Question: Please answer the following question quickly, showing all work accordingly on all sections. Thank you. The yield to maturity of a $1,000 bond with a

Please answer the following question quickly, showing all work accordingly on all sections. Thank you.

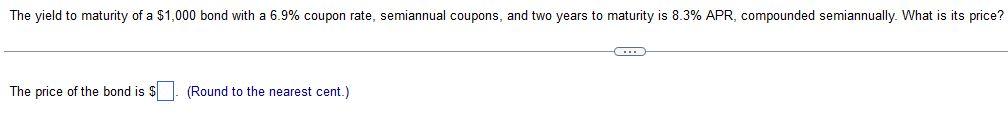

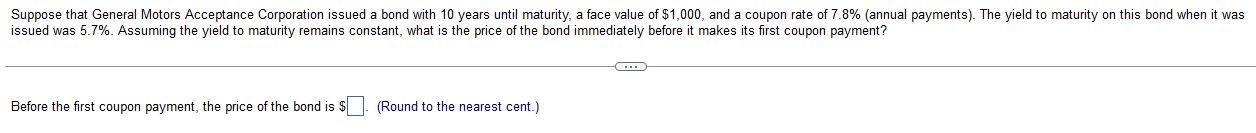

The yield to maturity of a $1,000 bond with a 6.9% coupon rate, semiannual coupons, and two years to maturity is 8.3% APR, compounded semiannually. What is its price? The price of the bond is $ (Round to the nearest cent.) issued was 5.7%. Assuming the yield to maturity remains constant, what is the price of the bond immediately before it makes its first coupon payment? Before the first coupon payment, the price of the bond is $ (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts