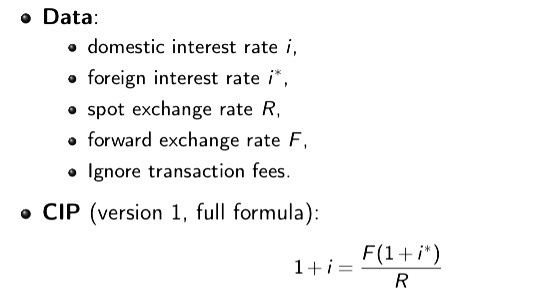

Answer questions 11 through 17 based on the following data: 12-month interest rate on dollar-denominated assets (like US bank deposits) is 1.2% 12-month interest rate on euro-denominated assets (EU's bank deposits) is 4.0% The current spot exchange rate is one euro for $1.50. The current 12-month forward exchange rate is one euro for $1.47. You expect the spot exchange rate might fall to one euro for $1.45 in a year, but you are not SO sure. 14. If you engage in a covered interest arbitrage by investing in euro-denominated assets, what is your rate of return based on euros? You must use the full formula for this calculation. A) 0.333% B) 1.920% C) 2.000% D) 4.000% 15. If you engage in a covered interest arbitrage by investing in euro-denominated assets, what is your rate of return based on dollars? You must use the full formula for this calculation A) 1.920% B) 2.000% C) 4.000% D) 4.250% 16. You are asked to answer question (23) again. But this time, you must use the approximation formula for the calculation. Then what is the rate of return based on dollars: A) 1.950% B) 2.000% C) 2.125% D) 4.000% 17. Suppose that you engage in a uncovered interest arbitrage by investing in euro-denominated assets. What is your expected rate of return based on dollars using the approximation formula? A) 0.333% B) 0.512% C) 0.667% D) 1.500% Data: domestic interest rate i, foreign interest rate i*, spot exchange rate R. forward exchange rate F, Ignore transaction fees. CIP (version 1, full formula): F(1+i*) 1+1=

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts