Question: Please answer the following question. A bond pays a coupon rate of 5% annually and matures in 10 years. The principal is $10,000 and current

Please answer the following question. A bond pays a coupon rate of 5% annually and matures in 10 years. The principal is $10,000 and current market price is $8,500.

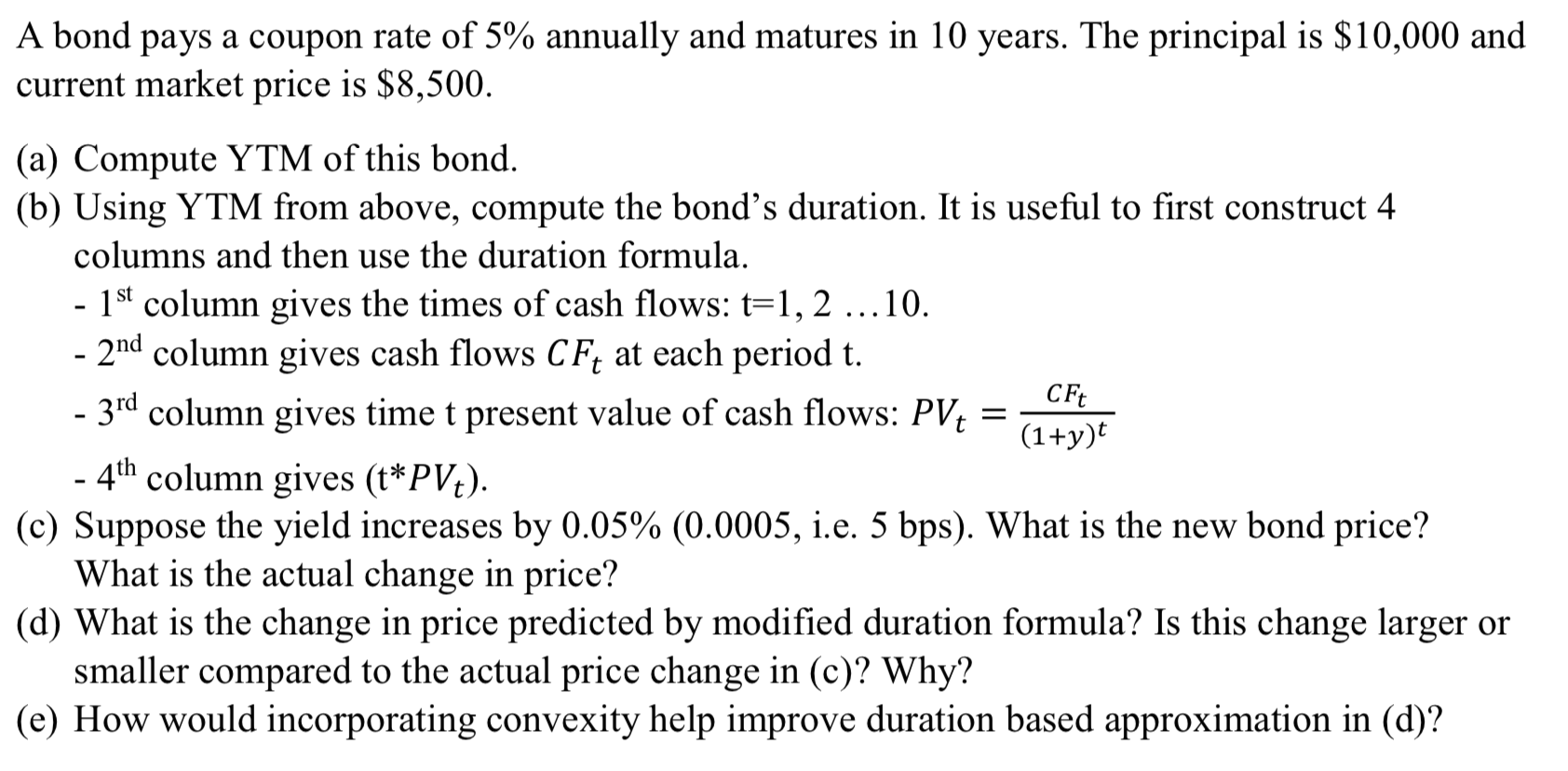

A bond pays a coupon rate of 5% annually and matures in 10 years. The principal is $10,000 and current market price is $8,500. (a) Compute YTM of this bond. (b) Using YTM from above, compute the bond's duration. It is useil to rst construct 4 columns and then use the duration formula. - lSt column gives the times of cash ows: t=l, 2 ...10. - 2nd column gives cash flows C Ft at each period t. CF: (1+y)t - 3\" column gives time t present value of cash ows: PVt = - 4th column gives (t*PVt). (c) Suppose the yield increases by 0.05% (0.0005, i.e. 5 bps). What is the new bond price? What is the actual change in price? (d) What is the change in price predicted by modied duration formula? Is this change larger or smaller compared to the actual price change in (c)? Why? (e) How would incorporating convexity help improve duration based approximation in (d)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts