Question: Please answer the following. If correct, I will make sure to thumbs up. Thank you! 9. Modified internal rate of return (MIRR) Aa Aa The

Please answer the following. If correct, I will make sure to thumbs up. Thank you!

Please answer the following. If correct, I will make sure to thumbs up. Thank you!

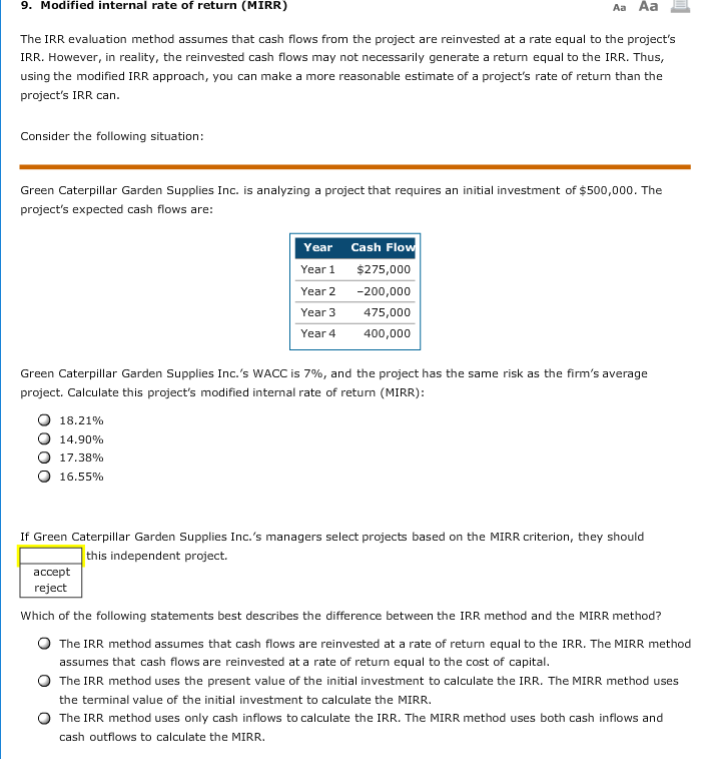

9. Modified internal rate of return (MIRR) Aa Aa The IRR evaluation method assumes that cash flows from the project are reinvested at a rate equal to the project's IRR. However, in reality, the reinvested cash flows may not necessarily generate a return equal to the IRR. Thus using the modified IRR approach, you can make a more reasonable estimate of a project's rate of return than the project's IRR can Consider the following situation Green Caterpillar Garden Supplies Inc. is analyzing a project that requires an initial investment of $500,000. The project's expected cash flows are Year Cash Flo Year1 $275,000 Year 2 -200,000 Year 3 475,000 Year 4 400,000 Green Caterpillar Garden Supplies Inc.'s WACC is 7%, and the project has the same risk as the firm's average project. Calculate this project's modified internal rate of return (MIRR): O 18.21% 14.90% 17.38% 16.55% If Green Caterpillar Garden Supplies Inc.'s managers select projects based on the MIRR criterion, they should this independent project. accept reject Which of the following statements best describes the difference between the IRR method and the MIRR method? O The IRR method assumes that cash flows are reinvested at a rate of return equal to the IRR. The MIRR method assumes that cash flows are reinvested at a rate of return equal to the cost of capital O The IRR method uses the present value of the initial investment to calculate the IRR. The MIRR method uses the terminal value of the initial investment to calculate the MIRR. The IRR method uses only cash inflows to calculate the IRR. The MIRR method uses both cash inflows and cash outflows to calculate the MIRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts