Question: Please answer the following information using the content below. Differentiate between the concepts of Book Valuation, Liquidation Valuation, and Replacement cost Valuation. Explain the discounted

Please answer the following information using the content below.

- Differentiate between the concepts of Book Valuation, Liquidation Valuation, and Replacement cost Valuation.

- Explain the discounted cash flow approach to valuation.

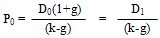

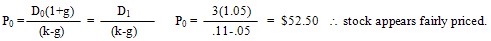

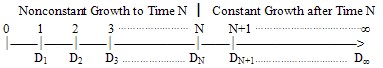

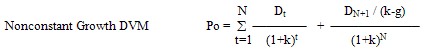

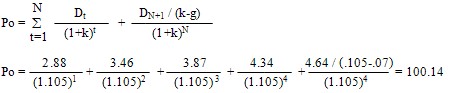

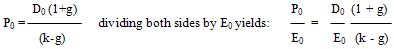

- Differentiate between the General Dividend Valuation Model, the Constant Growth Model, and the Nonconstant Growth Model.

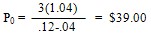

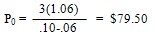

- Use the constant growth model to value stocks, estimate required rates of return, and calculate implied growth rates, and the nonconstant growth model to value stocks.

- Explain some of the difficulties associated with using dividend valuation models to value stocks.

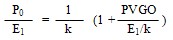

- Explain the difference between a regular price earnings ratio and a forward price earnings ratio, and know how both are calculated.

- Provide a detailed explanation for why price earnings ratios differ across firms.

- Discuss the relationship between price earnings ratios and investment opportunities.

- Apply the earnings multiplier model to help in arriving at an investment recommendation on a stock.

- Explain the approach used by Niederhoffer & Regan to illustrate the importance of unexpected earnings in driving stock prices, and the results of their study.

- How analysts can use their earnings forecasts to arrive at an investment recommendation.

- Identify and discuss a number of factors that should be considered when evaluating how a given stock is likely to perform over the next year or two.

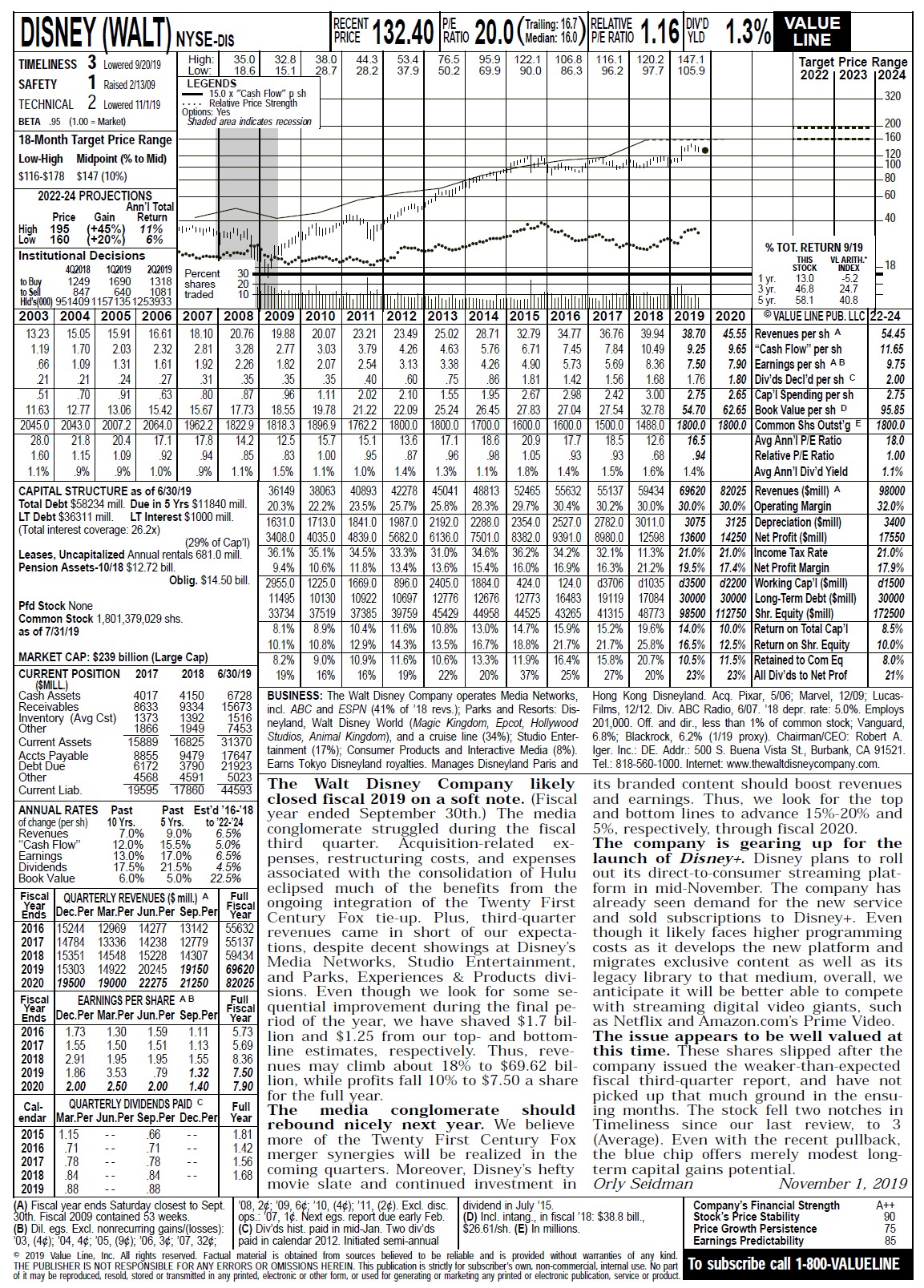

- Explain the company and industry reports provided by Value Line in some detail.

- Explain different methods for estimating earnings per share, including the associated calculations.

- Explain different methods for estimating long-term growth rates in earnings per share and dividends per shares, including the associated calculations.

- Explain three techniques that can be used to estimate fair required rates of return for a security, and the associated calculations.

- Discuss factors to consider when projecting the future price earnings ratio for a firm.

- Explain the relationship between the economic climate and the stock market.

FUNDAMENTAL ANALYSIS AND COMMION STOCK VALUATION

(Chapters 17 and 18 FIN5515 Notes)

I. Alternative Valuation Methods

The focus of fundamental analysis is on projecting a firm's future earnings per share (eps) and dividends per share (dps) streams and on assessing the risk associated with the firm's common stock. These estimates may be used in estimating the true "intrinsic value" value of the firm's stock, which can then be compared to the current stock price to arrive at an investment recommendation on the stock. Alternatively, these estimates along with other factors can be used to estimate a reasonable price/earnings ratio for a stock, which then can be compared to the actual price/earnings ratio to arrive at an investment decision. Before considering how to estimate the intrinsic value of a stock further, a couple of other valuation measures are considered.

A. Book Value Per Share

The book value of a share of stock can be calculated using the following equation:

BV = Total Shareholders' Equity from Balance Sheet / # of Shares Outstanding

Total shareholders' equity consists of the sum of the Common Stock, Paid-in-Surplus, and Retained Earnings Accounts on the right hand side of the balance sheet. It essentially represents the total equity capital contributed by shareholders as of a point in time. Thus, in a sense the book value per share can be interpreted as the average capital contributed per share. Book values and market values frequently differ considerably, with market values typically, but not always, greater than book values. Since market values depend upon the projected future performance of the company, the risk of the company, etc., it is not surprising that the two values often differ markedly. To get a feel for the market-to-book ratio for some companies, go to Yahoo!Finance, enter a ticker symbol for a company, and click on "Statistics" to find the company's price/book ratio.

http://finance.yahoo.com/

As mentioned in Unit 6, higher growth firms generally have higher market-to-book ratios than lower growth firms. But historically speaking, high book-to-market stocks (i.e., low market-tobook stocks) have outperformed the low book-to-market stocks. Though it may be useful to know the book value of a stock for various reasons, it does not tell us much about what a stock should be selling for now, and therefore it is not particularly helpful for estimating the intrinsic value of a stock.

B. Liquidation Value

A company's liquidation value would equal the cash flow generated from liquidating the firm's assets less the amount required to pay off the firm's liabilities. Dividing this result by the number of outstanding shares would produce the liquidation value per share. The only time the per share liquidation value would be pertinent for estimating the intrinsic value of the stock is when it exceeds the estimated stock value obtained from valuing the firm as a going concern. A case in point might be if a firm owned a substantial amount of real estate that has a market value far greater than the value on the balance sheet. The stock price from valuing the firm as a going concern might actually be less than the liquidation value because the true value of the land is not reflected in the price. This is why liquidation value is sometimes considered a "floor" on the value of the stock. Liquidation valuation generally takes on added importance if a firm is approaching bankruptcy, but in normal circumstances it does not help us much when estimating the intrinsic value of the stock.

C. Replacement Cost

Replacement cost valuation is simply the dollar cost of replacing the firm's assets less its liabilities. Dividing by the number of outstanding shares would put this on a per share basis. Some argue that market values cannot exceed replacement values by too much for too long because competitors could replicate the firm with the increased competition ultimately lowering the stock price. Actually carrying out such a replication might be a lot more difficult than the above position assumes, however. As a rule, replacement cost estimates provide little help for estimating the intrinsic value of a share of stock.

II. Intrinsic Value Versus Market Value

Suppose you were offered an investment that promised to pay you $1,000 one year from today. How much would you be willing to pay for the investment? It depends upon what your required rate of return is on the investment? For example, let's assume that you assess the likelihood of getting paid, consider interest rates on one-year CDs, etc., and arrive at 10 percent as a fair return. Then you should be willing to pay $1,000/1.10 = $909.09. Note, if you multiply 1.10 times $909.09, you get $1,000. In other words, you would pay an amount such that if you received the promised payment, you make exactly 10 percent on your investment. Though this is a simple valuation problem, the underlying logic is identical to that employed in the most common approach for estimating the intrinsic value of a share of stock, which we consider next.

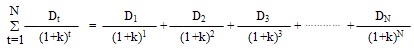

A. Discounted Cash Flow Approach to Security Valuation

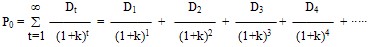

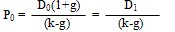

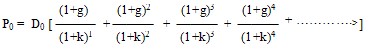

The Discounted Cash Flow Approach to Security Valuation is the most logical approach for valuing most financial securities. Investors purchase stocks to increase their wealth. So to determine the amount that one should be willing to pay for a given stock at a point in time, just estimate the cash flows the stock is projected to provide in the future (both magnitudes and timing) and discount these back to the present by a fair rate of return. In step-by-step fashion, the valuation process is as follows:

- Estimate the future cash flows the security is expected to provide.

- Determine a "fair" required rate of return (k) for the security (perhaps using CAPM).

- Discount the estimated expected cash flows to the present by the fair required rate of return, k.

So let's apply this approach to common stocks.

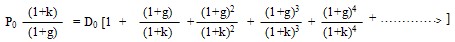

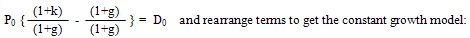

B. Common Stock Valuation - Dividend Valuation Models (DVM)

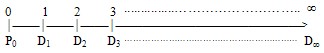

Valuing common stocks is more difficult than the simple valuation problem above for a couple of reasons. To add intuition, let's consider the valuation process for stocks versus bonds, which will be covered later in the course. First, the only cash flows that common stocks pay are cash dividends. Future dividends are not known, and thus have to be estimated. Since there is no terminal date, we have to project future dividends forever. (How long is Disney going to be around?) When valuing bonds, the magnitudes and timing of the promised cash flows are generally known, and there is a specified maturity date. Second, it is more difficult to accurately estimate the appropriate required rate of return on a common stock than for a bond. This is primarily because it is easier to assess and therefore price the risk of a bond than it is a stock. Actually, we will see later that if you know the price a bond is selling at and what the promised cash flows are, you can readily determine the market determined required rate of return on the bond (yield to maturity). Nearly all firms that pay cash dividends do so quarterly, but for simplicity, we will assume annual dividends paid at the end of each year. The problem we are attempting to solve can be illustrated as follows:

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts