Question: Please Answer the following Question but Please work on a new answer Do not copy and paste previous answers Avoid using Excel sheets Show all

Please Answer the following Question but Please

work on a new answer

Do not copy and paste previous answers

Avoid using Excel sheets

Show all your works

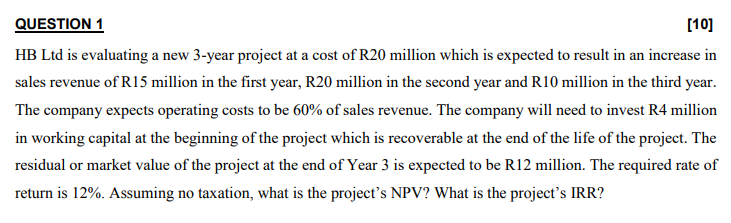

QUESTION 1 [10] HB Ltd is evaluating a new 3-year project at a cost of R20 million which is expected to result in an increase in sales revenue of R15 million in the first year, R20 million in the second year and R10 million in the third year. The company expects operating costs to be 60% of sales revenue. The company will need to invest R4 million in working capital at the beginning of the project which is recoverable at the end of the life of the project. The residual or market value of the project at the end of Year 3 is expected to be R12 million. The required rate of return is 12%. Assuming no taxation, what is the project's NPV? What is the project's IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts