Question: please answer the following question part a, b and c sions, a U.S. citizen 13.4 tax benenes TTUN TUTUL Foreign Resident Tests. In order to

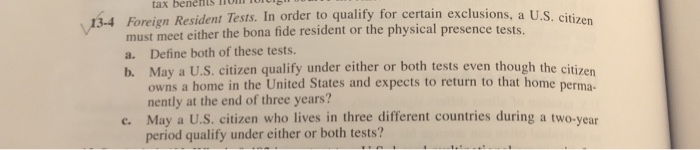

sions, a U.S. citizen 13.4 tax benenes TTUN TUTUL Foreign Resident Tests. In order to qualify for certain exclusions, a US : must meet either the bona fide resident or the physical presence tests. a. Define both of these tests. b. May a U.S. citizen qualify under either or both tests even though the citize owns a home in the United States and expects to return to that home perma nently at the end of three years? c. May a U.S. citizen who lives in three different countries during a two-year period qualify under either or both tests

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts